China’s Shadow Banking: Regulators To Force Greater Disclosure Of Off-Balance-Sheet Lending

China’s shadow banking system has been growing at an alarming rate. Currently, almost half of all new credit is supplied by non-banks or through off-balance-sheet vehicles of regular banks, up from 10 percent a decade ago. Regulators are aware of the risks this dimly lit sector poses to the Chinese banking system, and they are experimenting with rules to force greater disclosure of off-balance-sheet lending, the FT reports, citing people briefed on the new rules.

The amount of funds flowing through this system is growing rapidly – it was estimated to be around 25 trillion yuan ($4.02 trillion) at the end of 2012, or 48 percent of GDP and 39 percent of RMB loans.

Shadow banking can take many forms, including loan sharks, investment companies known as trusts and off-balance-sheet lending by regular banks. The most important of the latter are “wealth management products,” or WMPs, which are considered potentially dangerous.

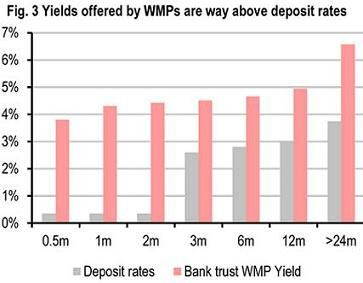

According to the People’s Bank of China’s definition, WMPs are investment management plans sold by banks. In theory, this makes them similar to products sold by the private banking arms of Western banks. They are not classified as deposits, so the yield they offer is not dictated by the PBoC deposit ceiling. Any losses on products whose principal is not guaranteed by banks should (in theory) be borne by the investors.

Xiao Gang, chairman of the board of Bank of China (SHA:601988), one of the top four state-owned banks, wrote in an op-ed in the English-language China Daily in October, saying that the shadow banking sector was a potential source of systemic financial risk over the next few years.

The quality and transparency of WMPs was “worrisome,” he said, adding that many assets underlying the products were dependent on real estate or long-term infrastructure projects that might find it impossible to generate sufficient cash flow to meet repayment obligations.

"To some extent, this is fundamentally a Ponzi scheme,” Xiao added.

The subject attracted headlines after the default of a WMP offered by Hua Xia Bank, an incident which is being investigated by police and regulators. Local media reported that the proceeds from the product, which offered a yield of 11 percent, were invested in a pawn shop that closed down.

HSBC analysts led by Yi Hu estimate WMPs accounted for 15 percent of new deposits last year. Small- and medium-sized banks are more reliant on WMPs, which amounted to 27 percent of their new deposits.

“We are concerned that as credit, inflation and the property market rebound in 2013, banks may have to offer higher yields on WMPs to attract depositors and maintain funding stability,” Hu said in a note to clients. This will bring higher funding costs to both the banking system and the economy, increase the risk of capital misallocation, and put pressure on the financial health of borrowers and banks’ asset quality.

Moreover, cases of potential defaults have begun to emerge in the WMP, trust and bond markets.

HSBC estimates that the leverage level of the Chinese economy, as measured by private credit to GDP, reached a record 177 percent at the end of 2012 due to higher non-bank credit and slower economic growth.

“The higher funding costs and the greater leverage that has built up in the past few years are likely to cause more defaults,” Hu said. “Any change of risk appetite or perceptions by investors could destabilize the banking sector from a funding perspective.”

© Copyright IBTimes 2024. All rights reserved.