Chipmaker Stocks Climb, Sickly Euro Treads Water

Gains in chipmakers lifted stocks to calm investors after hawkish Federal Reserve comments increased the likelihood of a hefty interest rate hike later this month and raised fears over how much this could slow the economy.

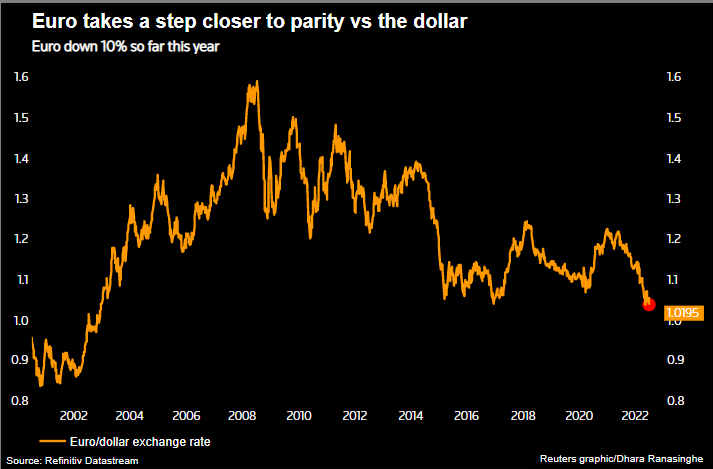

The euro struggled to avoid dipping below parity with the safe-haven dollar.

Sterling was up 0.45%, little changed after Britain's Prime Minister Boris Johnson resigned following a string of ministerial resignations. The pound plumbed 2-year lows on Wednesday amid mounting political uncertainties.

Berenberg senior economist Kallum Pickering said a new leader less hostile to the European Union could help the pound.

"Over time, less fraught and uncertain UK-EU relations may prove to be the catalyst for stronger business investment and a sustained appreciation in sterling towards fair value against the dollar," Pickering said.

The FTSE blue chip index in London gained 0.9%.

Semiconductor firms rose in Europe after South Korea's Samsung posted its best second quarter profit in four years. Steady U.S. stock futures also bolstered European shares.

S&P 500 futures were up 0.35%, indicating a steady start on Wall Street where investors sought to gauge whether anticipated rate hikes would trigger recession.

Minutes from the Fed's June meeting published on Wednesday said an even more restrictive stance might be needed if elevated inflation persisted, with a 50 to 75 basis point hike likely when a two-day meeting ends on July 27.

The minutes sent euro zone yields higher.

The STOXX index of 600 European companies was up 1.5% at 412 points, still down about 16% from its record high six months ago.

The MSCI global share index was up 0.5%, having lost about a fifth of its value so far this year.

Kevin Thozet, investment committee member at Carmignac asset management, said U.S. economic data was pointing towards slower economic growth, though not imminent recession.

"Markets are potentially exaggerating recession risk or recession coming very rapidly," Thozet said, adding that investors were pivoting towards utility-style companies like pharmaceuticals, which are less sensitive to downturns.

"We are collectively buying what we need more than what we want," Thozet said.

Elsewhere in Europe, the euro sought to claw back from its near two-decade trough against the greenback and avoid going below parity for the first time since December 2002.[FRX/]

"The euro is in freefall and we have not heard any official from the European Central Bank commenting. It's as if they are locked in a bunker," Thozet said.

GRAPHIC: Euro/dollar heads towards parity?

"It's not just a question of recession, it's a question of how dark it gets in Europe," added Chris Weston, head of research at brokerage Pepperstone in Melbourne.

Unlike the Bank of England and the Federal Reserve, the ECB has yet to begin raising interest rates despite record high inflation in the euro zone, but the central bank is expected to increase rates by 25 basis points later this month.

"They could be hiking by 50 basis points and potentially they should," Thozet said.

GRAPHIC: Inverted U.S. Treasury curve a harbinger of recession

DUET OF FED SPEAKERS

Crude oil fluctuated on either side of $100 a barrel as tight supplies and worries over demand jostled for market attention.

Brent crude futures dipped below $100 a barrel early in the Asia session but recovered and were last at $101.69, up 1% on the day but down almost 10% for the week so far.

Benchmark U.S. 10-year yields were last at 2.92%, up slightly on that day after having fallen from a more than 11-year high of 3.498% on June 14.

The yield curve, measured by the gap between two and 10-year U.S bond yields, continued to push further into inverted territory, a sign that bond markets suspect aggressive rate hikes to tame inflation.

"The next litmus test for the direction in yields ... will be the speeches by Bullard and Waller - who should shed more light into the thinking of the hawkish camp within the (Fed)," said NatWest Markets' rates strategist Jan Nevruzi.

James Bullard, the St Louis Fed President, and Fed Governor Christopher Waller are both due to speak at 1700 GMT, though Friday's U.S payrolls data is also keenly awaited.

Asian stocks managed gradual gains, with MSCI's broadest index of Asia-Pacific shares outside Japan up 1% from a two-month low.

Japan's Nikkei closed up 1.47%, while South Korea's KOSPI index gained 1.8%, its best day in nearly two weeks, with Samsung Electronics one of the biggest movers after reporting earnings guidance that suggested a rebound for its chip business.

© Copyright Thomson Reuters 2024. All rights reserved.