Crude Oil Drops Below $92 After Disappointing China Manufacturing Data

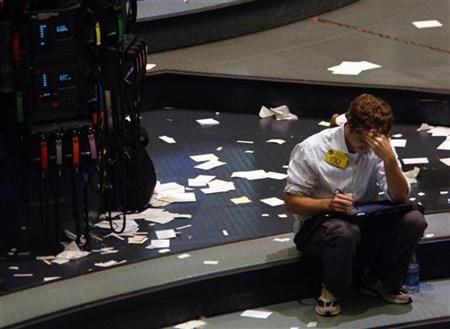

Crude oil prices declined and hovered below $92 a barrel in Asian trading Friday as disappointing Chinese manufacturing growth weighed on sentiment.

Light sweet crude for April delivery declined 0.29 percent or 30 cents to $91.77 a barrel in electronic trading on the New York Mercantile Exchange during Asian trading hours. Brent crude oil futures for the April delivery fell 0.45 percent or 51 cents to $110.88 a barrel on the ICE futures exchange in London.

Traders’ sentiment turned negative after the data released by the China Federation of Logistics and Purchasing showed that Chinese manufacturing activity expanded in February but at a slower rate than in the previous month. It also came in below expectations.

China's official Purchasing Managers' Index (PMI) declined to 50.1 in February from 50.4 in January and also fell short of the economists' estimate of 50.5, suggesting that the recovery in the world’s second largest oil consuming nation was yet to gain momentum.

Meanwhile, the final reading of the HSBC Flash Purchasing Managers' Index (PMI), a measure of the nation-wide manufacturing, also showed slowdown in conditions. The PMI declined to 50.4 in February from January's two-year high of 52.3.

"While comfort can be sought from the fact that the Chinese economy remains in expansion territory, the dip from prior PMI readings does illustrate that the recovery is far from linear and that there are still a few bumps in the road," Tim Waterer, senior trader at Sydney-based CMC Markets, told Reuters.

Oil futures declined Thursday as the stronger U.S. dollar and mixed economic data weighed on the sentiment. Light sweet crude for April delivery declined 0.8 percent or 71 cents and settled at $92.05 a barrel on the New York Mercantile Exchange, while Brent crude for the April delivery slipped 0.4 percent or 49 cents and settled at $111.38 a barrel.

The U.S. economic data Thursday was mixed with fourth quarter GDP revised to 0.1 percent from initial estimation of 0.4 percent contraction but the increase was less than economists’ estimation of 0.5 percent growth. Meanwhile, other reports showed a drop in the new U.S. claims for jobless benefits last week and a sharp rise in Chicago-area manufacturing activity in February.

© Copyright IBTimes 2024. All rights reserved.