Clorox Rejects Icahn's Bid Again

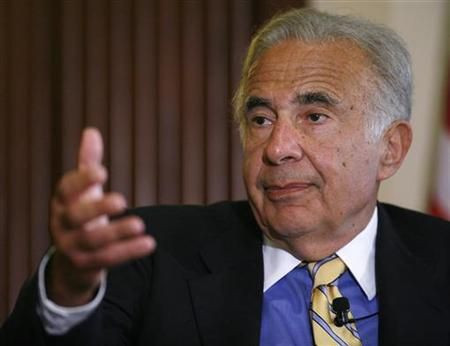

Clorox rejected Carl Icahn's takeover bid for the second time on Wednesday, calling the bid "inadequate."

The Oakland-based company rejected Icahn's $80 per share bid, which valued the company at $10.7 billion. Icahn had previously made a $10.2 billion bid on July 15th but was rejected only a few days later by the company.

The rejection comes a day after a pension fund filed a lawsuit against Clorox for attempting to use a shareholders-rights technique against Icahn. If Icahn was to acquire more than 10 percent of the company, the "poison pill" would allow for all shareholders to acquire more shares at a discounted rate, making a takeover attempt more expensive.

This move, the lawsuit said, is not in the best interest of shareholders or the company's future.

"In refusing duly to consider the Icahn proposal, or other alternatives, the board is not acting in good faith and is deriving an improper personal benefit in impeding the sale of Clorox," the retirement system said.

Analysts have speculated that Icahn is trying to use a "pump and dump" strategy to try to instill some life into the company and get the stock price to go up. After making his initial bid, Icahn encouraged companies such as Procter& Gamble and Kimberly-Clark to also place bids on Clorox.

The speculation was that more competition could push the share price up to $100, and then Icahn would dump his stock with a hefty profit. But the stock hasn't gotten anywhere near that $100 price just yet, and actually haven't even reached Icahn's first bid of $76 dollars a share.

It's unknown what Icahn will do now that his takeover bid has been rejected twice. He could bump up his price yet again or perhaps start a proxy fight by slating his own board of directors.

Even an increased bid might not gain Clorox's favor though, especially after Icahn hinted that he'd consider breaking up the company if his takeover bid was successful.

© Copyright IBTimes 2024. All rights reserved.