Chinese Foreign Direct Investment (FDI): Going On A ‘Shopping Spree’ In Europe

With trillions of dollars in foreign-exchange reserves, China is gradually diversifying from its custom of simply parking that wealth in low-risk government bonds. The Chinese are now buying up depressed assets on foreign soil. And their favorite destination is Europe.

Since 2008, China has been allocating an increasing share of its $3.18 trillion worth of foreign-exchange reserves, the world’s largest, to both Europe and the U.S.

The world's second-biggest economy’s outbound direct investment from non-financial firms in January totaled $4.9 billion, up 12.3 percent from a year ago, according to China Commerce Ministry data released last Wednesday.

The debt crisis in Europe presents the prospect of discounted prices, while an increasingly strong yuan is making European (and American) assets look more attractive. Just seven years ago, the Chinese yuan (CNY) traded at 8.23 to the dollar. Now the CNY trades at 6.23 and continues to strengthen.

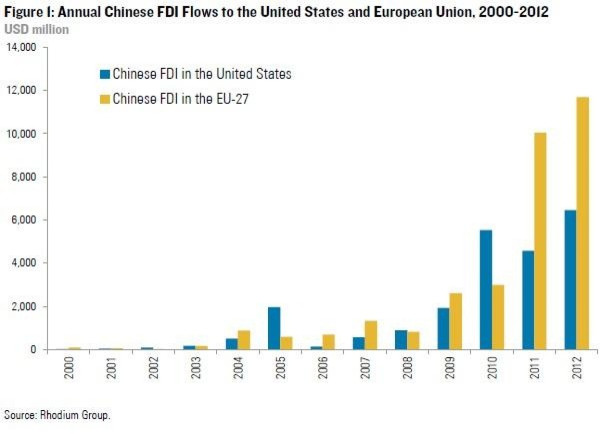

After a similar take-off phase, patterns diverged in the past two years, with Europe receiving almost twice as much investment as the U.S., according to a new report from the Rhodium Group.

Annual flows to the European Union grew from less than $1 billion annually before 2008 to an average of $3 billion in 2009 and 2010, before tripling to more than $10 billion in the past two years. Ten years ago, there were fewer than 20 cross-border deals. But that has changed: 573 deals have been done between 2000 and 2011, with Germany in the leading position.

Meanwhile, in the U.S., Chinese investment surged from less than $1 billion in 2008 to $5 billion in 2010, before dropping again to $4.7 billion in 2011. In 2012 investment reached a new record of $6.5 billion, but values remained below the levels seen in the EU in the past two years.

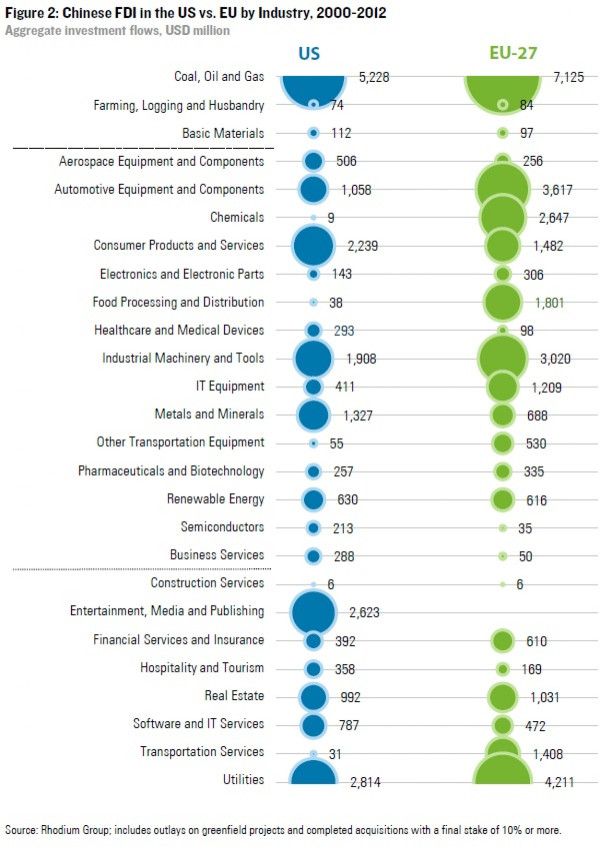

“Chinese investors seized opportunities to buy into cash-strapped European industrials and assets promising stable long-term returns such as utilities and other infrastructure,” the Rhodium report said.

Geographically, Chinese investment is concentrated in a few large EU economies – namely, France, the UK and Germany.

China's foreign-exchange regulator has been actively but quietly investing in British property and infrastructure, the Wall Street Journal reports. Since last May, U.K.-registered Gingko Tree Investment Ltd., a wholly owned unit of China's State Administration of Foreign Exchange, has invested more than $1.6 billion in at least four deals, including a water utility, student housing, and office buildings in London and Manchester.

Rhodium Group researchers Thilo Hanemann and Adam Lysenko found that U.S. security reviews have killed some deals and likely dissuaded other investors.

By contrast, European officials welcomed Chinese investment in sensitive, high-profile assets like airports, electricity grids and ports. Including utilities, Chinese firms spent close to $6 billion on European infrastructure assets.

Investments in U.S. infrastructure assets would make commercial sense for Chinese state enterprises and sovereign investment vehicles as well, but the reactions to similar earlier investments such as the Dubai Ports World controversy in 2006 seem to have made Chinese investors cautious about U.S. infrastructure plays.

National security concerns are also affecting investment in high-tech sectors. Chinese telecommunications equipment firms, for example, spent more than three times as much in Europe than in the U.S., where the Committee on Foreign Investment in the United States (CFIUS) has interfered with several deals and firms have seen their business prospects diminished by intervention from U.S. government officials, members of Congress and security agencies, according to the report.

While much of the world, including Europe, is embracing China’s telecommunications giant Huawei Technology Co. Ltd. (SHE:002502), the U.S. market is wary.

A House Intelligence Committee report released in October urged the U.S. government to block acquisitions or mergers by Huawei and ZTE Corporation (HKG:0763), China’s two largest phone-equipment makers, for fear that this will provide opportunities for Chinese intelligence services to tamper with U.S. telecommunications networks for spying.

The congressional report concluded that with their ties to the Chinese government, neither of these companies can be trusted with infrastructure of such critical importance.

“The risks associated with Huawei’s and ZTE’s provision of equipment to U.S. critical infrastructure could undermine core U.S. national security interests,” the report said.

“As the Chinese economy matures and firms become more experienced at doing business abroad, Chinese interest in advanced economy assets will continue to be strong in coming years,” the Rhodium report states. “The political response will be critical for future deal-making in both economies.”

© Copyright IBTimes 2024. All rights reserved.