Comcast-Time Warner Cable Hearings: At Senate Judiciary Committee, Critics Cite History Of Flouting FCC Merger Conditions

Some say a merged Comcast-TWC would be like a ‘nationwide octopus with massive tentacles’

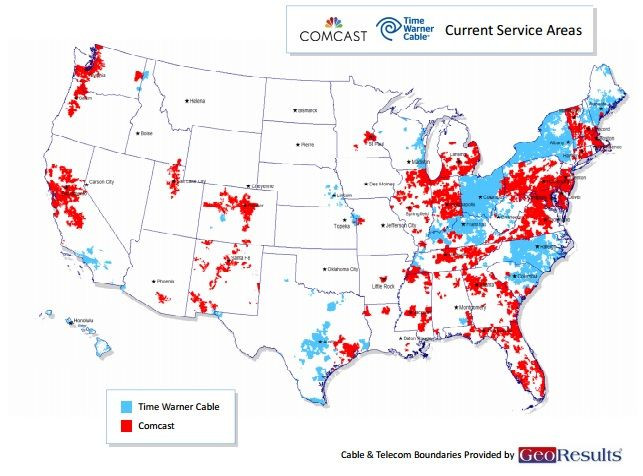

In its bid to dominate roughly one-third of the U.S. cable television and Internet markets, Comcast has pledged to foster a competitive environment that will benefit consumers. But its checkered history of flouting federal merger conditions in favor of its own interests tells a different story.

That’s according to critics who testified Wednesday morning before the U.S. Senate Judiciary Committee hearing examining the prosed merger between Comcast Corp. (NASDAQ:CMCSA) and Time Warner Cable Inc. (NYSE:TWC). The hearing, which marks the start of a regulatory process that will ultimately determine if the country’s No. 1 and No. 2 cable providers can merge into one massive pay-TV behemoth, saw testimony from a number of consumer advocates and media-industry professionals worried that a merged Comcast-TWC would use its market dominance to squash emerging players before they’ve even had a chance to start.

“Unfortunately, Comcast has a track record,” said James Bosworth, chief executive of Back9Network Inc., a soon-to-launch golf and lifestyle network that will compete directly with the Comcast-owned Golf Channel. In impassioned testimony, Bosworth said he had been hoping to secure a carriage deal with Time Warner Cable, but that negations “sputtered” after the merger with Comcast was announced. He said Comcast’s stated commitment to issues like Net neutrality -- the principle that all Internet content be treated equally by providers -- means very little given that it already has a history of violating FCC-imposed merger conditions and blatantly favoring its own content over that of its competitors.

As a case in point, Bosworth cited one of the key conditions for the 2009 merger between Comcast and NBCUniversal, which required Comcast to bundle news networks near one another on a channel lineup, creating what’s known as “news neighborhoods.” The condition was meant to prevent Comcast from giving preferential placement to its own news networks, such as CNBC. But in 2011, Bloomberg L.P. accused Comcast of discriminating against Bloomberg TV, leaving it outside the news neighborhood while packaging CNBC close to major news channels like CNN and Fox News. It was a direct violation of the merger condition, Bloomberg argued, and the FCC ultimately agreed. But it took two years before the FCC ordered Comcast to relocate Bloomberg TV. Had Bloomberg TV been a fledgling network like Bosworth’s, it may not have survived to see the court battle through.

“Comcast clearly has the incentive to act in an anticompetitive manner based on its vertical integration,” Bosworth said. “That incentive alone is not concerning; what is problematic is that it has -- and with Time Warner Cable will certainly have -- not only the incentive but the ability to profit over the long term by thwarting competition in the programming market.”

The Comcast-NBCUniversal merger, which created the largest media and communications company in the world, was approved only after Comcast agreed to a condition that it would not unfairly discriminate against either video distributors or emerging online competitors. But Gene Kimmelman, president and chief officer of the nonprofit Public Knowledge, said a merged Comcast-TWC would present competitive risks that “far exceed traditional regulatory policy practices.” In his testimony, an animated Kimmelman said a merged Comcast would have unprecedented ability to squelch competing interests at a time when mobile technology, emerging streaming platforms and alternative set-top boxes are finally offering hope to long-suffering cable customers plagued by constantly rising cable bills and poor service. Kimmelman compared a merged Comcast-TWC to a “nationwide octopus,” with “massive tentacles … capable of squeezing innovation in sectors all throughout the distribution chain.”

Not surprisingly, David Cohen, executive vice president of Comcast, disagreed, and in fact cited innovation as one of the merger’s primary aims. “The business reason for this transaction is to create a scale that will enable Comcast to invest more in innovation, and infrastructure, and ability to compete effectively,” he said in his testimony. “When we invest, our competitors invest, too.”

Cohen said traditional boundaries between media, communications and tech companies are becoming obsolete, and that Comcast’s “real competitors” are national and global firms like Apple Inc. (NASDAQ:AAPL), Google Inc. (NASDAQ:GOOG) and Netflix Inc. (NASDAQ:NFLX). He said Comcast’s expansion into locations currently served by TWC will only help the two companies compete closer to the same level of those firms. “While this transaction will make us bigger, that’s a good thing, not a problem,” he said.

The hearing was moderated by Sen. Patrick Leahy, D-Vt., chairman of the committee and a longtime critic of media consolidation, who voted against the landmark 1996 Telecommunications Act, which allowed cross-media ownership for the first time in American history. Leahy said the proposed merger will need to be highly scrutinized, and said he worried about its potential impact on consumers’ access to the Internet at a time when the Internet is becoming more vital to everyday life. “It is an annoyance for consumers when they cannot stream the most recent season of ‘House of Cards’ due to an interconnection dispute,” Leahy said. “But in the future, it could be a matter of life or death for patients who cannot reach healthcare services for the same reason.”

Got a news tip? Email me. Follow me on Twitter @christopherzara.

© Copyright IBTimes 2024. All rights reserved.