Financial Reform Stories

Canadian dollar edges higher as debt focus shifts to Italy

The Canadian dollar ended slightly stronger against its U.S. counterpart on Monday as markets struggled to deal with fresh turmoil in Europe as fears heightened that Italy would be the next victim of the euro-zone debt crisis.

SunTrust to Drop $5 Monthly Debit Card Fee from Nov. 2

SunTrust Banks Inc said on Monday it planned to drop a $5 monthly debit card service fee, adding the Atlanta-based regional bank to the list of lenders dropping such maintenance fees amid rising public criticism of the industry.

Analysis: Volcker pay curbs spark fears of Wall St. exodus

The Volcker rule has created a new battlefield over Wall Street pay that banks fear will send their star traders and hedge fund advisers fleeing.

Canada's Carney ready for FSB regulator limelight

As a young hockey player with dreams of making it big, Mark Carney liked to get revved up before a big game by listening to AC/DC's Hell's Bells.

Debit Card Fees: Sen. Durbin Calls Out Wells Fargo on New Consumer Charges

U.S. Sen. Dick Durbin, D-Ill, the No. 2 Democrat in the Senate, said banks' reasoning for imposing consumer debit card fees was "disingenuous."

New CFTC Trading Limit: Will It Curb 'Speculation'?

The United States pushed through its toughest measures yet to curtail speculation in commodity markets in a tight vote on Tuesday, likely shifting the focus of a fierce four-year debate from the regulators to the courts.

Las Vegas Debate: Republicans Avoid Housing Policy in Hard-Hit Nevada

Nevada has the highest foreclosure rate in the country, but the Republican presidential contenders provided few concrete solutions to the crisis while debating in Las Vegas.

Obama Chides Banks, Taps Anger Over Wall Street

President Barack Obama launched an onslaught against banks and Republicans this for working to block financial reform, using a populist tone amid public anger over Wall Street practices.

Obama chides banks, taps anger over Wall St

President Barack Obama launched a broad onslaught against banks on Thursday, tapping into public anger over rising fees to garner populist support ahead of his 2012 re-election campaign.

Stock Trader: ‘I Go to Bed Every Night and Dream of Another Recession’ [VIDEO]

Stock trader Alessio Rastani told the BBC, Governments don't rule the world. Goldman Sachs rules the world.

Obama to Present a Jobs Plan Focused on Spending, Urged GOP to Put America First [FULL TEXT OF SPEECH]

With more than a million unemployed construction workers across the nation, President Barack Obama on Monday said he intends to spend to rebuild America's infrastructure and boost hiring, which will be key components of a plan he is working on to stimulate the U.S. economy.

Obama vs. 2012 Republican Candidates: Who Has the Better Plan for the U.S. Economy?

Where do President Barack Obama and the Republican presidential candidates stand on the U.S. economy? Here's a summary of their differing proposals.

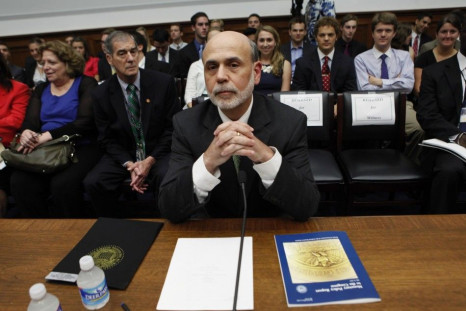

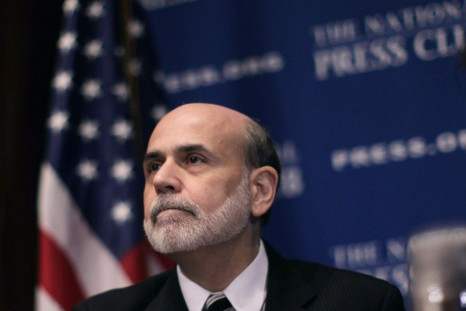

Bernanke: Regulators Formulating Rules for SIFIs

As major institutions around the world continue to deal with the impact of the financial crisis, regulators will soon be laying down ground rules to buttress against a potential collapse of financial firms large enough to shake global markets, Federal Reserve Chairman Ben Bernanke said Thursday.

Small Donors, Big Bundlers Net Obama $46 Million for 2012

President Barack Obama's march to $1 billion in campaign cash continues, as a combination of small donations and effort by fundraising heavyweights garnered the president $46 million in the second quarter.

Rajat Gupta to Pursue Lawsuit Against SEC

Rajat Gupta, the former Goldman Sachs Group Inc. director, can proceed with a suit claiming the U.S. Securities and Exchange Commission violated his rights when it filed an administrative action accusing him of passing illegal stock tips and thereby denying him a jury trial, reports say.

SEC seeks to clampdown on bankers bonuses

The Securities and Exchange Commission (SEC) is proposing regulations to put a clampdown on large bonuses handed out banks, brokerages and hedge funds as part of the Dodd-Frank financial reform package.

Fed's Hoenig: Big banks too risky, rates too low

Wall Street's financial giants continue to pose major risks to the U.S. economy, and must be broken up to avoid another meltdown, Kansas City Federal Reserve Bank President Thomas Hoenig said on Wednesday.

Bernanke to testify on Dodd-Frank next week

Federal Reserve Chairman Ben Bernanke and other top U.S. regulators will appear before the Senate Banking Committee next week to discuss the implementation of the Dodd-Frank financial reform law, the committee announced on Thursday.

FDIC proposes curbs on bankers bonuses

The Federal Deposit Insurance Corp. (FDIC) has proposed new rules that will mandate large financial institutions to delay payment of 50 percent of executive bonuses for a period of three years in order to discourage risky financial activities.

Obama Speech Preview : Challenges are 'bigger than politics'

President Barack Obama will say that the challenges the U.S. faces are bigger than party and politics, according excerpts from Tuesday night's State of the Union Address.

Why U.S. stocks can go up in 2011

The health of the American economy and the level of accommodation in monetary policy are the two most important factors that influence U.S. stock price movements. In 2011, it seems U.S. equities may get support both.

Senator says mortgage crisis risk remains

Sen. Jim Bunning, R-KY expressed anger Wednesday that the potential for another mortgage crisis remains, despite efforts to deal with the mortgage crisis over the past decade.

It’s hiring stupid! Adding 200,000 jobs a month is the real test

The fall in initial jobless claims in the U.S. to the lowest level since July 2008 is not a right pointer to a possible labor market recovery, according to an analyst, who says the true test for the economy is the creation of anything above 200,000 payroll jobs in a month.

EU/IMF pressuring Greece to accelerate economic reforms

Greece's international lenders have agreed to provide the debt-ridden country with the third installment of a loan – valued at 9-billion euros -- but warned that the Greeks must make an extra effort to address its deficit next year.

Banks will need permission to pay dividends: Fed

The Federal Reserve on Wednesday announced guidelines for evaluating whether or not banks will be allowed to take actions that could result in a diminished capital base in 2011.

Too big to Fail era over: Treasury Dept.

Too big to fail is now over and American taxpayers will never be asked to bear the costs of a financial firm's failure, said U.S. Treasury deputy secretary Neal Wolin.

Obama wins first financial reform victory in months

The Obama administration scored its first financial regulation reform victory in months on Thursday when a U.S. congressional committee approved new rules for over-the-counter derivatives.