Cost Of Living Crisis: Americans Pull Back On Online Shopping

The recent coronavirus pandemic had a massive impact on the American way of life. One area in particular that was affected was our shopping habits, with many of us increasing our online spend and visiting physical stores far less than we used to.

This boom in business for the e-commerce industry, though, seems to have been short-lived. Post-pandemic, America is going through a cost-of-living crisis with rising inflation meaning that belts all across the land have been tightened. Many goods cost more than they used to, and consumers have less money to buy them with.

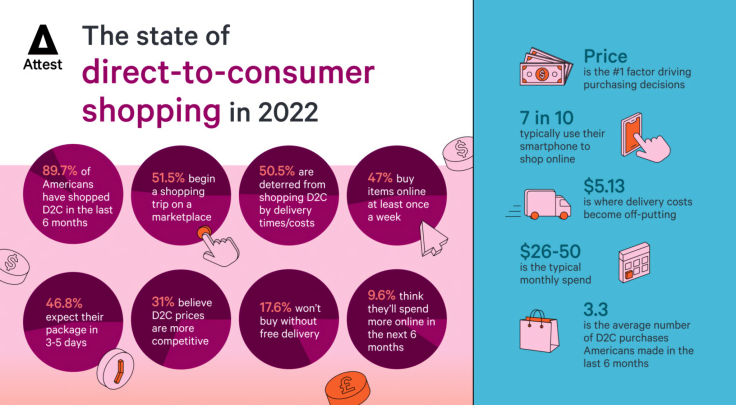

The result of this is that a significant number of Americans — 25% — are spending less money online. According to Attest’s U.S. direct-to-consumer (D2C) report 2022 a quarter of Americans reduced their online shopping outlay over the last six months. While a third (33%) said that they spent more online in the last six months than previously, although this is likely due to the inflated cost of the items that they buy.

Tough times for consumers and online retailers

The struggles for those that use the internet as their primary sales channel don't end there, either. Marketplace Etsy recently found itself under fire for not supporting its sellers enough — so much so that sellers recently went on strike — which goes to show that these really are challenging times for online retailers.

The bad news for D2C brands is that these tough times show little sign of coming to an end soon. A further 20% of Americans say that they will have to cut back on their online spending over the next six months. With inflation seemingly out of control, three in 10 say they expect to pay more over the next six months as their spending power is reduced.

Reasons to be cheerful

But it isn't all doom and gloom. Diving deeper into the data, we can find some reasons for optimism. Nearly 85% of Americans have bought something from a D2C retailer in the last six months, and of those that have, they've bought an average of 3.3 items.

The single largest percentage of people (23%) spend between $26-50 per month, while 12% spend less than this. The remaining 65% spend more than $50 buying goods online each month, with 30% spending over $100.

Americans are certainly shopping online with high regularity; 47% buy items online at least once a week. People aged 25-34 are the most frequent online shoppers, with 27% in this age group shopping more than once a week.

The types of goods that most prefer to buy online are largely in the technology (59% vs 39% who would rather buy in-store) and gift (69% vs 29%) categories. But there are many things that a majority of Americans would rather buy in a store, such as groceries (77% vs 23%), furniture & homewares (65% vs 33%), beauty & grooming products (58% vs 40%) and pet products (53% vs 38%).

Shopping smart(phone)

Smartphone shopping is massively popular among Americans; 66% say they most frequently use their mobile to research or make purchases online, rising to 79% in the 25-34 age range. However, older shoppers over-index for using desktop computers, laptops and tablets for visiting D2C websites.

Another area where direct-to-consumer sellers might feel encouraged is that there is still a perception among Americans that their prices are more competitive than those of bricks-and-mortar stores. According to the research, nearly one third (31%) of respondents cited this as a reason for favoring online stores. Capitalizing on this perception could be key to their survival in the short term.

Delivering the goods

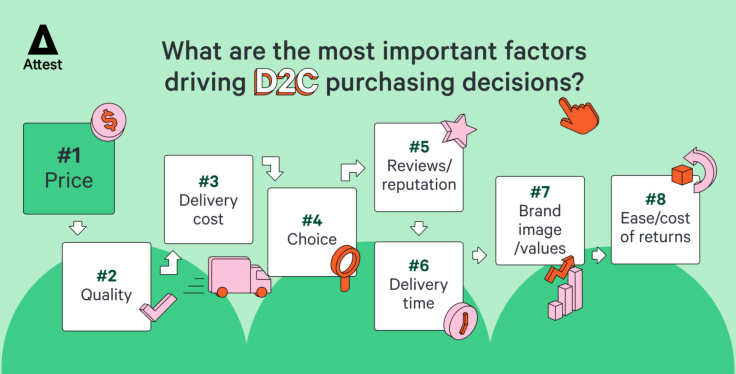

Americans seem to have recognised the need for patience when it comes to online shopping. Delivery time was ranked as only the sixth-most important factor that drives Americans to make a D2C purchase. Some 22% said they’d be happy with delivery in 6-8 days, while 9% are prepared to wait 9 days or more.

With memories of lines of container ships queuing outside most of the nation's major ports still fresh in our minds, as well as the increased burden put on hauliers and logistics providers by the boom in e-commerce during the pandemic, this comes as little surprise. The majority (47%), though, still expect to receive their parcel in 3-5 days.

Vendors that are worried about delivery costs eating into their profit margins should be encouraged by the fact that only 18% of people said they wanted delivery to be free.

However, the research found that a decisive 79% of Americans won't consider paying over $8 for delivery, and the average price point where Americans will start to be deterred from ordering is $5.13.

The significant number of Americans that have either cut back on their online spending in the past six months or that plan to do so in the next six months should give D2C companies pause for thought. However, there are some encouraging signs — many Americans are still buying goods online regularly and there is still a common perception that there are better deals to be found on the web than in stores. D2C brands that can use this intelligence to adapt to the challenging market conditions should be able to weather the storm.

(Jeremy King is the CEO of Attest.)

© Copyright IBTimes 2024. All rights reserved.