Column-Sterling Needs The Kindness Of Reserve Managers :Mike Dolan

Perhaps remarkably, some of the world's major economies still hold at least part of their rainy-day savings in sterling and British government bonds - raising questions about whether long instability in both will keep them doing so.

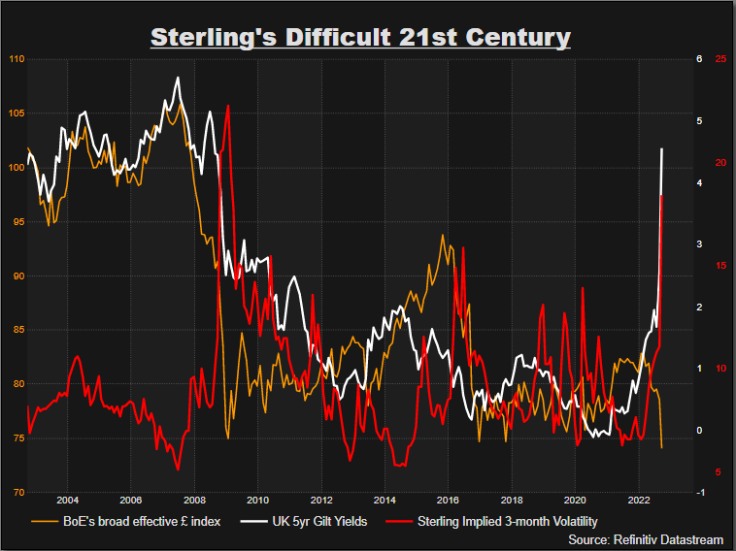

A pound plummeting to record lows and an illiquid and sometimes unstable gilt market has sent shockwaves around global markets since late last week - adding credence to recent fears that Britain, still the world's 6th biggest economy in the world, risked a balance of payments crisis on current policy trajectories.

The decision by new Prime Minister Liz Truss to go for broke and slash taxes during raging inflation, an energy shock, mounting borrowing needs and rising interest rates has perplexed the sort of foreign investors Britain sorely needs to attract to keep balancing its books. Sterling and gilts have taken the immediate heat and no one's clear yet what happens next.

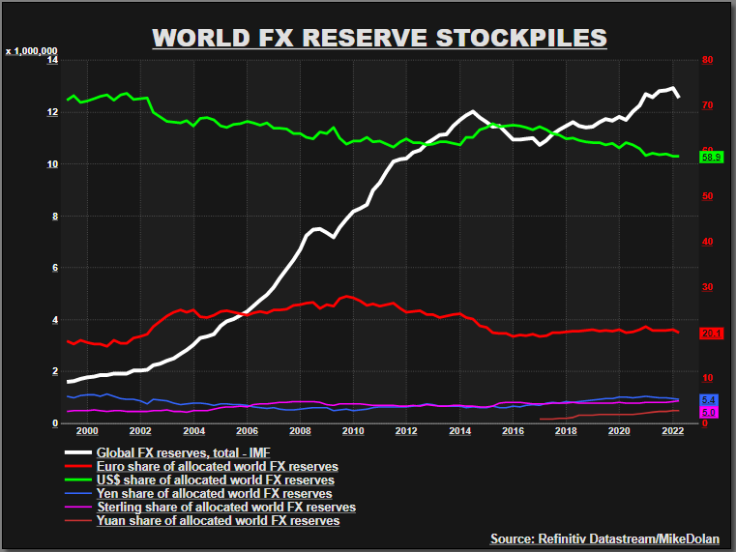

And yet despite many jibes about Britain being seen as an emerging market, it has retained an enviable position as printer of one of the world's five main reserve currencies - second only to the United States and euro zone, roughly on par with Japan and ahead of China.

At the International Monetary Fund's last count in the first quarter of this year, almost 5% of the world's foreign currency reserves were denominated in sterling - a total of $625 billion dollars worth of sterling and sterling assets on a crude calculation from the $12.55 trillion total.

