Column-Dazed And Confused Enough To Buy Bonds: Mike Dolan

With prices falling like a stone as central bank tightening goes into overdrive, buying bonds may appear confused - but perhaps that very confusion is good enough reason in itself.

Financial markets are full of often contradictory old adages and pearls of 'wisdom' - like being greedy when others are fearful, but also not trying to catch a falling knife.

There's a kernel of truth to all of them but, mostly, they apply to different types of savers, traders or investment managers with different horizons and risk appetites.

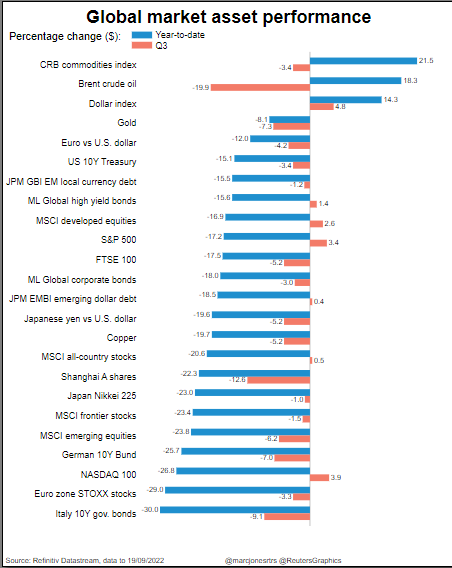

Right now, anyone playing bonds as a 'safe' alternative to plummeting stock prices is likely getting burned as inflation and interest rates rocket and bond indices nosedive in tandem with equities.

Even Exchange Traded Funds invested in U.S. Treasury bonds with relatively short maturities of between 1-3 years are in the red for both the third quarter and the year to date, with ETFs in longer duration Treasuries of between 7 and 10 years now losing more than 15% so far in 2022.

Whacked further by a soaring dollar, indices of overseas sovereign bonds in dollar terms are down almost 24% - even worse than then S&P500's 19% year-to-date reversal.

Far from portfolio buffers, these sorts of moves make bonds meat and drink for hedge funds.

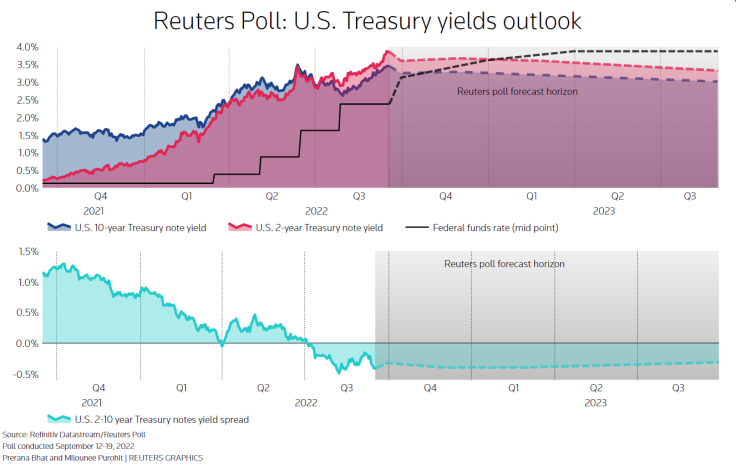

Speculative funds playing futures markets are playing bonds as one of the "big shorts" of the year - with net bearish bets on two-year Treasuries rising to their highest in almost 18 months last week and net shorts on longer-dated paper at the highest in a year as the Federal Reserve meets this week.

Rudyard Kipling's poetic exhortation to keep your head when all about you are losing theirs - which has also become a tired old piece of investment advice - then falls to longer-term asset managers more interested in yield and return rather than price.

