China's Struggling Huarong Secures $6.6 Billion Lifeline

Cash-strapped debt collector Huarong Asset Management has announced plans to raise $6.6 billion by selling shares and divesting more assets as the deeply indebted Chinese state-owned firm tries to stay afloat.

The rescue plan, made in an overnight Wednesday filing to the Hong Kong stock exchange, will see the firm sell some 41.2 billion shares to investors led by Citic Group at 1.02 yuan apiece.

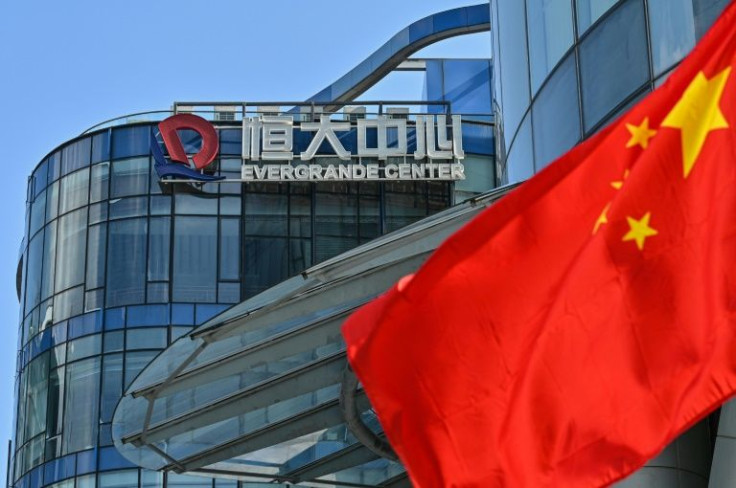

The news came as real estate giant Evergrande, whose struggles to address a swollen debt pile has fanned fears about the Chinese property sector, announced it was raising $273 million by selling its remaining stake in film production and streaming company HengTen Networks.

Hong Kong-based Allied Resources Investment Holdings snapped up HengTen for HK$1.28 a share, a 24 percent discount on its Wednesday close, according to a filing with Hong Kong's stock exchange.

Both Evergrande and Huarong have become worrying examples of Chinese companies that have run up massive debts, with mainland authorities desperate to stem any contagion from their potential collapse.

Huarong, one of four debt collectors created by China's finance ministry, spooked Asian markets earlier this year when it delayed its annual report in March.

Investors began to worry about whether it could cover its $242 billion in liabilities -- including some $20 billion in offshore bonds -- although it has so far met all its repayment obligations.

Five months later Huarong finally published its results, revealing a record $15.9 billion loss for 2020 as well as the outlines of a rescue plan.

The share sale announced late Wednesday is part of that rescue package and will see the finance ministry's stake in Huarong fall to 28 percent from 57 percent.

But it is still below the 50 billion yuan ($7.8 billion) Huarong said it hoped to raise when it first announced the rescue plan in August.

Alarm bells began to ring about privately owned property giant Evergrande earlier this summer when it struggled to make a series of repayments on domestic and foreign bonds.

The liquidity crunch at one of China's biggest property developers -- which has some $300 billion in liabilities -- has battered investor sentiment and rattled the country's key real estate market, adding to fears of wider contagion.

Evergrande has since scrambled to sell assets to raise cash.

Last week it met a deadline to pay overdue interest on three US-dollar bonds before their grace periods ended.

Meanwhile, Hong Kong media have reported that the firm's chairman Hui Ka Yan is offloading some of his personal fortune to raise cash, including a luxury property in the finance hub's ritzy Peak district.

Bloomberg News also reported Thursday that Chinese property management company Country Garden Services Holdings is planning to raise $1.03 billion through a share sale, an indication of how the real estate sector is rushing to fill an ongoing liquidity crunch.

© Copyright AFP 2024. All rights reserved.