Hungary's best and brightest are feeling pinched by an increasingly demanding government.

European investors looking to bet on risky derivatives will be able to use gold to back their trades, one of the Continent's major exchanges said Friday, a development that could both make the yellow precious metal a more valuable asset and foster the growth of derivative trading volume.

Netanyahu is paying a visit to the U.N. General Assembly in New York next month where he will likely bump into U.S. President Barack Obama, or at least expect him to issue strong rebukes against Iran in his speech to the world.

Investors rewarded Portugal's efforts to trim its budget gap by sending the credit-default swaps on Portugal to a low of 725 basis points on Thursday, down from 1,515 in January and 1,237 in May, according to Bloomberg. The implied probability of Portugal defaulting on its debt fell to 46 percent from 73 percent.

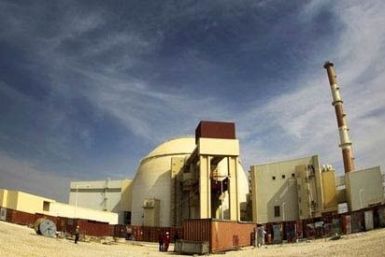

Four men, one German and three Iranian-Germans, have been arrested in Germany on suspicion of having supplied Iran with key parts for its heavy water reactor.

The EU on Tuesday declared that the Israeli city of Modi'in did not lie fully in Israel; parts of it belong to the West Bank. This could have consequences for Israel's trade with the EU.

Most of the European markets rose Tuesday as investors were hopeful that the ECB will soon announce stimulus measures as the GDP data from Germany and France indicate that the euro zone economy continues to falter.

Asian shares steadied Tuesday with investors staying sidelined ahead of more figures from Europe and the United States later in the day, after recent data showed the euro zone's debt woes were eroding business activity globally.

Gasoline production issues and tensions between Iran and Israel have sent U.S. gasoline prices above $4 per gallon in some cities, and prices likely won't fall until October, according to gasoline analysts.

Asian stock markets ended with gains last week as sentiment continued to improve on hopes that the European Central Bank would shortly take policy action to lower the peripheral bond yields of struggling nations such as Italy and Spain.

The U.S. trade deficit in June was the smallest in 1-1/2 years as lower oil prices curbed imports, according to government data on Thursday that suggested an upward revision to second-quarter growth.

A front-page article in the Italian newspaper Il Giornale attacked Germany’s handling over the ongoing euro crisis.

Asian shares rose to a three-month high Wednesday, supported by expectations that policymakers will soon decisively address the euro zone fiscal crisis and declining global growth.

Asian stock markets advanced Tuesday on renewed hopes that the European Central Bank (ECB) will shortly take policy action to lower the peripheral bond yields of struggling nations such as Italy and Spain.

After rounding up over 6,000 suspected illegal immigrants over the weekend, Greek authorities announced that 1,600 will be deported.

With the iPhone 5 rumored to be released in this September, Samsung is taking a new approach in encouraging customers to switch by offering a rebate of up to $300 for old smartphones.

Most European markets fell Monday as investors remained watchful following a disappointing last week when the European Central Bank (ECB) made no announcement on monetary easing measures to rejuvenate the faltering euro zone economy.

If hundreds and hundreds of teddy bears can't bring down Europe's last dictatorship, what can?

The exit of one or more countries from the euro zone could drive gold prices significantly higher by the end of this year, according to a Friday Capital Economics report.

The Merchants Payments Coalition (MPC), which represents retailers, says the fees levied on American supermarkets, stores and gas stations by Visa and MasterCard are up to three times more than in other parts of the world, inflating prices for U.S. consumers.

Asian stock markets declined Friday as sentiment was dampened after the European Central Bank (ECB) failed to offer any new stimulus measures to resolve the sovereign crisis in the euro zone.

U.S. stock index futures point to a higher opening Friday ahead of the Bureau of Labor Statistics' nonfarm payrolls report and unemployment report.