Crude Oil Futures Gain After China Manufacturing Data

Crude oil prices advanced in Asia Friday as sentiment was buoyed after a private survey showed an increase in China's manufacturing activity in December.

Light sweet crude for January delivery gained 0.80 percent or 69 cents to $86.56 a barrel in electronic trading on the New York Mercantile Exchange during Asian trading hours. Brent crude oil futures for the January delivery rose 0.45 percent or 49 cents to $108.40 a barrel on the ICE futures exchange in London.

Concerns over a sharp growth slowdown in the world's second-largest oil consuming nation eased after a preliminary reading of the HSBC Flash Purchasing Managers’ Index (PMI) showed that Chinese manufacturing activity expanded further in December.

The HSBC Flash PMI, a measure of the nation-wide manufacturing, climbed to 50.9 in December, its highest level in 14 months, compared to 50.5 in November.

Economic data from the U.S. also improved, with initial jobless claims declining to a near four-year low and retail sales rebounding in November, indicating that the economic recovery in the largest oil consuming nation is picking up.

“We're seeing positive PMI, industrial data and they are all pointing to the direction of an economic recovery. The underlying demand is going to improve gradually," Sijin Cheng, a commodities analyst at Barclays Capital, told Reuters.

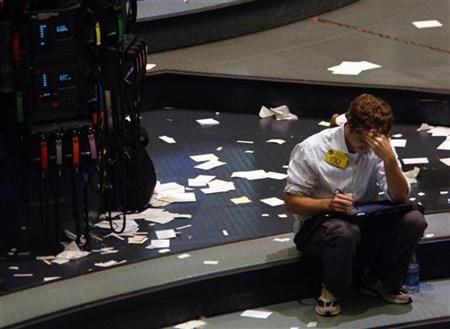

Oil futures declined Thursday as investor sentiment turned negative following uncertainty over the progress made by the Congress leaders in reaching an agreement to avert the looming fiscal cliff. Republican House Speaker John Boehner again accused the White House of willing to slow-walk the economy right up to the fiscal cliff.

Light sweet crude for the January delivery declined 1 percent or 88 cents and settled at $85.89 a barrel on the New York Mercantile Exchange while Brent crude for the January delivery fell $1.59 and settled at $107.91 a barrel.

© Copyright IBTimes 2024. All rights reserved.