Barclays Stories

Analysts Slam RIM's Latest Phone Delay; Shares Tumble

Several brokerage firms trimmed their price targets on Research in Motion shares and questioned the BlackBerry maker's ability to recover, after the company delayed the launch of its new line of smartphones.

Europe's Markets Higher Friday at Mid-Day, Led By Mining Sector

European shares were slightly higher on Friday at mid-day amid thin trading as miners tracked rising metal prices, offset by lingering concerns over the Eurozone debt crisis and reservations ahead of U.S. inflation data.

As U.S. Economy Gains Steam, Hopes Pinned on Eurozone

The threat of Europe's financial crisis drifting overseas, slowing the U.S. recovery, remains. The Federal Reserve noted this week that Europe's debt crisis remains a threat to the U.S. economy, which it said is expanding moderately. Concerns linger over the health of the European banking sector and possible ratings downgrades in debt-ridden European countries.

Analysts Slam RIM's Latest Phone Delays

Several brokerage firms trimmed their price targets on Research in Motion shares and questioned the BlackBerry maker's ability to recover, after the company further delayed the release of its new line of smartphones.

World Stocks Rise from 3-Week Low

World stocks rose on Friday after upbeat U.S. data and corporate results, while concerns over the European banking sector and nervousness about potential ratings downgrades in European sovereign debt underpinned German government bonds.

Fitch Downgrades Seven Global Banks

Fitch Ratings, the third-biggest of the major credit rating agencies, downgraded seven global banks based in Europe and the United States, citing "increased challenges" in the financial markets.

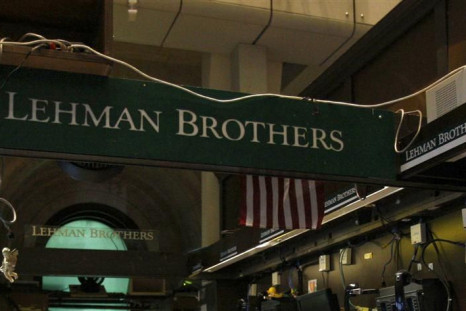

Lehman Seeks $1.33 Billion Archstone Stake, Challenging Sam Zell

The estate of Lehman Brothers has sought to match Sam Zell's $1.33 billion bid for a 26.5 percent stake in Archstone, sharpening the rivalry for the multifamily housing giant.

Thomas Cook axes 200 Shops, Checks out of 500 Hotels

Thomas Cook will close 200 underperforming shops and 500 hotels and is lining up further disposals, as it battles to cut debt and restore confidence among investors and customers after a bailout by its banks.

Europe's Markets Rise Tuesday at Mid-Day on German Economic Sentiment

European shares rose on Tuesday, bouncing from a steep sell-off in the previous session, though strategists said investors would need to feel more confident about a resolution to the Eurozone crisis before the market could break out of a recent range.

Who is Mikhail Prokhorov?

Born in 1965, he is the Russian entrepreneur and billionaire who owns the NBA franchise the New Jersey Nets. But more importantly, perhaps, what has thrust him into the global limelight is his decision to challenge Russian Prime Minister Vladimir V. Putin for the country's presidency. The third richest man in Russia made his money in precious metals but he wants to leave his legacy in politics.

Barclays’s Top-Paid CEO Bob Diamond Fires 30 Execs for 'Being Jerks'

Barclays Plc. (BCS) chief executive Bob Diamond has fired as many as 30 bankers for violating his newly imposed "no-jerk" rule and acting in a way that embarrasses the company.

Lehman's Bankruptcy Estate Preparing Bid for Archstone Stake: Report

The bankruptcy estate of Lehman Brothers Holdings Inc. is preparing to make a $1.33 billion bid for part of apartment owner Archstone that it does not already hold, according to a report in The Wall Street Journal.

Lloyds' CEO Must Reapply For His Job When he Returns From Medical Leave: Report

Lloyds Banking Group's chief executive António Horta-Osório, who signed off on medical leave in early November because of exhaustion, will have to re-apply for his job at a board meeting next week before he can return to work, the Financial Times reported.

Forest City Enterprises Narrows 3Q Loss to $41.9 Million on Stronger Residential Leasing

Real estate developer Forest City Enterprises reported a net loss of $41.9 million, or 25 cents per share, in the third quarter ending Oct. 31, down from $50.6 million, or 33 cents per share, loss in 2010.

