China's Roaring Real Estate Market Slows Down, But Price Growth Still Tops The World

China's real estate prices have been cooling off lately, but they remain hotter than anywhere else. According to Knight Frank, a real estate consultancy, the country has the top three cities in the world for the highest housing price growth. From the fourth quarter of 2006 to the fourth quarter of 2011, Beijing and Shanghai saw prices increase 110.9 percent, beating out Hong Kong, which saw prices rise 93.7 percent over the same period.

The government is worried about runaway inflation and has put in place policies to rein in prices.

In Beijing and Shanghai at least, prices have begun to stabilize over the last year. Between the end of 2010 and the end of 2011, housing prices in the two cities fell by 2 percent; the Hong Kong market remained strong and prices rose 11.3 percent over the same period.

Outside of China, Israel had the highest price growth, comparatively far lower at only 54.5 percent. Overall, East Asia countries topped the list of big real estate performers. Out of the top 10 locations in the world for housing price growth in the past 5 years, half were located in East Asia.

China's government has begun a broad effort to cool down the property market amid concerns the housing market is overheating and too expensive for average middle-income citizens.

China said in December that it would maintain its property-tightening policies, promote the return of home prices to reasonable levels and promote the healthy development of the property market. The government announced that restrictions on multiple-home purchases would remain in place throughout 2012, to prevent a potential real estate bubble from bursting.

Analysts point out that in the past China's growing class of high-income earners lacked good investment channels, and therefore chose to put their assets into real estate to secure better returns.

China's National Bureau of Statistics reported that the 2011 average income in Beijing was about 80,449 yuan, or roughly $12,770. Knight Frank research showed that the average price per square meter of new home in Beijing was 20,561 yuan, or about $3,260; in other words, more than $300 per square foot. The survey reflected pricing in Beijing's urban and suburban zones but excluded prices for second-hand housing.

Shanghai prices were in the same vicinity, at 19,504 yuan per square meter. In inland cities, however, such as Chongqing and Chengdu, prices remained comparatively much lower, at 6,586 yuan per square meter and 6,254 per square meter, respectively -- but incomes in central China are far lower as well.

That means housing in major coastal Chinese cities may already be more expensive than in U.S. urban areas, even as incomes remain far lower. The $300 per square foot is comparable to prices in San Franciso and higher than those in Los Angeles and the five boroughs of New York City, according to information from Haver Analytics, an economic research company. Average incomes of between $50,000 and $60,000 per year are also much higher in those U.S. cities, according to the Brookings Institution, a nonprofit public policy organization based in Washington.

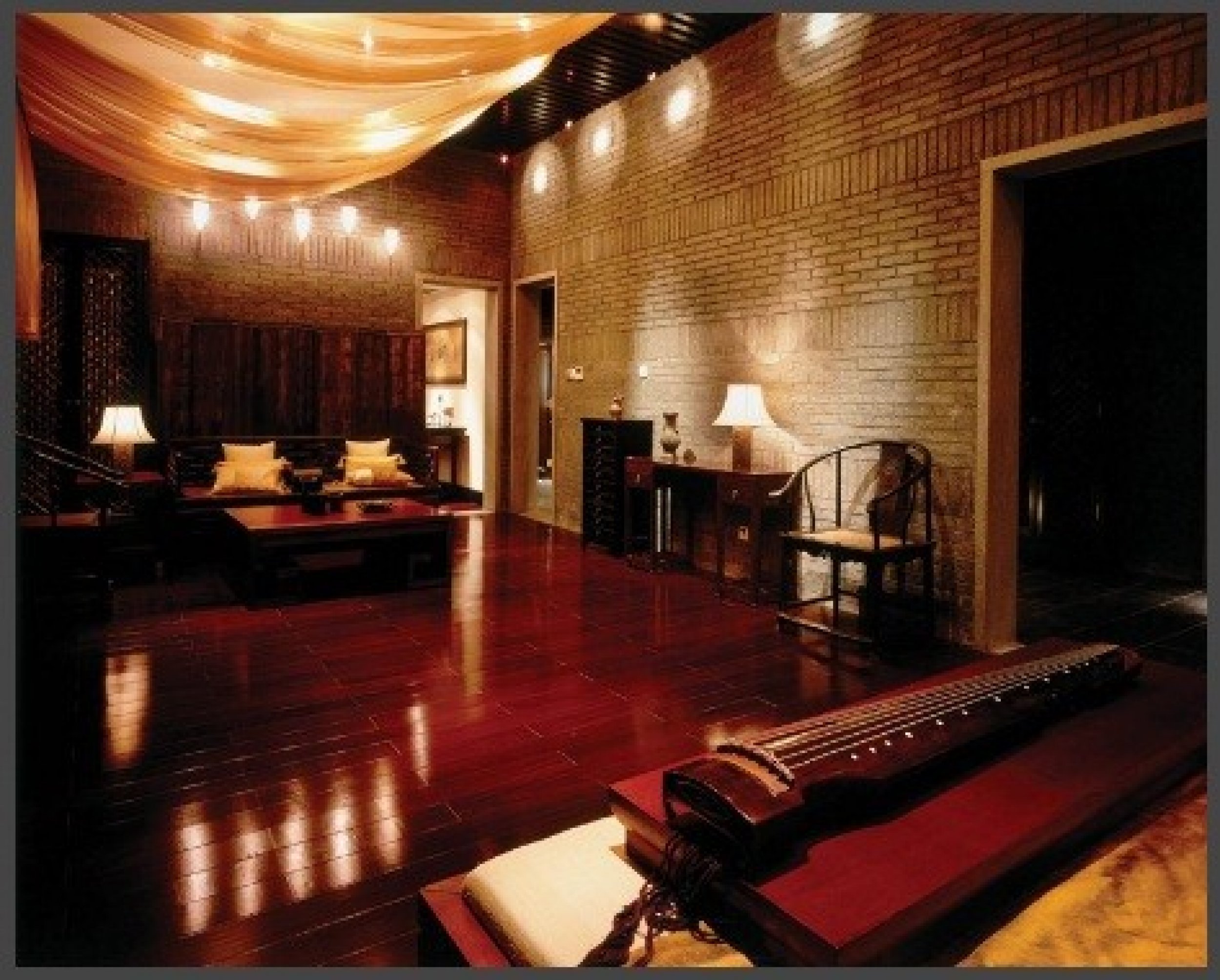

Knight Frank said high-end residential prices in downtown Beijing ranged between 50,000 and 80,000 yuan per square meter, or about $730 to $1,180 per square foot, more or less equal to prices in Manhattan.

Nevertheless, China's large property developers appear to be performing well. Vanke, China's largest property developer, which mostly focuses on the country's large coastal cities, reported in late March that its sales had risen 23.5 percent over the past year. The company's profits have risen 32 percent since March 2011, to 9.62 billion yuan, or about $1.5 billion.

© Copyright IBTimes 2024. All rights reserved.