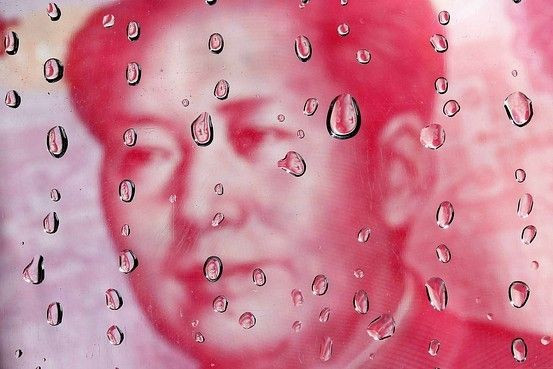

China September Data Preview: Bottom, But Not Bottom Out?

A deluge of data releases over the coming days is expected to show that growth in China reached its nadir in the third quarter, though it may take another couple of quarters for growth to truly bottom out.

In recent months, export growth has collapsed, import growth contracted for the first time since 2009, growth in property investment was down sharply in July (before recovering in August) and expansion in industrial production is at a 39-month low.

While China's official manufacturing Purchasing Managers Index rose slightly to 49.8 in September from 49.2 in August, it remained in contraction territory (below 50) for a second straight month and failed to erase persistent doubts about the strength of the world's No. 2 economy.

Even China’s normally robust services sector showed signs of significant weakness in the past month. The official services PMI fell from 56.3 in August to 53.7 in September -- its lowest point since November 2010.

On Monday, the World Bank lowered its growth forecast for China, citing weak demand for its exports and lower investment growth.

The bank said it expects China's economy to grow by 7.7 percent this year, down from its projection of 8.2 percent in May. "China's slowdown this year has been significant, and some fear it could still accelerate," the bank said in its latest report.

China's exports have been hurt by economic problems in the euro zone and the U.S., two of its biggest markets. Meanwhile, policymakers have found it difficult to boost domestic demand enough to offset the decline in foreign sales.

September Data Outlook

Oct. 13: Trade. China’s export growth likely declined to 1 percent year-on-year in September from 2.7 percent in August, while import growth increased to 1.5 percent from a drop of 2.7 percent in August, according to Bank of America Merrill Lynch China economist Ting Lu.

The trade surplus will probably remain almost unchanged at $26.2 billion in September from $26.7 billion in August.

“Export growth could remain in low single digits or even close to zero growth for a few months due to the slowdown in the U.S. and the euro zone,” Lu wrote in a note to clients. “For imports, rising oil prices and falling dollars in the past two months could increase the headline dollar value of Chinese imports.”

Oct. 15: Consumer Price Index. The annual CPI, a major gauge of inflation, may have eased to 1.9 percent in September from 2 percent in August, according to economists polled by Thomson Reuters.

Food prices, which account for nearly one-third of the prices used to calculate China's CPI, are expected to decline in September.

According to the Ministry of Commerce, wholesale average vegetable prices in the first three weeks of September fell by 4.8 percent after increasing 13.3 percent in August.

Oct. 15: Producer Price Index. The PPI, a main gauge of inflation at the wholesale level, is expected to decline further to -3.6 percent in September from -3.5 percent in August.

Although prices of steel, coal and chemicals have stemmed the slide and started rebounding since the second week of September, according to the Ministry of Commerce, economists believe it could take a couple of months for rising commodity prices to have an impact on PPI.

Oct. 11-15: Bank lending. Economists polled by Reuters estimate that China's banks issued 650 billion yuan ($103.4 billion) of new loans in September, compared with 704 billion yuan in August.

As the government has sped up infrastructure investment project approvals in September as part of its second-round easing effort, economists expect a rise in loan demand.

On the supply side, the People’s Bank of China still held back a reserve-requirement ratio (RRR) cut and the interbank liquidity condition has remained tight, which could constrain the supply of new loans.

Beijing is keen to avoid a repeat of the credit binge that followed the 2008 markets' crash, whose after-effects have left the economy overly reliant on investment and saddled its banks with bad loans.

Growth of outstanding loans and M2 likely rose to 16.3 percent and 13.6 percent, respectively, in September from 16.1 percent and 13.5 percent, respectively, in the prior month.

Oct. 18: GDP. China's economy expanded 7.6 percent from a year earlier in the second quarter, the slowest pace in three years. A recent Reuters poll suggests that the third quarter was possibly worse, at 7.4 percent.

“Though even in mid-2013 the recovery may be mild, we should keep in mind that China’s potential growth rate is trending down, and in our view it’s unlikely Beijing would carry out any significant stimulus plan this time around,” Lu wrote.

Oct. 18: Industrial production. Factory output probably rose 9 percent in September from the year-ago period, after hitting a 39-month low of 8.9 percent in August.

Oct. 18: Fixed-asset investment. Annual growth in fixed-asset investment is seen picking up moderately to 19.5 percent from August’s 19.1 percent.

“We expect infrastructure FAI growth could remain robust in September as it would be the focus of the ongoing second-round of policy easing,” Lu wrote. “Property FAI could also hold up well on a recent surge of land sales.”

Oct. 18: Retail sales. Consensus calls for China's retail sales to remain roughly unchanged at 13.3 percent in September.

While weak economic growth could drag down the growth of discretionary consumption goods such as autos, recent improvements in home sales could also boost sales of home appliances and construction materials. Overall, retail sales growth in September should remain largely stable compared with August.

© Copyright IBTimes 2024. All rights reserved.