Greek parties will try on Wednesday to agree to a reform deal in return for a new EU/IMF rescue to avoid a chaotic default, after repeated delays which have prompted warnings that the euro can live without Athens.

U.S. stock index futures edged higher on Wednesday as leaders in Greece again attempted to reach a deal on reforms in exchange for a new bailout.

Greek parties will try again on Wednesday to agree a reform deal in return for a new international rescue to avoid a chaotic default, after delays prompted some EU leaders to warn that the euro zone can live without Athens.

The ongoing Eurozone debt crisis and the efforts to find a way out and save the single currency could potentially shake up and redefine the global economic equilibrium.

Asian shares hit their highest level in more than five months on Wednesday and the euro hovered close to an 8-week high as investors kept hopes alive for an agreement on details of a new Greek bailout package despite further delays.

Leaders of the three parties in Prime Minister Lucas Papademos's coalition postpone crunch meeting.

Greek political parties delayed yet again on Tuesday making the tough choice of accepting painful reforms in return for a new international bailout to avoid a chaotic default, seemingly deaf to EU warnings that the euro zone can live without Athens.

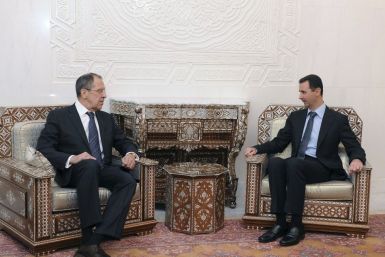

Russia won a promise from Syrian President Bashar al-Assad on Tuesday to bring an end to bloodshed in Syria, but Western and Arab states acted to isolate Assad further after activists and rebels said his forces killed over 100 in the city of Homs.

Given the fragile state of the global economy and brewing geopolitical risks, investors should be underweight equities while favoring selected commodities such as gold and oil, Mohamed El-Erian, CEO and co-chief investment officer of bond fund giant PIMCO, told CNBC on Tuesday.

A meeting of Greek political leaders to discuss a 130-billion-euro ($172 billion) bailout scheduled for Tuesday has been postponed to Wednesday, a Greek government official said.

An announced unity government between the formerly antagonistic Palestinian factions Hamas and Fatah has drawn a cautious response from the White House, drawing a contrast with a swift condemnation from the Israeli government.

France is gradually losing its vitality and presence in global export markets.

Greek officials Tuesday missed yet another deadline to agree to conditions for receiving $170 billion in bailout money, a particularly disappointing development as Athens had appeared earlier in the day to be close to a final deal.

The United States, the European Union and Israel have long branded Hamas as a terrorist organization; while the west generally supports the Palestine Authority.

Iranian buyers have defaulted on payments for about 200,000 tonnes of rice from their top supplier India, exporters and rice millers said on Tuesday, a sign of the mounting pressure on Tehran from a new wave of Western sanctions.

U.S. social media group Facebook seems ready to publish categories of data it collects from users, an Austrian student group lobbying for stricter privacy rules said on Tuesday.

As recently as last November, deep into the Syrian crisis, Brazil specifically rejected any foreign intervention in Syria.

Bombardment of Homs on eve of visit by Russian foreign minister Sergei Lavrov as world powers scramble for diplomatic strategy.

A Syrian regime military assault on Homs killed dozens of people on the eve of a visit to Damascus by Russia's Foreign Minister Sergei Lavrov aimed at pressing President Bashar al-Assad to end an 11-month uprising by implementing swift reform.

China on Monday barred its airlines from a European scheme to reduce carbon emissions, hardening its stance a week before a summit at which the European Union will seek Chinese help to ease its debt crisis.

German Chancellor Angela Merkel told Greece Monday to make up its mind fast on accepting the painful terms for a new EU/IMF bailout, but the country's political leaders responded by delaying their decision for yet another day.

Stocks closed slightly lower on Monday as lingering questions about Europe's debt crisis and corporate earnings overshadowed growing optimism about economic growth after a five-week rally.