Cisco Systems: Could Profit Pickup Show Doldrums Over?

Shares of Cisco Systems have jumped 20 percent in the past three months, which could be an indicator the No. 1 vendor of Internet networking products has surmounted a rough patch.

Cisco shares traded late Monday around $17.94, a far cry from the $13.93 set after disappointing fourth-quarter results came out Aug. 10.

After Wednesday's close, the San Jose, Calif.-based internet colossus is scheduled to report first-quarter results, which analysts expect to be much better. If so, it's likely other technology leaders expected to report this month --- like Hewlett-Packard, Dell and Nvidia --- could signal a prosperous 2012 is ahead.

Analysts expect Cisco will report net income around $1.8 billion, or 34 cents a share, down from 37 cents a year ago, as revenue increases about 3 percent to $11.01 billion.

There are three reasons underlying the estimates.

First is that Cisco still has to pay costs of restructuring in the third quarter, when it fired 6,500 employees and closed a factory in Mexico with another 5,000 workers. They could be as much as $300 million, far below the fourth quarter's $750 million.

To move more into the home and consumer electronics sector, Cisco acquired Scientific-Atlanta in 2006 for $6.9 billion. Now, it's been shutting factories where it made set-top boxes sold to carriers like Verizon Communications for its FiOS TV services.

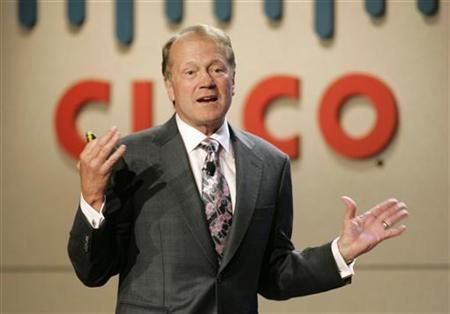

Second, Cisco's revenue appears to have been relatively immune from what CEO John Chambers, 62, had warned would be a slowdown in orders from the public sector, or government agencies. The fears appear to have been overblown.

IBM, for example, reported its third quarter public sector sales were solid and that European orders were strong, despite fears of getting hammered by the European financial crisis.

Third, as the No. 1 provider of switches and routers, ahead of smaller vendors like Juniper Networks and Huawei Technologies, Cisco has apparently won major new orders from several top U.S. service providers, said analyst Rohit Chopra with Wedbush Securities.

These customers are giants like AT&T and Verizon, which constantly upgrade networks to move more traffic. They account for about one third of Cisco's revenue.

Cisco may also have benefited from the management shakeup at rival HP, where CEO Leo Apotheker was ousted in favor of former eBay CEO Meg Whitman on Sept. 25 as well as the vaunted management skills of CEO Chambers, who promised investors in August the company would be better managed for profitability ahead.

Cisco's lead independent director, Carol Bartz, 63, lost her job as CEO of Yahoo on Sept. 5. Among her fellow Cisco directors is Yahoo co-founder and former CEO Jerry Yang, 42.

Cisco's market capitalization is now about $95.3 billion, a far cry from 2000, when it was around $579 billion.

© Copyright IBTimes 2024. All rights reserved.