China’s Real Estate Is Back, Home Prices Could Rise 5%-10% In 2013

China’s real estate sector, the pre-eminent driver of China’s growth, is in recovery mode, according to economists at Standard Chartered, as developers cut prices and local city governments began to ease real estate regulations. They believe warnings of an imminent nationwide housing market collapse are overblown.

Real estate, according to Lan Shen and Stephen Green of Standard Chartered, accounted for 12.4 percent of China’s total output in 2012. Real estate investment as a share of gross domestic product edged up to 13.8 percent last year, from 13 percent in 2011.

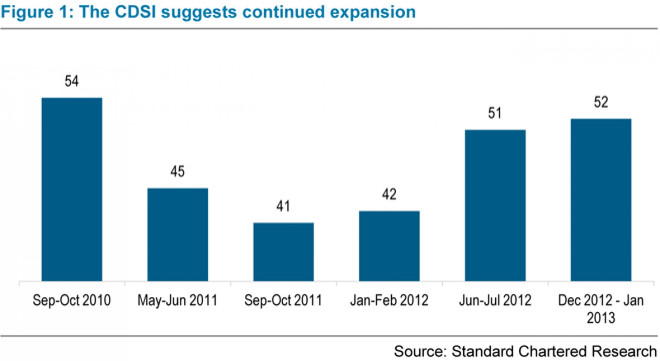

The China Developers Sentiment Index, an index developed by Standard Chartered based on its quarterly survey of 30 mainland developers operating in Tier 2 and Tier 3 cities (Wuhan, Xi'an, Shijiazhuang, Chengdu, Zhongshan, Nanjing), indicated a continued expansion in the fourth quarter of 2012.

A rebound in the housing market will bring with it all manner of positive growth drivers – everything from recovering steel demand to more car purchases.

Apart from a few cities, apartment prices appear somewhat stable, and the likelihood of the government tightening housing policy is declining.

“This suggests that the recovery can be sustained,” Shen and Green said in a note to clients.

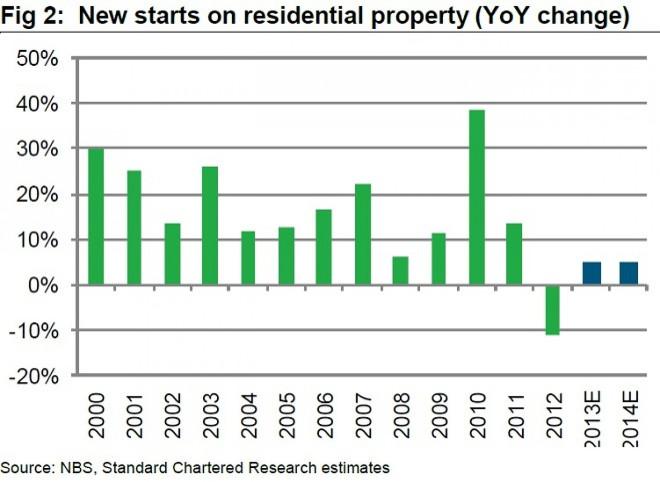

Most developers had slowed down the speed of construction in 2012, which caused new starts to fall 8 percent year-over-year. As the market has recovered and sentiment improved since the fourth quarter of last year, developers speeded up the scale of construction.

Overall, new starts will likely rise about 5 percent to 10 percent year-over-year in 2013, according to Standard Chartered.

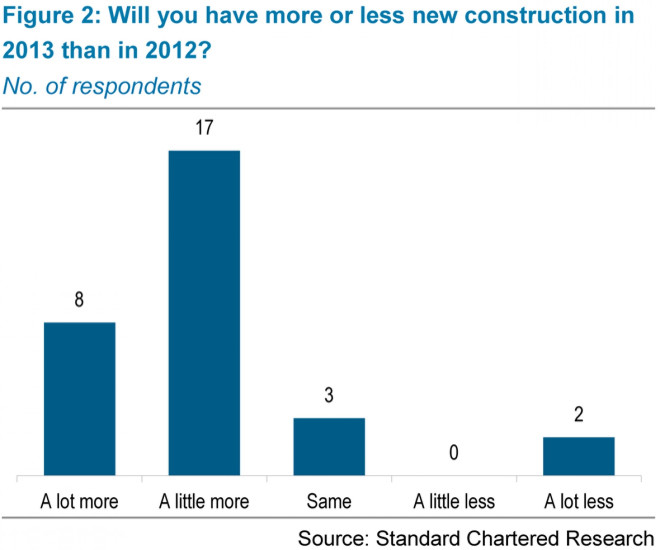

Shen and Green found 25 developers out of the 30 surveyed said they would be building more than in 2012 (eight said they would be building a lot more).

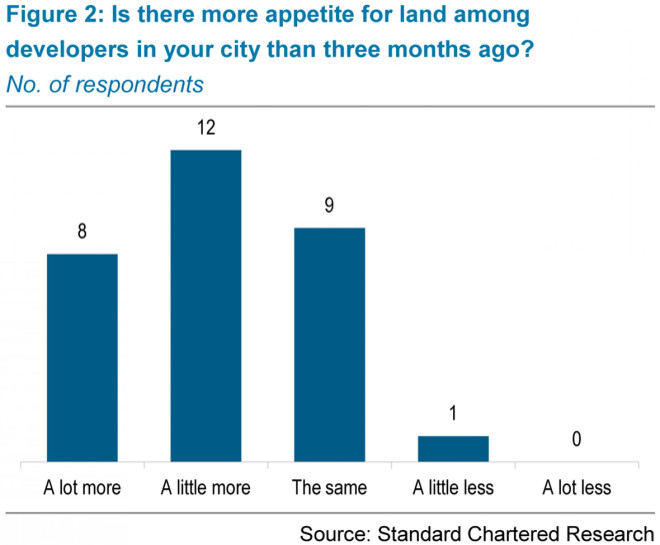

Developers are also snapping up more land. Eighteen of the 30 developers polled intend to buy land in the next three to six months, the highest in the past four phases. Twenty of them report a bigger appetite for land among developers in their cities compared with three months ago.

