Cloud Services Are Booming For Axon Enterprise Inc

Axon Enterprise Inc. (NASDAQ:AAXN) continues to see a rapid rise in body camera use in 2018, with over 20,000 cameras sold in the second quarter. Even better for investors, customers tied into long-term contracts are adding up, and that drives high-margin growth in Axon's cloud segment.

This article originally appeared in the Motley Fool.

But Axon's biggest business, for the time being, is still Tasers. Here are the important details on Tasers, body cameras, and everything else going on at Axon Enterprise after the recently released second-quarter earnings report.

What happened with Axon Enterprise this quarter?

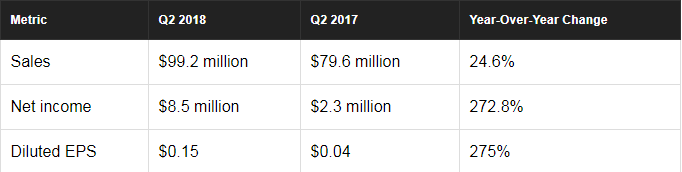

The headline numbers are impressive and show the revenue growth and margin expansion that investors were hoping to see this year. But breaking results down by segment is important:

- Sales of weapons (Tasers) were up 14.4% versus a year ago to $60.6 million. Gross margin for the legacy business was also up 110 basis points to 70.8%.

- The software and sensors segment includes body cameras and related cloud services, which are now split into two categories. In the "sensors and other" category, sales were up 16.1% versus a year ago to $16.1 million, showing the growing adoption of body cameras. Axon Cloud net sales were up 76.3%, showing the addition of new cloud subscriptions to the business. As we should expect, sensors and other gross margin was a low 16.7%, while cloud gross margin was a lofty 77.8%. Axon wants to lock customers into long-term cloud contracts because that's where the real profit is.

- Overall, gross margin was 63.6%, which is solid but could have been better if it weren't for low-margin sales from the recently acquired Vievu company. Buying Vievu probably won't directly be a big financial win given these low margins, but it eliminates Axon's fiercest competitor, which should drive higher margins in the future.

Axon continues to see rising adoption for both Tasers and body cameras, which is a great sign for the company. Long term, even more growth could come from new products, and management updated investors on progress on that front as well:

- Axon Fleet, the company's vehicle product, was launched this summer, and management said it will begin shipping soon.

- Evidence.com cloud storage continues to see improvements, with body camera footage, drone images, and citizen-submitted images now storable and searchable on the cloud.

- Axon Air was announced in the second quarter, adding drones to the company's list of products. Axon will lean on DJI to build the drones, using the product as another source of footage storable in the cloud.

- Axon Records, an evidence-capture tool for officers' use in the field, is still in testing and isn't expected to generate significant revenue until mid-2019. Since it's the most transformative product in the pipeline, this delay isn't welcome news. But at least we now have a better idea of when the product will come out.

What management had to say

In a letter to shareholders, CEO Rick Smith indicated that Axon is still investing heavily in growth initiatives: "Our product pipeline is key to delivering upon our long-term growth objectives. We continue to scale our research and development organization, with significant progress building out our engineering team year to date."

Spending on R&D may keep net income relatively low for the foreseeable future, but if Axon is able to expand product capabilities and lock customers into its high-margin platform long term, the investment will be worth it.

Looking forward

Despite two quarters with growth of 27.7% and 24.6%, management didn't change their expectation for 18% to 20% revenue growth in 2018. It's possible they're being conservative, but they may also see a slowdown in demand coming.

Management's guidance also reiterated a 300- to 400-basis-point improvement in operating margins in 2018. But in the future, the company will use adjusted EBITDA margin, which pulls out one-time and noncash costs, when giving margin guidance.

Travis Hoium owns shares of Axon Enterprise. The Motley Fool owns shares of and recommends Axon Enterprise. The Motley Fool has a disclosure policy.