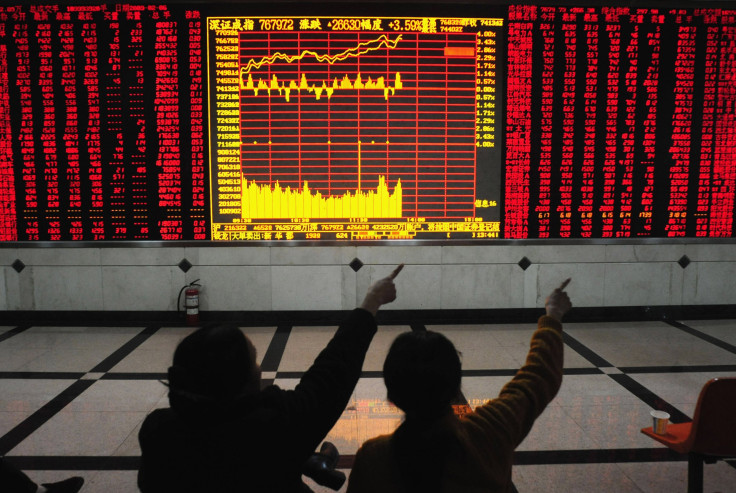

Chinese Stock Market Hits 7-Year High Despite Bubble Warnings, Farmers Look To Cash In On Boom

SHANGHAI -- China’s stock market hit a seven-year high on Friday, as the recent bull run continued, with investors apparently undeterred by volatility, which some experts say is a warning of a bubble. The main Shanghai Composite Index closed at 5023.10, after breaking through the 5,000-mark for the first time since 2008. It follows a rise of more than 50 percent on the market this year alone, which has enticed millions of new retail investors to pour into the market.

A correction last week, when the market dropped 6.5 percent in a day, had led some to signal alarm bells that the market is overvalued. But despite a number of warnings, including from some in the Chinese media and the country’s regulators themselves, a wave of new listings of state enterprises this week -- including the $2.16 billion listing of China National Nuclear Power Corporation, the country’s largest for nearly five years, may have contributed to the rise, by helping to convince investors that the Chinese government is backing the market.

It’s an attitude that informed the country’s first boom, in the first half of the last decade, when many investors said the government could not afford to let the market crash -- only for the markets to drop from over 6,000 points in 2007 to under 2,000 the following year. And some analysts have warned that the current boom seems far removed from the fundamentals of China’s economy, which has seen economic growth slow to 7 percent in the first quarter of this year for the first time since 2008 (though industrial output did show signs of a fragile recovery in May, according to latest figures.)

Shanghai-based economist Andy Xie told the International Business Times recently that the authorities were “stoking up” the markets to distract attention from other problems, but warned that this would divert capital from the real economy. BNP Paribas said this week that the country’s A shares were a “speculative bubble” that would eventually burst, though it did not predict when this would happen.

Various factors have contributed to the boom. Although China’s securities regulator has said it will restrict margin trading, which allows citizens to borrow from brokerages to invest in the market, many investors have found it easy to raise funds, and a recent cut in lending rates has stimulated borrowing. And Premier Li Keqiang’s recent emphasis on encouraging innovation, and making it easier for technology start-ups to raise funds through the markets, also appears to have caught the imagination of a country that now has many examples of rags-to-riches tales of successful tech companies, from Alibaba to Tencent.

China’s hi-tech board, the ChiNext Index, has performed best of all, rising by more than 160 percent this year (though it fell 1 percent on Friday, with some investors reportedly anxious that it was overvalued). And a new link with Hong Kong’s stock exchange has also allowed foreign capital to flow into China’s markets -- while the country is waiting to see whether its ‘A-Share’ market will be included in MSCI’s Emerging Markets index.

Meanwhile stories of success continue to lure new investors, with more than 4.5 million new trading accounts opened last week alone, according to the South China Morning Post. (The government recently relaxed rules that restricted investors to just one account each.)

Shanghai’s Dragon TV reported Friday on a village in northern Shanxi province, where more than a hundred residents were now reported to be combining their traditional occupation, growing apples, with “frying stocks” -- as buying and selling shares is known in China.

One resident, Liu Lianguo, told the channel that playing mahjong, the residents’ former spare time occupation, might lead people astray, into a life of gambling -- whereas the government was “encouraging us to invest in the stock market.” Some villagers were reported to have earned tens of thousands of U.S. dollars in just a few weeks.

And with stories of students investing in shares, and a wave of novels about playing the markets now attracting readers, it’s no wonder that one Dragon TV news presenter said this week that, “if you’re not frying shares at the moment you feel embarrassed to talk to people, you don’t know what to talk about.”

It was reported last week that 100 new dollar billionaires had been created in China in the previous month alone, due to the rise in share valuations. Yet there have been some spectacular slumps too -- with massive plunges in recent weeks in the values of companies including Hong Kong-listed solar technology firm Hanergy, and real estate developer Evergrande.

Still, despite a series of experts warning of what the Financial Times this week described as dangerous “euphoria” on the Chinese markets, there have also been enough voices arguing that China’s stocks could still boom for a year or two to keep more people pouring into the markets.

© Copyright IBTimes 2024. All rights reserved.