Costco Earnings To Stand Out As Americans Shop More At Warehouse Clubs

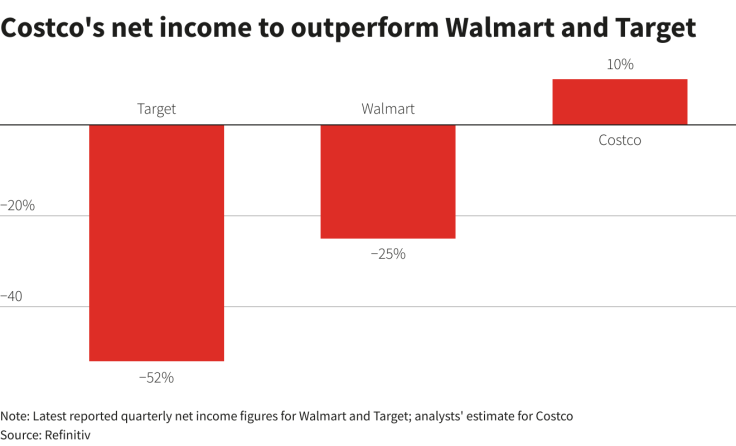

Costco Wholesale Corp is expected to post a rise in quarterly earnings on Thursday as the spending power of Americans with store memberships remains largely intact even as surging inflation dents profits of major U.S. retailers.

Walmart Inc and Target Corp's bleak profit forecasts have left the retail industry rattled and highlighted the wariness of low-income households to spend on discretionary goods.

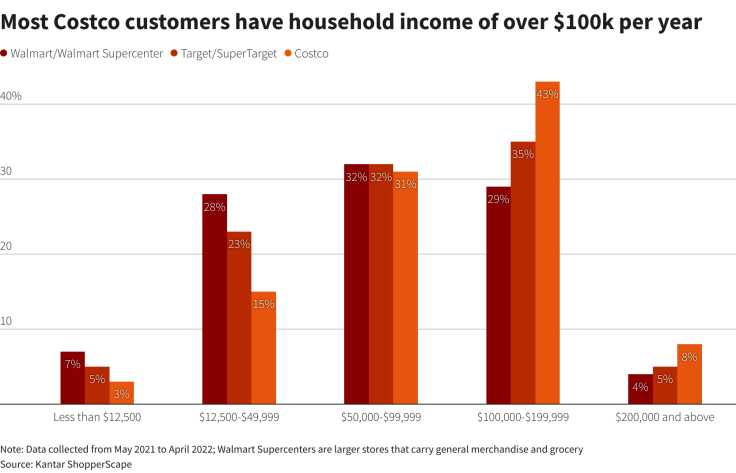

Costco, however, lies in a sweet spot, as an average shopper at its warehouses makes much more in a year than a typical Walmart and Target customer, and the warehouse club operator's efforts to keep gas prices several cents below the national average also drives memberships.

Membership fee income accounts for a bulk of Costco's profits.

Graphic: Most of Costco customers have household income of over $100k a year -

"The American consumer will go out of their way to save money on gas," D.A. Davidson analyst Michael Baker told Reuters. "The gas business drives traffic to the parking lot, and then somewhere between 30% and 50% of those customers end up going into the club and buying something."

Analysts will also be keeping an eye on the impact of China's COVID-19 lockdowns on Costco's supply chain. The warehouse club chain sells many products made in China, including iPhones, clothing and certain products for its private-label brand Kirkland Signature.

CONTEXT

Costco's smaller rival BJ's Wholesale Club Holdings Inc last week reported a quarterly profit above estimates, as higher-income customers shopped more and made up for a slowdown in spending from others.

"The benefit at the higher income cohorts is frankly a little better than what we expected," BJ's Wholesale Club Chief Executive Bob Eddy said on an earnings call.

THE FUNDAMENTALS

* Analysts polled by Refinitiv, on average, expect Costco to earn $3.04 per share for the third quarter, an increase of over 10% from a year earlier.

* Costco reported same-store sales growth, excluding the impacts from changes in gasoline prices and foreign exchange, of 12.2% and 8.7% for March and April, respectively. The chain's third quarter typically ends in early May.

Graphic: Costco's net income to outperform Walmart and Target -

WALL STREET SENTIMENT

* The current average rating among 37 analysts is "buy", with none of them having a "sell" rating on Costco's shares.

* The median price target (PT) is $581.50, 33% above Tuesday's close and 3% lower from a month earlier, in light of five PT cuts since Walmart's results.

© Copyright Thomson Reuters 2024. All rights reserved.