Co-movement indicates herd mentality and predicts stock market crashes?

A study at the New England Complex Systems Institute has found that increasing co-movement in stocks may precede violent market crashes. The study appeared on arXix.org of Cornell Unversity.

Previously, attempts at predicting crashes centered on correlation and volatility. However, volatility relates to violent crashes in that it increases after them, but not really before, so it may not be a good leading indicator.

Using correlation as a measure, then, may expose studies to the weakness of having volatility as an input.

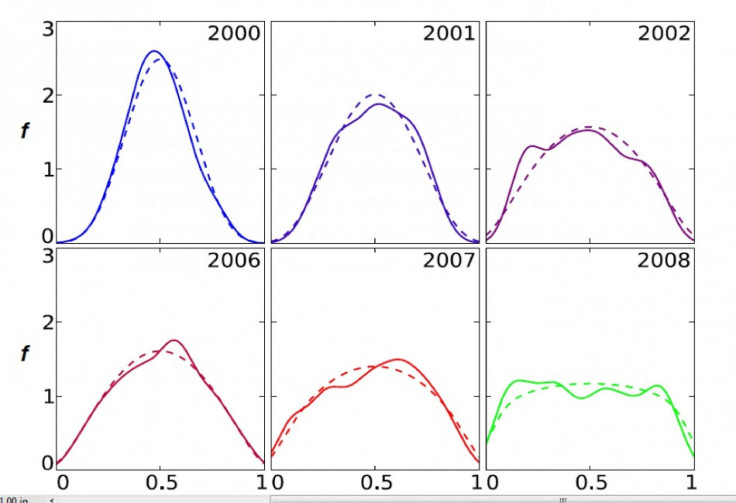

The team at the New England Complex Systems Institute found that a better measure is simply the fraction of stocks that move up or down in a given session, regardless of the magnitude of the moves. These records are then graphed over a period, as shown in the above picture.

In 2000, the results were clustered around the middle, meaning on most days, about 50 percent of the stocks went up and 50 percent went down, so co-movement was low. However, in 2008, the curve was much flatter, meaning that on many days, a large fraction of stocks moved either up or down together, so co-movement was high.

According to the researchers, the flattening of the curve - signaling increasing co-movement - may predict stock market crashes.

Their explanation is that when investors are nervous, they tend to become followers instead of thinking for themselves, hence the increase in co-movement. Herd mentality then kicks in, which makes the market vulnerable to a collective stampede out of financial assets.

Email Hao Li at hao.li@ibtimes.com

Click here to follow the IBTIMES Global Markets page on Facebook

Click here to read recent articles by Hao Li

© Copyright IBTimes 2024. All rights reserved.