Chinese Slowdown Means Soft Growth For Emerging Markets - Some More than Others

Despite fears of an emerging market slowdown thanks to recently slowing growth in China, the International Monetary Fund is forecasting that they’re still set for growth, just not as fast as they may be used to.

“On a global level, the situation’s looking up,” said Barry Bosworth, global economics expert and former presidential advisor at the Brookings Institute. “They’ve taken a somewhat more optimistic tone. In the last couple of years reading the thing was just a big downer."

The report, parts of which were released Thursday, suggests that growth in emerging markets will continue despite a slowdown in Chinese demand.

“Positive external conditions provided emerging market economies with the opportunity to strengthen their economic policies and reforms,” the report reads. “But while growth may soften as those conditions unwind, it will remain strong.”

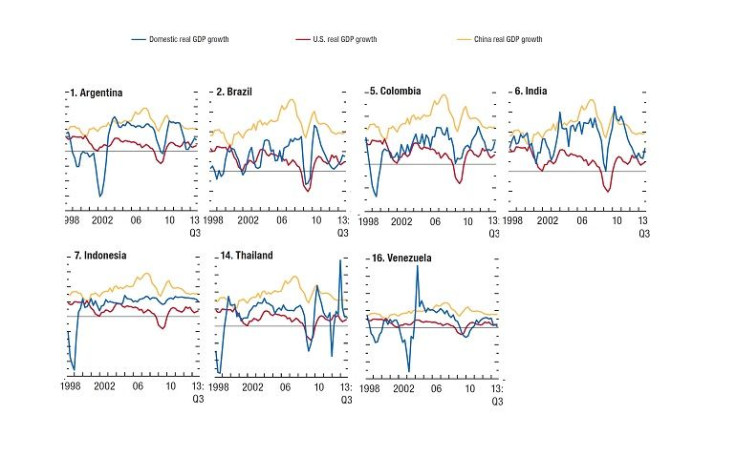

But certain emerging markets are more attached to China than others, and thus more sensitive to fluctuations in the Chinese economy. Due to trade patterns, the fate of some countries is tied to China, while others are more correlated with the United States.

For example, Argentina, Brazil, Colombia, India, Indonesia, Thailand and Venezuela all show stronger ties to Chinese growth.

“In general, countries that are big raw material producers and selling in the world market are correlated with China,” said Bosworth. As China's economy expanded, it required more and more of metals, construction materials and agricultural products. Struggling emerging economies were happy to provide them, which boosted economic growth. But all this changed when the Chinese economy started to slow.

Brazil, for example, was hit hard.

“Brazil was very dependent on being able to sell raw materials to China, and people in Brazil saved nothing themselves. It’s very subject to these fluctuations or cycles of expectations," he said.

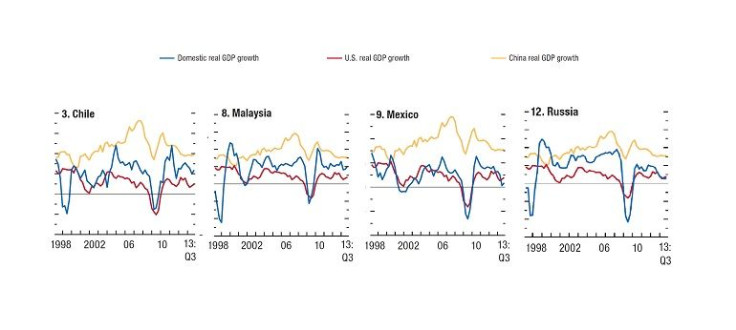

Meanwhile, the IMF data shows that economic growth in Chile, Malaysia, Mexico, Russia and Turkey is more correlated to the U.S. than to China. This is mainly due to the fact that these markets primarily sell products to North America and Europe.

“Countries that are more producers of various types of manufactured products being sold into advanced economies will be more correlated with the U.S.,” Bosworth said.

Russia marks an interesting difference. Though it’s a major exporter of raw materials and energy, many of its partners are in Europe rather than China.

Not included in the IMF report were profiles of so-called “frontier” economies, which are economies whose capital markets are less developed than those of emerging markets. The IMF says frontier economies, many of which are in sub-Saharan Africa, are expected to see record levels of growth in the upcoming years. China has been highly involved among these economies, too, but it’s too early to predict what the outcomes might be.

© Copyright IBTimes 2024. All rights reserved.