China’s Growing Dairy Demand A Boon For Quality Local And Foreign Brands

The “white gold rush” is on. China’s growing appetite for dairy products is expected to benefit Chinese dairy producers as well as exporting countries like New Zealand.

The dairy industry in China has experienced rapid growth in recent years. The market was worth $40.6 billion last year, compared with only $20.7 billion in 2008.

According to HSBC, liquid milk is the China dairy market’s core product, representing more than 80 percent of total consumption. But low liquid milk penetration rate in China means there is substantial growth potential over the next decade.

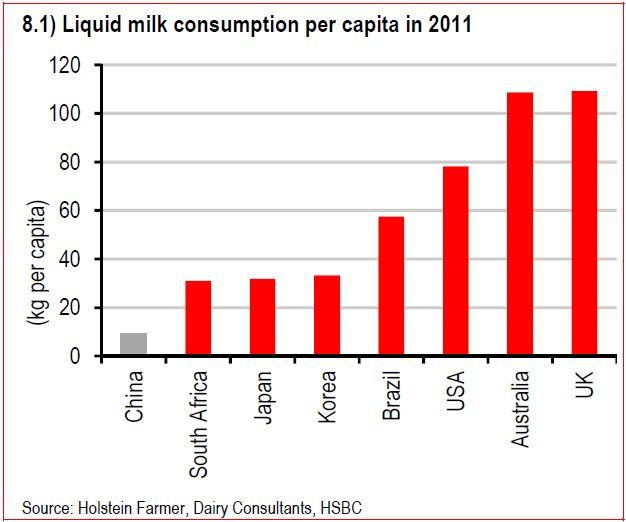

While per capita liquid milk consumption has multiplied from 1.0 kilogram (2.2 pounds) in 2000 to 9.4 kilograms in 2011, it still remains low compared with other developed and emerging markets.

The milk-drinking levels in South Africa, Japan and Korea are 3.4 times to 3.6 times China's, and those in Australia and U.K. are as high as 12 times greater.

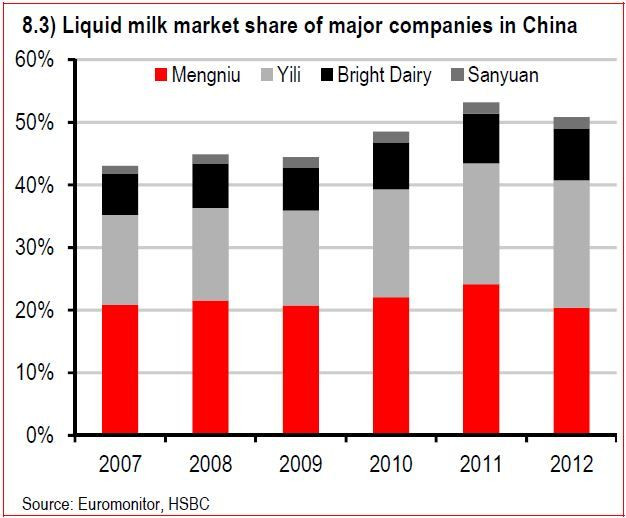

The liquid milk sector in the world’s second-largest economy is fairly concentrated, following consolidation among producers in the past few years.

Two of the largest national players, China Mengniu Dairy Company Ltd. and Yili Group, have expanded their combined share from 35 percent in 2007 to 41 percent in 2012.

“We expect the consolidation trend will continue for another decade, with national and regional players expanding further into the rural market,” HSBC analyst Christopher Leung said in a note.

China is the world's top dairy importer. Imports of milk powder (including infant formula) represented 33 percent of the global market in 2012, rising to 38 percent in 2013, according to HSBC.

A series of milk contamination scandals since 2008, in which Chinese-made formula tainted with the industrial chemical melamine killed six infants and sickened 300,000, has shaken consumer confidence in domestic dairy products.

“Demand for imported infant formula has been exceptionally strong in the past few years as consumers have increasingly traded up to higher-end infant formula products,” Leung said.

The easing of the one-child policy will also boost the growth of the infant formula milk powder market, and HSBC expects this to raise consumption of infant formula products by 4 percent to 8 percent yearly.

Rising demand from China helped New Zealand record its first trade surplus in January since March 2012, and its highest surplus ever for the first month of the year.

Of 4.1 billion New Zealand dollars ($3.4 billion US) in total exports, 1.2 billion went to China -- a leap of 92 percent from a year earlier. Milk powder, butter and cheese made up just over 40 percent of exports, and nearly half went to China.

In February, French food giant Danone SA (EPA:BN) paid $663 million to more than double its stake in China Mengniu Dairy Company Limited (HKG:2319) as the nation’s demand for dairy products rises.

On the same day, RRJ Capital, a private equity firm run by former Goldman Sachs partner Richard Ong, announced it plans to invest 1.5 billion yuan ($248 million) in a unit of Bright Dairy & Food Co. Ltd. (SHA:600597), China’s third-largest milk producer.

At the same time, tighter regulations have led to consolidation among domestic dairy farms and milk collection centers, with the larger and better-run enterprises surviving.

The Chinese government said last year it wanted to cut the number of domestic milk powder manufacturers to 50 from 127, and to see 10 large dairy entities with an annual income of more than 2 billion yuan take over 70 percent of the market in five years, a Fitch report said.

In addition, the rapid increase in prices in the past few years has provided farmers with greater incentive to focus on the safety and quality of their raw milk.

© Copyright IBTimes 2024. All rights reserved.