Crude Oil Prices Hover Below $97 On Demand Worries

Crude oil prices declined and hovered below $97 a barrel during the Asian trading hours Wednesday after the U.S. crude stockpiles increased much higher than expected.

Light sweet crude for May delivery declined 0.52 percent or 51 cents to $96.70 a barrel in electronic trading on the New York Mercantile Exchange during Asian trading hours. Brent crude oil futures for the May delivery fell 0.34 percent or 39 cents to $110.34 a barrel on the ICE futures exchange in London.

Crude prices declined after an inventory report late Tuesday showed a higher-than-expected rise in the U.S. crude stockpiles last week. The American Petroleum Institute (API) said crude inventories had increased by 4.7 million barrels in the week ending Mar.29, far higher than Reuters’ estimate of a 2.2 million barrel rise.

Recent weak manufacturing reports from both the U.S. and Europe also raised concerns of weaker oil demand. Euro zone Purchasing Managers' Index (PMI) report released by Markit this week had shown that activities remained in contractionary territory for the 20th straight month.

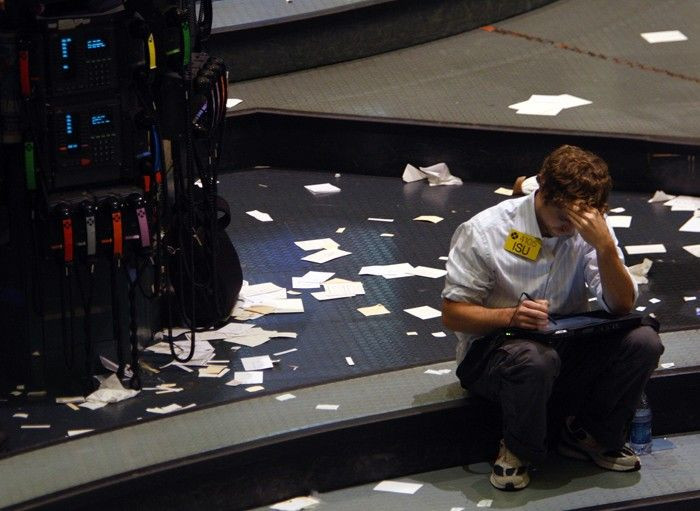

Data released Monday by the Institute of Supply Management (ISM) showed that the U.S. manufacturing activity unexpectedly slowed in March. The manufacturing index declined to 51.3 in March from 54.2 in February and also widely missed Reuters' forecast for a reading of 54.2, raising concerns over the strength of economic recovery in the world’s largest oil consuming nation.

“The U.S. economy took such a body blow three, four years ago with the financial crisis, it's like a patient that's been hit by a car, it's going to take a long while for it to recover. And if the patient is in such shape, it is going to take time for us to start seeing demand actually growing to levels before the financial crisis,” Jim Ritterbusch, president of Ritterbusch and Associates in Galena, Illinois, told Reuters.

Meanwhile, data released by the National Bureau of Statistics and China Federation of Logistics and Purchasing showed that China's services activity increased in March compared to the previous month. The non-manufacturing Purchasing Managers' Index (PMI) rose to 55.6 in March from 54.5 in February. The data came two days after an official report showed that factory activity in the world’s second largest oil consuming nation climbed to an 11-month-high in March but missed market expectations.

After the opening bell Wednesday, the U.S. Energy Information Administration (EIA) is due to report weekly inventory data that are expected to show that stockpiles increased by 2.2 million barrels last week.

On Tuesday, Light sweet crude for the May delivery gained 0.1 percent or 12 cents and settled at $97.19 a barrel on the New York Mercantile Exchange, while Brent crude for the May delivery fell 39 cents to settle at $110.69 a barrel.

© Copyright IBTimes 2024. All rights reserved.