Congo's Conflict Minerals: US Companies Struggle To Trace Tantalum, Tungsten, Tin, Gold In Their Products

A smartphone, a lightbulb, an underwire bra and a pair of earrings: These everyday items contain materials that human rights groups say help fuel one of the world’s bloodiest conflicts. The so-called conflict minerals are tantalum, tungsten, tin and gold, mined and extracted from ore often in war-torn areas such as eastern Democratic Republic of Congo, where the mineral trade has been linked to armed groups that regularly commit mass atrocities, including rape and murder.

U.S. firms are spending millions to comply with a complex provision in the Dodd-Frank financial reform law that requires companies to divulge their use of any of the four conflict minerals and disclose whether they originated in Congo or surrounding countries in sub-Saharan Africa. The 5-year-old rule has increased the demand for conflict-free minerals and has redirected some of the cash flow away from armed groups in eastern Congo. But recent reports revealed most companies that filed the disclosures were unable to source the minerals, and experts said a convoluted supply chain, costly audits and the ongoing conflict in Congo’s mineral-rich east have created hurdles. The difficulty to comply with the provision also has raised fears some companies might choose to sever trade with the world’s poorest country, where corruption and violence are rife.

“There are these cultural or practicality issues that go beyond just the fact that Congo doesn’t have passable roads. There’s limitations or constraints wherever you look,” said Chris Bayer, an independent research consultant who specializes in conflict minerals. “I think it would turn off a company. It’s difficult for them to get quality data.”

U.S. President Barack Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act in July 2010 in response to the Great Recession. Later that year, Congress enacted Section 1502 of the act to impose additional reporting requirements on U.S. companies to disclose their use of “conflict minerals” if they were “necessary to the functionality or production of a product” manufactured by those companies.

Congress passed the rule “because of concerns that the exploitation and trade of these metals by armed groups was helping to finance conflict in the Democratic Republic of Congo and is contributing to an emergency humanitarian crisis,” according to the U.S. Securities and Exchange Commission. The rule also requires a company to determine whether any of its minerals originated in the other “covered countries” of South Sudan, Uganda, Rwanda, Burundi, Tanzania, Malawi, Zambia, Angola and Central African Republic.

'Once It Hits The Smelter, The Origins Are Gone'

Bayer studied the latest reports filed with the SEC for Tulane University in New Orleans and Assent Compliance, a New York consulting firm. The findings published in August found that about 90 percent of the 1,262 companies that filed the required conflict mineral disclosures last year said they couldn’t determine whether their products were conflict-free. Two-thirds of the companies, including Google and Amazon, did not define the country of origin of the metals or their derivatives. Only 314 companies, or less than 24 percent, reached full compliance with the Dodd-Frank Act mandate. About 43 percent failed to disclose how they performed due diligence, Bayer said.

“Either they don’t have the data or they don’t have the confidence in the data to actually disclose the country of origin,” he said in a telephone interview. “They’re just working with what they’ve got.”

Tracking these metals is no easy task, of course. Companies must go through the many tiers in their corporate supply chains, from the mines to trading houses to exporters to transit countries to refiners. It’s through this supply chain that Apple gets the tantalum for its iPhone, that General Electric obtains tungsten for its lightbulbs and that a jeweler obtains gold for a pair of 14-karat earrings.

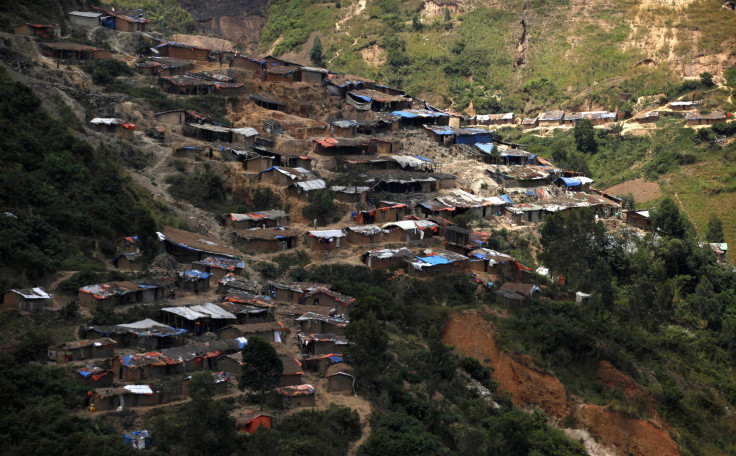

Conflict minerals are found in mines around the world, but the spotlight is often on the Democratic Republic of Congo, which has some of the richest mineral deposits in the world. The country produces 20 to 50 percent of the world’s supply of tantalum, according to National Geographic. These minerals pass through the hands of various actors within each tier, as well as numerous middlemen, as they are shipped out to processing plants in neighboring countries and East Asia. There are more than 2 million artisanal miners in eastern Congo alone that extract small amounts of metal from ores, and the smelters provide materials to various industries.