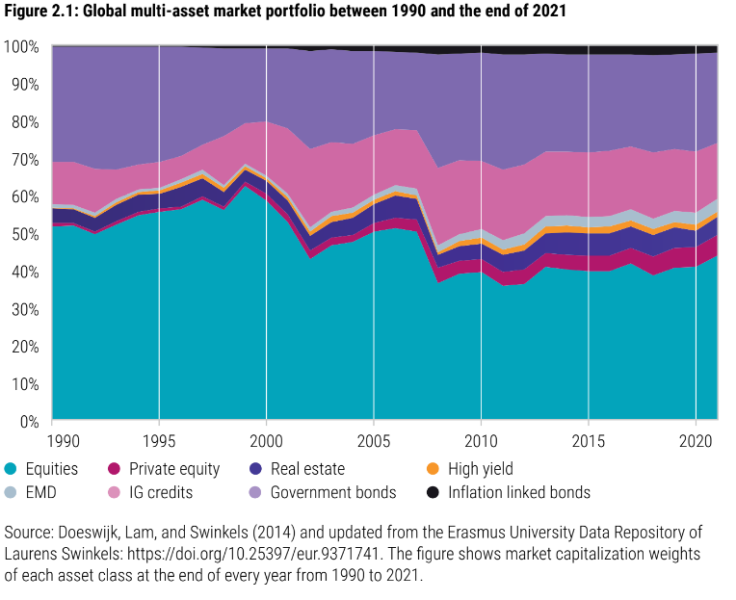

With higher yields, expected annual returns over the coming period have improved markedly. And even though equity prices have fallen and cheapened on many models, their relative value versus bonds has not.

Bad Year For Bonds

Global asset returns

'AGE OF CONFUSION'

In their latest annual report on 5-year expected returns, Dutch investment manager Robeco describes the period ahead as the "Age of Confusion".

For Robeco, markets have been disorientated by multiple recent shocks - compounded by a lack of understanding of inflation and shifting monetary policy alongside an ongoing debate about whether the so-called Great Moderation of structurally low inflation and interest rates had indeed ended.

This heightened uncertainty is reflected in an almost doubling of the volatility in analyst forecasts of 12-month forward global earnings estimates compared to pre-Covid levels.

But equities remain historically expensive and arguments about a lack of alternatives are now harder to make, it reckons.

Robeco estimates the rise in 'risk-free' government yields means that an estimated equity risk premium for a euro-based investor of 3% is now below the 3.5% long-term average for the first time in the 12-year history of their annual publication.

"This is partly because we envisage a level shift in consumption volatility that warrants a higher medium-term equity risk premium than is currently reflected by the market."

While not exactly a clarion call to buy bonds - where it still sees yields and term premia below 'steady state' estimates - Robeco managers do view them as 'substantially cheaper' and upgraded a 5-year annualized returns forecast for euro hedged developed economy sovereign bonds by 1.5 percentage points. It trimmed expected equity returns by a quarter point.

"Major claims of paradigm shifts require a heavy burden of proof. We find insufficient evidence to conclude that we are close to a tipping point where reflexivity leaves inflation in developed economies spiraling out of control," Robeco concluded, while acknowledging several competing scenarios.

Others are more direct in choosing bonds to protect mixed investments.

Societe Generale's global asset allocation team this month upgraded bonds by some 5 percentage points to 33% within its multi-asset portfolios, increasing U.S. bonds to one quarter of the overall allocation - hedging the additional weighting in euros as they don't want to increase an already high 53% dollar exposure any further.

"The Federal Reserve's credibility will continue to anchor inflation expectations under 2%," the SG team wrote. "Indeed, we consider US Treasuries to be one of the rare assets that have already priced in many of the risks ahead."

Confused? Almost 4% nominal yields on U.S. Treasury credit over two years or more than 3.5% now for 10 years may just be enough to bank to rebuild the mixed 60/40 equity/bond portfolios taking such a battering in 2022.

As Pictet Wealth Management's chief investment officer Cesar Perez Ruiz said earlier this month, 2023 could be the "revenge of the 60/40".

Reuters poll-U.S. treasury yield outlook

Robeco Chart on Asset Allocation History

The opinions expressed here are those of the author, a columnist for Reuters.

(by Mike Dolan, Twitter: @reutersMikeD; Editing by Chizu Nomiyama)

© Copyright Thomson Reuters 2024. All rights reserved.