Chinese And Other Emerging-Market Economies Have Shaken Investor Confidence, Bank For International Settlements Says

Accelerating concerns centered on growth in emerging-market economies (EMEs) generally and China’s economy particularly have rattled the confidence of financial-market participants around the world, the Bank for International Settlements reported in its “BIS Quarterly Review” released Sunday. The repercussions of this shaken confidence have been felt in markets focused on equity and debt securities, commodities, currencies and other assets, said the so-called central bank for central banks based in Basel, Switzerland.

“In China, equity markets plunged following a prolonged surge in stock prices that had propelled many stock valuations to extreme levels. This dented investor confidence and weighed on asset prices globally,” the BIS reported in its review of international banking and financial-market developments. It also said:

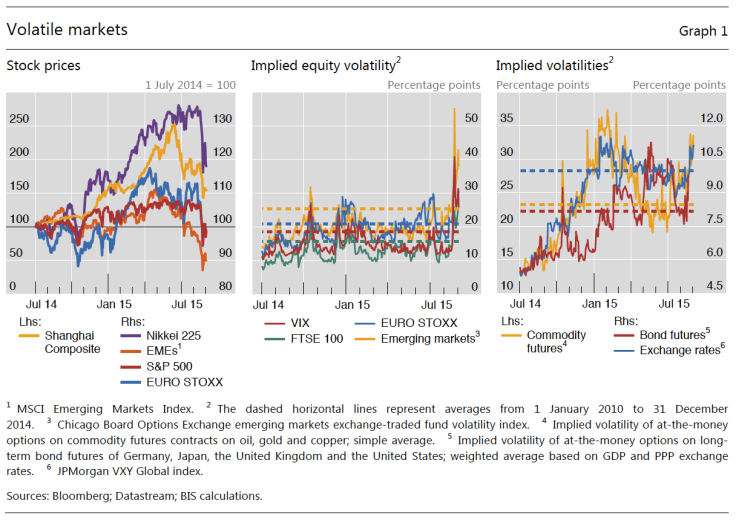

“The Chinese authorities’ decision in August to allow the renminbi to depreciate against the dollar gave markets a renewed jolt. The move intensified investors’ concerns about growth prospects for China, EMEs more broadly and, ultimately, the global economy. As a result, a number of currencies came under further pressure, particularly in Asia. With Chinese equities resuming their plunge in the second half of August, risky assets sold off across the globe and implied volatilities spiked up across asset classes.”

Focusing on these recently spiking levels of volatility at a media briefing Friday, Claudio Borio, head of the monetary and economic department at the BIS, said: “[T]he last quarter -- the period under review in this issue -- has one distinguishing feature: turbulence. Initially … it was Greece that grabbed all the attention and headlines. But the Greek crisis, for all its drama and potential disruptive force, soon ended once some form of agreement was reached in early July.” However, Borio said:

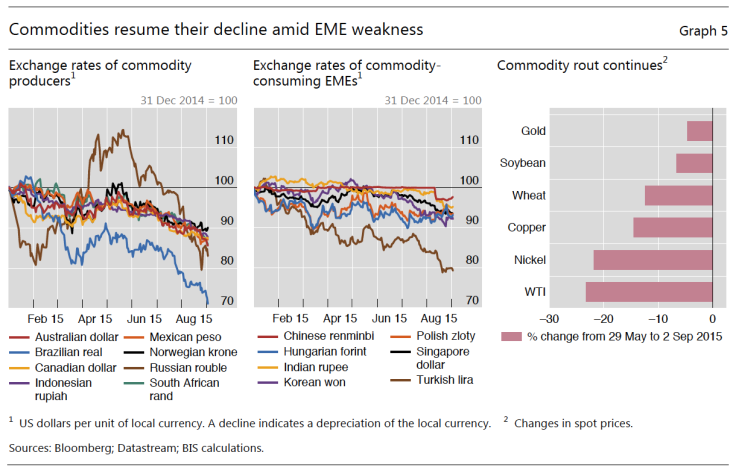

“The shocks in July and August set off much bigger and far-reaching tremors. Stock markets around the world weakened. More importantly, commodity prices plummeted -- accelerating their previous longer-term decline -- and volatility spiked. The oil-price gyrations were remarkable. The price sunk to a new trough below $40 on 24 August, undoing the whole of the partial recovery in the second quarter of the year, then soared some 30 percent in only one week before dropping back again. Even more importantly, the exchange rates of … EMEs, especially commodity exporters, were hit hard, and their credit spreads widened, although generally not dramatically.”

Along the same line, the BIS reported in its review:

“Perceptions of falling demand due to weakening economic activity in a range of EMEs most likely played a key role, although strong supply helped to undermine oil prices. In turn, falling commodity prices further hurt the growth outlook for commodity-producing EMEs. As a result, many commodity producers saw renewed depreciation of their exchange rates, which was exacerbated by another episode of dollar strengthening resulting from the U.S. monetary-policy outlook.”

More clarity on the U.S. monetary-policy outlook should come when the Federal Open Market Committee issues both its policy statement and its latest summary of economic projections Thursday, the same day Federal Reserve Chair Janet L. Yellen conducts a press conference. The Fed has not boosted its federal funds rate in about a decade, and the CME Group FedWatch currently puts the probability of a rate hike at only about 23 percent this week.

Whatever the Federal Reserve chooses to do with its short-term interest rates this time around, its decision is unlikely to have any material effects on the bias divergence on monetary policy between it and almost every other major central bank on the planet, with the Fed oriented toward tightening and the rest oriented toward loosening. Accordingly, the impacts of this bias divergence are likely to continue, meaning a comparatively strong U.S. dollar on the one side and a comparatively weak euro, Japanese yen, British pound sterling, Canadian dollar, Swedish krona and Swiss franc on the other side, with the Chinese renminbi appearing to have less in common with the former currency and more in common with the latter currencies -- and all that implies.

© Copyright IBTimes 2024. All rights reserved.