Barclays Stories

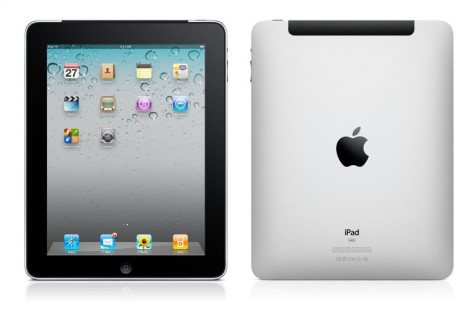

iPad 2 May Repeat Success Of iPad With New Features

Apple Inc., which revolutionized the tablet market with its launch of iPad in April 2010, will be reportedly launching its new iPad 2 at an event in San Francisco, California on March 2 with a launch date on early April.

U.S. crude oil prices touch $100 for first time since Oct. 2008 on Libyan chaos

The price of oil crude oil futures touched $100 per barrel for the first time since October 2008 on deepening worries over the political chaos and violence in oil-rich Libya.

Qatar expresses interest in buying stakes in RBS, Lloyds

The Persian Gulf kingdom of Qatar has expressed some interest in investing in two major partially-nationalized British banks, Royal Bank of Scotland (NYSE: RBS) and Lloyds Banking Group (NYSE: LYG).

Apple iPad 2 Appears on Track for April Launch

Apple iPad 2 shipments appear on track for April and the company will hold an event in March to launch the next generation of iPad, according to Barclays Capital.

Gold at $1,400 as equity markets drop sharply

Gold fell back slightly toward $1,400 an ounce on Tuesday, breaking a six-session rally, as turmoil in Libya prompted bullion investors to take profits and as sharp losses in equities and other commodities markets prompted margin selling.

China rejects key G20 imbalance indicators

China rejected plans to use real exchange rates and currency reserves to measures global economic imbalances, casting doubt on the ability of Group of 20 major economic powers to reach agreement at a meeting on Friday.

Gold hits 5-week high as Mideast concerns simmer

Gold hit five-week highs in Europe on Friday and silver its strongest since 1980 as growing unrest in the Middle East lifted interest in precious metals, though another reserve requirement hike from China curbed gains.

Federal IT Budget Backs Growth in Cloud Plays

U.S. President Barack Obama's proposed 2012 Federal budget included proposals to improve the inefficiencies in government data centers. The budget outlines the adoption of cloud-computing and virtualization technologies to lower IT spending costs and increase agility.

Merkel crony named chief of Bundesbank

Jens Weidmann has been named chief of the Bundesbank, replacing Axel Weber who recently quit for “personal reasons.”

Do iPad Rivals Gain On Enterprise Space?

Barclays Capital said it continues to believe the new tablet category (led by Apple Inc.'s iPad) is poised for rapid growth over the coming years.

S.Africa's rand struggles vs dlr, stocks edge lower

South Africa's rand softened against the dollar on Tuesday with the market showing little inclination to resist central bank moves since the start of the year to weaken the currency.

Barclays says regulation to hit returns; profit up

British bank Barclays will review its portfolio and cut costs to boost profitability as it grapples with tougher regulations which it said will lower its returns.

China trade surplus shrinks, supports government's G20 case

China's trade surplus fell to its lowest in nine months in January after imports surged, supporting the government's case ahead of a G20 meeting that it is doing enough to spur domestic demand without speeding up currency appreciation.

UK small firms hesitant to seek bank loans-survey

Britain's smaller companies are reluctant to tap banks for financing due to negative perceptions of the sector, a survey said on Friday, as politicians continue to attack the industry for not lending enough to businesses. Britain wants banks to lend more money in order to stimulate the country's faltering economy, and this week it struck a deal

Kinder Morgan's upsized IPO raises $2.86 billion

Pipeline company Kinder Morgan Inc sold more shares and priced them above the expected range, an underwriter said on Thursday, raising about $2.86 billion in the largest U.S. energy initial public offering since 1998.

Job openings dip in December, but layoffs decline

U.S. job openings slipped in December, a government report showed on Tuesday, but a decline in layoffs supported views of a gradual labor market recovery. Job openings, a measure of labor demand, eased 139,000 to a seasonally adjusted 3.1 million, the Labor Department said in its monthly Job Openings and Labor Turnover Survey.

UK government irons out pact with major banks over lending, and pay

The British government has entered into a comprehensive agreement with the nation’s largest banks on matters related to lending, transparency and bonuses payments to executives, after four months of negotiations and wrangling.

Dell Means Business With Windows Tablet

Company does a refresh on its laptop and desktop lines while giving out minor details on a new Windows tablet.

Regulators set to curb bank bonuses, part of global move

Regulators on Monday are expected to make their most forceful attempt yet to clamp down bank bonuses since the 2007-2009 financial crisis, but the proposals pale in comparison to harsher restrictions already set in Europe.

Mideast turmoil leaves experts, markets struggling

The Middle East is headed into the unknown, on that everyone agrees -- but the speed of events in Egypt and elsewhere has left analysts and financial markets struggling to find their bearings.

Will Intel Miscue Impact HP, Dell, Apple, Western Digital, Seagate?

Intel's design issue could have a ripple effect throughout the IT Hardware food chain, said an analyst at Barclays Capital.

Nomura posts jump in profit but costs weigh

Nomura Holdings <8604.T>, Japan's top brokerage, reported its biggest profit in three quarters after gains in Tokyo stocks gave a boost to revenues, but higher costs to expand overseas limited earnings growth.

Intel's Chip Issue Could Hit Q1 PC Builds: Analysts

Market analysts are of the view that the Intel's chipset issue could hurt the personal computer (PC) shipments in the first quarter.

Euro zone crisis seen turning corner

European policymakers and international bankers at the Davos forum said on Saturday the euro zone's debt crisis had turned a corner and any doubt about the survival of the single currency area had passed.

Gold Gives Back Another Overnight Rally as Japan Downgraded, Eurozone Warned on Imported Inflation

Gold fell back from its third overnight rally in four days in London trade on Thursday, dropping 1.1% against the Dollar. We don't feel that this downward pressure can persist, given ample global liquidity and low long-term real interest rates, says Standard Bank's commodity team in a client note.

Gold rises after Fed as ETFs shed bullion

Gold rose on Wednesday, snapping a four-day losing streak, after the Federal Reserve's lukewarm economic assessment and its plan to complete its bond-buying program boosted bullion's safe-haven appeal.

Barclays cuts 1,000 jobs, focus on returns sharpens

Barclays Plc is to cut about 1,000 UK jobs as it stops offering financial planning advice in its branches, in further evidence the bank is sharpening the knife on areas of sluggish profitability.

Barclays to cut 1,000 UK retail banking jobs

British bank Barclays Plc is to cut about 1,000 UK jobs as it stops offering financial planning advice in its branches.

Lehman files new plan for repaying creditors

Bankrupt financial company Lehman Brothers Holdings Inc proposed a new plan for dividing up billions of dollars among its creditors and offered a bigger payment to bondholders, provided they sign on.

Banker bonuses spur discontent as pay gap grows

Annual bonuses at top global banks are causing ructions that could drive a outsized round of defections as weaker profits and tougher rules widen the pay discrepancy between star performers and everybody else.