Coronavirus Economy: Americans Dipping Into Retirement Savings To Get Through Pandemic

KEY POINTS

- Americans have some $30 trillion stashed in retirement accounts

- 31 million Americans are falling back on their retirement savings to either augment income or to keep cash on hand through the pandemic

- Among those who have lost their jobs since Jan. 1, half said they are dipping into retirement funds

More than a quarter of employed and recently unemployed adults say they have taken money our of their retirement funds or plan to do so to cope with the coronavirus pandemic, with 20% of millennials saying they’ve used the savings as a source of income, a survey released by Bankrate.com Wednesday indicated.

“More than 1 in 4 working or recently unemployed households with retirement savings has either already used some for immediate income or plans to do so, including half among the recently unemployed,” Bankrate.com chief financial analysis, Greg McBride said in a statement emailed to IBTimes.

“This is most pronounced among younger households, who may miss out on decades of future compounding if forced to turn to their retirement savings during these trying times.”

Americans have some $30 trillion stashed in retirement accounts, with those in their 20s averaging $16,000, those in their 30s averaging $45,000, those in their 40s averaging $63,000, those in their 50s averaging $117,000 and those in their 60s averaging $172,000.

The Bankrate.com survey, which queried 1,326 adults, indicated 31 million Americans are falling back on their retirement savings, with 13% saying they are using their 401(k)s and IRAs as an immediate source of income and 14% saying they plan to do so. Among those who have lost their jobs since Jan. 1, half said they are dipping into retirement funds.

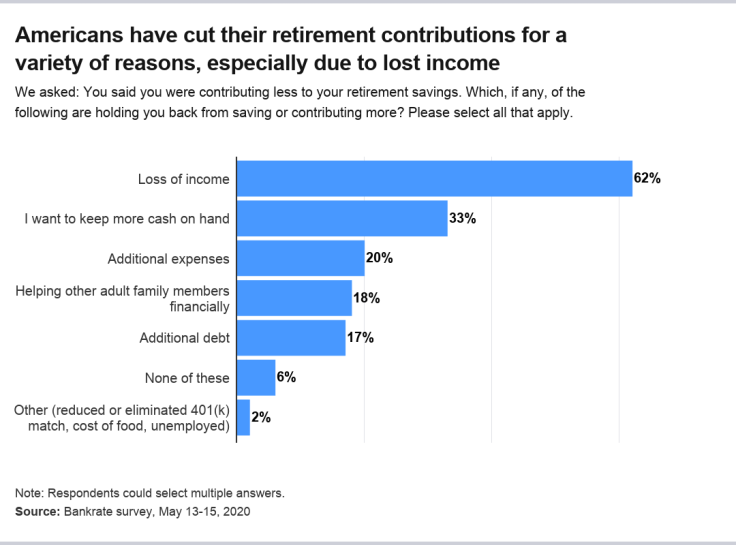

Among those using retirement funds, 62% said it was because of a loss of income, 33% said they wanted to keep more cash on hand and 20% cited additional expenses. Eighteen percent said they were helping adult family members financially, 17% cited additional debt and 2% provided a variety of reasons including being unemployed, a loss of matching funds from employers, food costs or maternity leave. Six persons had no reason at all.

About 18% of those queried said they had to reduce the amount they are contributing toward retirement because of the COVID-19 pandemic, with those recently laid off more than twice as likely to reduce contributions than those who are still working. Of those still employed, 22% said they had reduced retirement contributions.

Some 38% of millennials and 45% of Generation Z who have retirement savings “have already used some to replace their income since the coronavirus crisis started. That compares with 8 percent of Generation X and nearly 10 percent of boomers,” Bankrate.com said in a summary.

The survey was conducted by YouGov, May 13-15.

The personal finance site Magnify Money said its survey indicates 49% of Americans have dipped into or plan to dip into retirement savings (the withdrawal averaging $6,757.20), and 47% have either stopped or lowered their retirement savings.

© Copyright IBTimes 2024. All rights reserved.