Cisco’s 4Q Results: Major Tech Bellwether For HP, Oracle

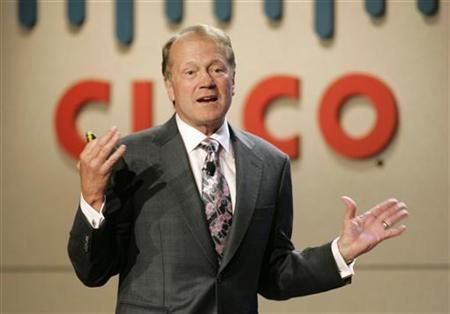

Cisco Systems Inc. (Nasdaq: CSCO), the No. 1 provider of Internet gear, is scheduled to report fourth-quarter results Wednesday that are expected to be much better than last year's, when CEO John Chambers said the company was overmanned and was in the midst of layoffs and retrenchment.

The San Jose, Calif., company is expected to report net income of $2.47 billion, or 46 cents a share, compared with only $2.19 billion, or 40 cents a share, in 4Q 2011, analysts surveyed by Thomson Reuters estimate.

Fourth-quarter revenue for the period ended July 31 is expected to rise about 3.6 percent to $11.6 billion.

Cisco is among a handful of technology giants whose reports are out of sync with most other companies, so they represent a bellwether of where the industry is headed for the rest of the year. Agilent Technologies Inc., (NYSE: A), the electronic instrument maker that was the original Hewlett-Packard Co. (NYSE: HPQ) before it was spun off, is also scheduled to report financials Wednesday.

Next week, HP itself reports third-quarter results. Oracle (Nasdaq: ORCL), the No. 1 database developer, closes its first quarter in August and will report results in early September.

Last week, HP said it expected to report stronger-than-expected operating searnings, following an earlier quarterly prediction by arch-rival International Business Machines Corp. (NYSE: IBM).

A year ago, Cisco was buffeted by the easing demand for gear from European customers ailing from the slowdown, a decrease in public sector orders from federal and state governments and dealing with inefficient consumer electronics factories in Mexico that came with its acquisition of Scientific-Atlanta in 2006.

But Chambers and his management team have done a good job rebuilding value, said Amitabh Passi, analyst with UBS, who rates Cisco a "Buy" and sees it gaining share in blade servers against HP, as well as China's Huawei Technologies. "More consistent execution" over the past 12 months improves his opinion of Cisco's prospects.

As well, Cisco has now expanded its footprint into the video market since the closing of its $5 billion acquisition of NDS Group of the UK from private equity firm Permira Advisers and Rupert Murdoch's News Corp. (NYSE: NWS). The takeover bolsters Cisco's offerings in software, as well as conference and video services, which are much in demand by enterprises.

Still, the company is experiencing major competition from software providers or so-called "software defined networks," provided by rivals such as storage giant EMC Corp. (NYSE: EMC), which controls VMware (NYSE: VMW), the No. 1 specialist in virtualization software. With virtualization, companies can effectively design and manage entire networks in software alone.

But Tim Long, analyst with BMO Capital, said he didn't expect VMware's approach to threaten Cisco much in the near term.

Cisco shares have gained more than 7 percent in the past year, although they've lost 5 percent to date in 2012. They closed Tuesday at $17.17, down 17 cents, giving the company a market capitalization of $91.9 billion.

© Copyright IBTimes 2024. All rights reserved.