Markets Now Seeing Once-Unthinkable Greek Eurozone Exit as Inevitable

Talk of Greece voluntarily leaving -- or being kicked out of -- the eurozone was once verboten. Now bank economists, investors, and even central bankers are talking about it as though it's a done deal. The divide between rhetoric is also growing. Those predicting the future Greek exit are calling it "manageable," while those saying it won't happen are labeling the possibility "catastrophic."

Asia Eyes ‘yo-yo’ Economy in 2012

Asia's economic growth looks set to stumble over the next few months, prompting a flurry of interest rate cuts and a spike in stimulus spending that may ultimately pave the way for a strong recovery in the second half of 2012. The catch-phrase for 2012 is the Asia yo-yo.

Boeing: Significant Cash Flow Improvements Seen Over Next Few Years

Boeing Co. (NYSE:BA) is expected to show significant cash flow improvements over the next few years, according to Barclays Capital Markets.

Lehman hearing may herald end of bankruptcy

Lehman Brothers Holdings Corp is about to take its last step toward exiting a more than three-year-long bankruptcy process, a move that should enable it to begin paying back investors next year.

Lehman Brothers close to naming a new board: report

The bankruptcy estate of Lehman Brothers Holdings is close to naming a new board of directors to help finish winding down the collapsed financial firm, the Wall Street Journal said, citing people familiar with the matter.

Brokerages Cut RIM Price Targets on Profit Warning

At least four brokerages slashed their price targets on Research in Motion's U.S.-listed stock after the BlackBerry maker warned of lower profit amid falling sales and an inventory pile up of its PlayBook tablet.

Bankrupt Lehman Brothers Close to Naming New Board: Report

Citing people familiar with the matter, The Wall Street Journal said the new Lehman board will be made up of seven experts in restructuring, real estate and derivatives but they don't have ties with Lehman. They'll reportedly oversee liquidation of billions of dollars in assets so that money can be dispensed among Lehman's many creditors.

Western Digital's Recovery Much Faster Than Expected: Analyst

Western Digital Corp. (NYSE: WDC), on Thursday, provided an update on its financial outlook for the December quarter and the progress to date of its recovery effort in Thailand. Barclays Capital raised its price target on shares of Western Digital to $40 from $35, while reiterating its overweight rating.

Bipolar Week for British Banks as Politicians, Central Bankers and Others Poo-Poo on Equity Party

As macroeconomic developments helped boost stock prices on the one hand, comments from central bankers, politicians and others, on the other hand, dampened the party in the equities market.

Global Bank Stocks Rally to Best Week of the Year

Bank stocks finished up one of the best-performing weeks of the year Friday, as a global coordinated stimulus by the world's top central bankers announced Wednesday injected some badly needed liquidity into the credit markets and signaled a willingness for future intervention if the going gets tougher.

Does BASEL Stand for "Banks Acting Silly to Enhance Liquidity?"

As banks around the world race to satisfy international capital requirements, they are going through a veritable fire sale, getting rid of non-core businesses no matter how much they will fetch. Beyond that, they are engaging in some odd transactions, including a substantial amount of balance sheet engineering.

Europe's Markets Close Higher Friday for Biggest Weekly Gain Since 2008

European shares rose on Friday, recording their biggest weekly gain since late 2008, on hopes Eurozone leaders were coming together to find a solution to the Eurozone debt crisis.

Europe's Markets Mixed Thursday at Mid-day

European shares fell in choppy trade on Thursday after data showed new U.S. claims for unemployment benefits rose unexpectedly last week, with some investors booking profits after equities jumped 9 percent in the previous four sessions.

Getco to Buy BofA's NYSE Market-Making Business

Getco LLC, an electronic market maker and high-frequency trading specialist, on Wednesday said it agreed to buy Bank of America Corp's floor-trading operations at the New York Stock Exchange, significantly expanding its market-making operations.

Exclusive: Zynga aims for $10 billion valuation in IPO

NEW YORK, Nov 30 - Facebook games developer Zynga Inc is seeking a lower-than-expected $10 billion valuation for its initial public offering, which is to be priced on December 15, two people close to the process said on Wednesday.

It's Game on for Zynga Initial Public Offering

Zynga is expected to price its shares on December 15 in one of the most highly anticipated IPOs of the year.