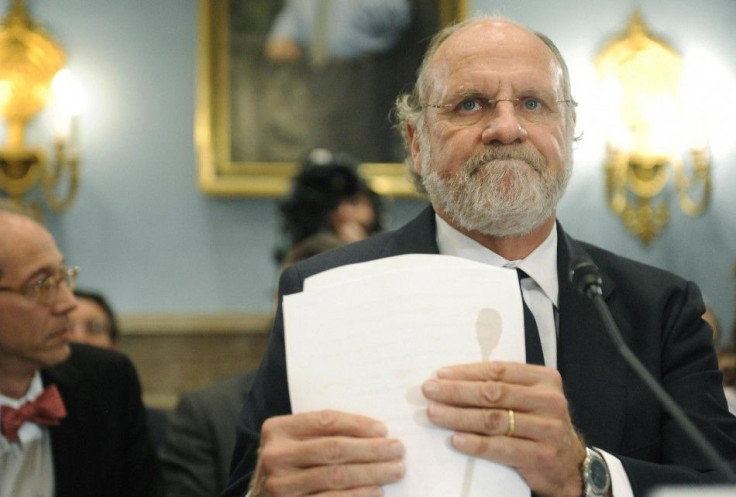

Civil Charges To Be Filed Against Jon Corzine Over MF Global Bankruptcy And Collapse, By Commodity Futures Trading Commission

Federal regulators plan civil charges against former Goldman Sachs CEO Jon Corzine later this week over the 2011 bankruptcy of his MF Global brokerage and its alleged misuse of client money, the New York Times reported Tuesday.

The Commodity Futures Trading Commission, which regulates futures and options, will file the case without offering Corzine a chance to settle, in a rarely adopted approach.

The federal lawsuit is likely to center on Corzine’s failure to prevent the loss of more than $1 billion in customer money. The agency is unlikely to implicate Corzine directly in the disappearance of those funds.

Spokesman Steven Goldberg said on behalf of Corzine that the suit is an “unprecedented and meritless civil enforcement action” and is politically motivated by the need to hold someone liable for MF Global’s collapse.

The firm’s October 2011 bankruptcy was the largest Wall Street bankruptcy since the 2008 financial crisis. When it filed for bankruptcy, MF Global owed $39.6 billion to more than 25,000 creditors, including $1.2 billion to its largest unsecured creditor, JP Morgan Chase & Co. (NYSE:JPM), court documents show.

If Corzine is found liable, he could face millions in fines and a ban on trading commodities. A civil judgment could also darken Corzine's reputation and possibly make it more difficult to defend against private lawsuits from former MF Global clients.

But because of the civil suit, Corzine is likely to avoid criminal prosecution. The trading commission declined to comment to the Times.

Goldberg denied any wrongdoing by Corzine, saying he shouldn’t be blamed for the actions of lower level employees about which he didn't know.

© Copyright IBTimes 2024. All rights reserved.