Clean Energy Investment: Companies To Issue $30 Billion In 'Green Bonds' This Year, S&P Reports

Electric utilities, real estate firms and other companies could issue a record $30 billion in “green bonds” this year, Standard & Poor’s Rating Services said Monday. The new investment tool is quickly gaining traction in global markets as countries and corporations seek to finance clean energy projects and reduce greenhouse gas emissions.

“The surge in green bond sales represents growing demand among investors for green investments amid concerns about climate change,” the New York-based ratings agency said in a Monday statement cited by Reuters.

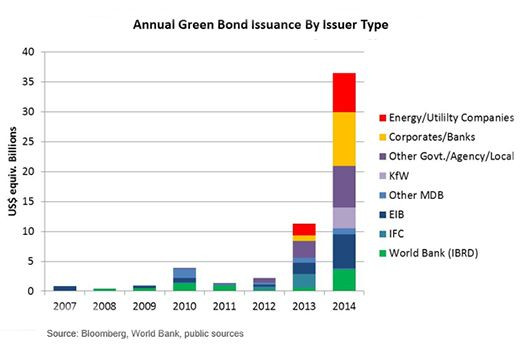

Development banks and companies typically sell green bonds to help pay for renewable energy projects such as wind farms and solar installations, as well as energy-saving building retrofits and highly energy-efficient appliances and technologies. Around $36.6 billion in green bonds were issued last year -- triple the amount in 2013 -- with companies accounting for about $19 billion of last year’s total.

The World Bank alone has issued nearly $8 billion in green bonds since 2008 to support projects such as mass transit systems in India, energy-efficiency improvement in China, sustainable forest management in Mexico, and geothermal power development in Indonesia. In February, the bank issued its largest round to date, with $600 million in green bonds going to a broad group of investors, including U.S. asset manager BlackRock, Deutsche Bank’s treasury management division, Nippon Life Insurance Company in Japan, and the United Nations joint staff pension fund.

“Green bonds have created a new way for investors to achieve the return they need while also supporting climate-friendly development projects,” the World Bank said in a February press release. “Many long-term investors today consider climate risk and sustainability in their investment choices."

S&P said Monday that the steep decline in global oil prices should not hamper interest in the green bond market this year. Cheaper crude oil will have less impact on renewable energy investments given that climate change is a long-term driver for such projects, Reuters noted.

Brent crude, the international oil benchmark, slipped to nearly $55 a barrel Monday amid fresh concerns of a global oil supply. Prices fell last week to about $53 a barrel, a six-year low, after news that U.S. oil storage facilities were rapidly filling up.

© Copyright IBTimes 2024. All rights reserved.