“Once it hits the smelter, the origins are gone. You can’t tell where the metal came from,” said Jeff Schwartz, a University of Utah S.J. Quinney College of Law professor who also researched the conflict minerals data submitted by companies to U.S. securities regulators. “There’s a lot of opportunities for gray or black markets to develop.”

Conflict Behind The Minerals

Armed groups and the Congolese army have seized control of countless mines in the eastern region since the late 1990s, when the Central African nation plunged into the deadliest conflict since World War II. The Second Congo War officially ended in 2003, but reports of mass killings, rapes and other crimes committed by rebels and government forces have continued unabated in the east, where much of the region remains under control of armed groups who have attempted to fill a power vacuum. The war and its aftermath killed more than 5 million people and displaced millions of others.

All sides of the conflict have been accused of attacking communities in close proximity to mines and other resources in order to fund their operations. International human rights groups say government troops and armed rebels have recruited child laborers to work in the mines, where working conditions are dangerous and dismal.

Holly Dranginis, policy analyst at Enough Project, a nonprofit in Washington, D.C., that aims to end genocide and crimes against humanity, said some U.S. firms are overwhelmed by the task of examining their conflict minerals supply chains, especially in war-torn Congo where corruption is rampant. But over time, conducting due diligence can produce positive results for both the company and the Congolese.

An investigative report by the Enough Project studied 14 mining locations in eastern Congo that produce three key minerals used in electronics, autos and an array of other products. Over a period of five months, the 2014 report found that the Dodd-Frank reform was forcing some companies to scrutinize and clean up their supply chains. Meanwhile, armed groups and Congolese army troops ceded control of two-thirds of the mines surveyed as the country’s military launched initial restructuring. Congolese miners at these sites were able to earn 40 percent more.

“It is a really big endeavor to go through and investigate supply chains as a company. The process itself begins with conversations and I think that’s one thing some companies don’t totally understand. It just takes time and commitment,” said Dranginis, who focuses on Congo. “Contacting your first-tier suppliers and ask them what they know about the next tier down, and you do that again with next tier and the next. It’s really almost an investigative process to find out who the actors are.”

'Everyone Has A Role To Play'

The process is also costly and some smaller companies may not have the bandwidth to audit their suppliers, experts said. U.S. publicly traded companies spent about $709 million and a combined 6 million working hours last year in order to comply with the filing requirements to disclose conflict minerals in their supply chains, according to the research by Tulane University and Assent Compliance.

Companies may decide to pull out of Congo altogether if they can’t handle the outlays or if the conflict on the ground worsens. This could have a detrimental impact on Congo's struggling economy, which relies heavily on mining, experts said. Mining accounts for 12 percent of GDP in Africa's third-largest country, according to estimates from the World Bank. However, the economic impact is much larger because of the businesses and services that support the industry, and much of the activity occurs in the informal sector and is not reflected in GDP data.

The Congolese government and military are rife with graft, and the November presidential election could offer an opportunity for change. But it also could stir political and ethnic tensions in the incredibly large and diverse country, which could exacerbate progress made on transparency and the conflict minerals trade, experts said.

“It’s important that the controls and due diligence measures don’t come at such a cost that it doesn’t make it economically viable to source from the region,” said Mike Loch, president of Responsible Trade LLC, which consults entities seeking to implement due diligence when the products they produce contain conflict minerals.

Loch, who worked nearly 30 years at Motorola Solutions as a director of sustainability with roles in conflict minerals, said the Dodd-Frank provision alone will not solve the conflict minerals issue in the Democratic Republic of Congo or its surrounding countries. A company can conduct due diligence but it’s up to the governments in these countries to increase transparency, provide security and create an environment that will attract further foreign investment, he said.

“It’s a company’s obligation to source responsibly. It’s a government’s obligation to provide security and provide the basic needs for the population. It’s up to civil society to provide oversight and raise awareness on issues,” Loch said. “Everyone has a role to play in solving this issue and if any one of those entities does not meet their obligation, it’s more than likely to fail.”

This report has been updated from its original version.

© Copyright IBTimes 2024. All rights reserved.