Land sales in China’s 10 major cities jumped 263 percent to 56.2 billion yuan ($9.02 billion) in January from last year, China Daily reported Tuesday, citing data from Shanghai E-house Real Estate Research Institute.

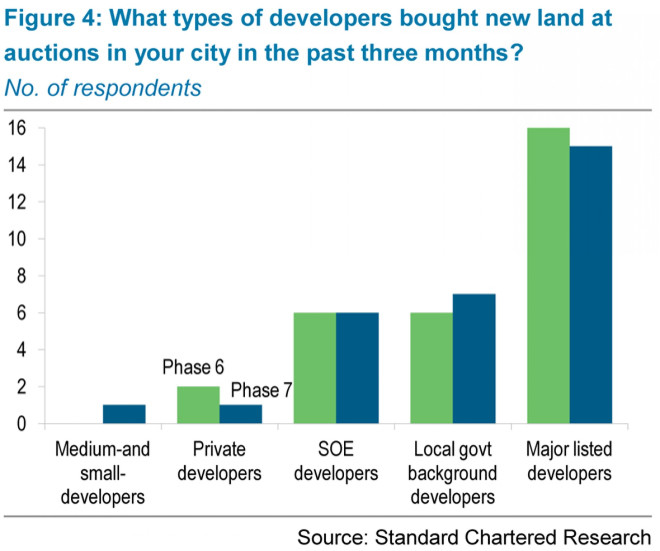

Consolidation continues to be the dominant trend in the primary and secondary land markets: big developers are getting bigger.

Major listed developers remain the dominant buyers at auctions, Shen and Green noted. Developers with a state-owned enterprise (SOE) or local government background were also active, while private and smaller developers remain cautious.

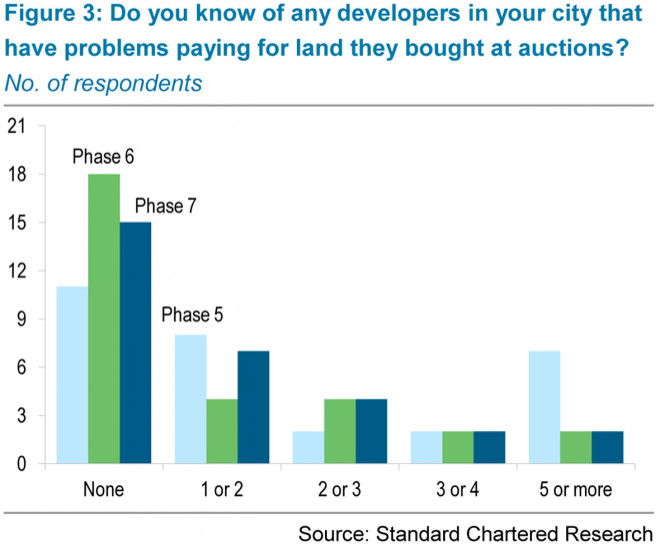

Developers’ cash positions also seem good. Half of them had not heard of a peer having problems paying for land.

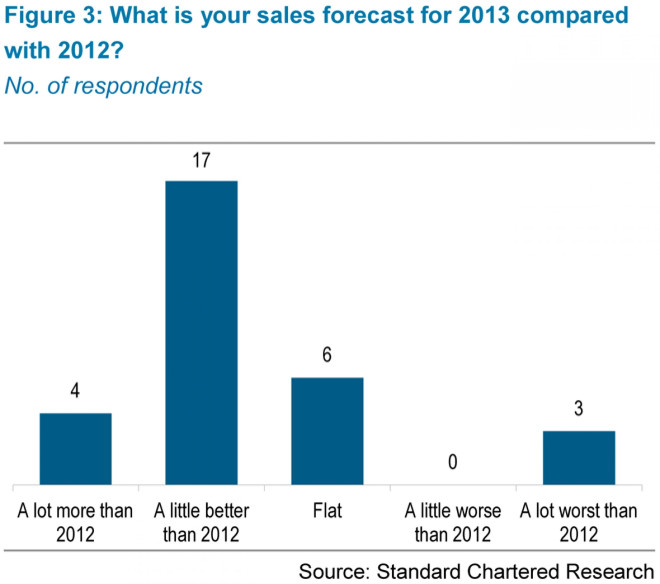

Several large developers have already raised their sales targets for 2013, and most of them polled indicated that price hikes this year should be around 10 percent.

There’s real demand in the housing market. According to these developers, 49 percent of sales in China are to first-time buyers, 35 percent to buyers upgrading, and 15 percent to investors. Another welcoming development is that incomes are growing faster than house prices, which has led to a drop in the affordability ratio -- the ratio of average home prices to average incomes.

To shield its economy from the fallout of the 2008 financial crisis, Beijing orchestrated a massive economic stimulus. It invested billions in infrastructure projects and encouraged banks to fund construction of apartments, office towers and retail centers. This caused a huge spike in home prices and pushed costs well above the reach of many people in China’s rapidly emerging urban middle class, sowing social discontent.

In early 2010, Beijing began introducing measures to stop property prices from rising too quickly.

“Half of our developers still expect no change in the central government’s stance on real estate in the next three months, but 11 respondents now expect policy loosening, a significant increase from previous phases,” Shen and Green said.

© Copyright IBTimes 2024. All rights reserved.