In context, that's more than two thirds of the Bank of England's own bloated balance sheet - which was amassed since the 2008 banking crash and doubled up during the COVID-19 pandemic.

In other words, that stable foreign demand for sterling assets is a powerful buffer against the sort of "sudden stop" creditor strikes many developing economies experience and one reasons many analysts think calm can return.

As ING economist Chris Turner points out: "UK authorities will probably just have to let sterling find its right level. The UK has a reserve currency so it can always issue debt - it's just a question of the right price."

But what if that reserve currency position is threatened and foreign central banks balk at holding so much sterling in their national savings stashes?

GRAPHICS: Sterling in world FX Reserves:

GRAPHICS: Trade-weighted pound, gilts and volatility:

ASIA EXIT?

As the pound nosedived by an eye-watering 5% to record lows against the dollar in a matter of minutes in Asian trading hours on Monday - before London trading had even started - there was some suspicion of major investors there bailing out of British holdings.

Seven of the world's top 10 reserve holding central banks are in Asia or the Middle East. China and Japan account for the lion's share of total holdings with about $4.5 trillion between them - but India, Taiwan, Saudi Arabia, South Korea and Hong Kong account for a further $2.5 trillion of overall reserves.

Jim O'Neill, former Goldman Sachs global economist and ex UK Treasury minister, said the timing of sterling's lunge in Asia reasonably raises questions about whether big and reliable players exited pounds and underlines the scale of the misconception and miscommunication of government and BoE policy.

O'Neill described what he saw as policymaking "naivety" and the "huge mismatch" between government thinking and what markets wanted to hear. "Another couple of days like the ones we've just seen would lead to utter chaos," he said.

RISE AND FALL

Sterling's now distant history as a world's dominant reserve early in the last century makes it no stranger to decline. It rapidly ceded pole position to the dollar after World War Two and remained only a minor holding as the euro consolidated the second place roster after launch in 1999.

But for a country now running a current account deficit of more than 8% of national output, it's critical Britain and sterling don't lose the remaining valuable and often sticky friends in overseas central banks.

The criteria typically used to choose foreign currency for reserves are based on liquidity, security and returns - but also structural issues like being part of the five currencies forming the IMF's unit of account, a basket known as Special Drawing Rights (SDRs). Economic size, share of world trade and commodity invoicing as well as loose membership of currency blocs and zones also plays a significant part in allocation over time.

Right now, sterling remains part of the SDR along with the dollar, euro, yen and renminbi, and inertia around this sort of mechanistic allocation matching probably helps the pound.

Even though detailed breakdowns are hard to come by, there are clearly many anomalies from country to country. Sweden's Riksbank holds 7% of its reserves in sterling, for example, while the European Central Bank holds none.

And remarkably, IMF data showed sterling's share had actually risen to its highest in over 20 years this year - almost twice what it was in 2000 and relatively unchanged despite the banking crash in 2008 or Brexit over the past six years.

It may even have strayed too high.

An annual UBS survey of global reserve managers in June ominously showed that a net 13% expected to cut allocations to sterling going forward, more than any other currency.

None said they planned to increase.

On the other hand, changes to allocations tend to be glacial unless there is a massive shock or change of circumstances.

"Central banks tend to go against the market and do what it takes to preserve their allocations, unless they come to the opinion that something major has changed from a long-term perspective," said hedge fund manager Stephen Jen at SLJ Eurizon. "I don't believe that's the case with the pound."

Whether this is in fact a paradigm shift or a major rethink of the credit quality or debt sustainability of Britain is now key to the story and will play out over the coming months.

GRAPHICS: UBS chart on its 2022 survey of world reserve managers:

The opinions expressed here are those of the author, a columnist for Reuters.

(by Mike Dolan, Twitter: @reutersMikeD; Editing by Josie Kao)

© Copyright Thomson Reuters 2024. All rights reserved.