China Stock Market Crash Handling Is 'Sloppy,' Goldman Sachs CEO Says

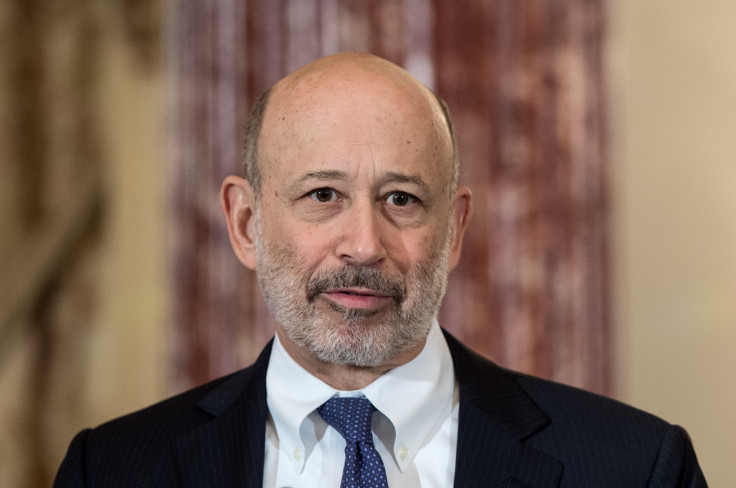

The way China has handled its stock market meltdown has been "sloppy" and "ham-handed," according to the most senior official in a leading American investment firm. In particular, China's devaluation of its currency, the yuan, as well as state-funded share buying in an effort to reverse its sagging economy, hasn't been quite as efficacious as the country may have planned for it to be, said Lloyd Blankfein, the chairman and chief executive officer of Goldman Sachs Group, the Wall Street Journal reported.

“They don’t have a lot of experience in this market stuff,” Blankfein told the newspaper Wednesday, but at least Chinese officials do "know what the problems are," he added. If China can update its markets to modern-day standards, it should be able to overcome the formidable "execution issues" facing the country's economy, Blankfein added.

The pointed criticism of China's economy and stock market meltdown, which started in late August when Asian currencies, commodities and shares plummeted to record lows, causing a negative ripple effect across the world's stock markets, came one day after China's stocks fell even further Tuesday, CNNMoney reported.

In the latest instance of instability in the country's stock market, the Shanghai Composite fell 3.5 percent, and the less-prominent Shenzhen Composite has suffered even worse losses.

Thursday saw Asian markets rise, but shares in China still fell late in the day in what seems to be a prevailing trend for shares there in the afternoons, MarketWatch reported. Uncertainty as it relates to the government's approach to illegal trading has also contributed to the downward economic trend in the country, according to MarketWatch.

All things considered, Blankfein said, China can eventually get past the difficulties it has with its market and the steady decline, but it's obviously an issue that will not be able to be solved overnight. "It's really hard," he said.

© Copyright IBTimes 2024. All rights reserved.