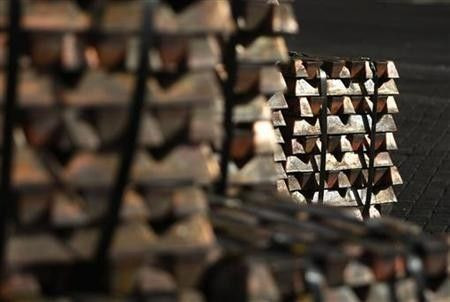

Copper Prices Expected to Remain High in 2012

Copper prices are expected to remain high in 2012 as China's economic growth boosts demand for the metal in an environment of low global inventories, according to Intierra Resource Intelligence.

China is the biggest buyer of Chilean copper, which it uses to manufacture cars and houses.

However, a tightening in Chinese economic policy, as well as falling home prices, could adversely impact the metal's performance. China's economic policy hit copper prices last year, when Beijing raised interest rates and copper prices fell from a record $4.63 per pound in February 2011.

Broader economic concerns, particularly in Europe, could also hurt copper trading, Inteirra said Wednesday.

Intierra said China may no longer be the market savior for copper in 2012, but the physical market fundamentals remain strong.

In the longer term, increased mine supply will temporarily overwhelm the market, creating a dip in prices from 2014 to 2017, followed by a recovery in the later part of the decade, said Intierra.

Production costs will become more of a factor in determing the price of copper and these costs are higher than in the past, Intierra said.

Copper was down five cents to $3.79 in Thursday midday trading.

© Copyright IBTimes 2024. All rights reserved.