Crypto Industry Lost Over $920M To Hacks And Frauds So Far In 2024: Immunefi

KEY POINTS

- DMM Bitcoin and BtcTurk were the hardest-hit in Q2 2024 threat attacks

- More than $572.6 million was lost to fraudsters and exploiters in the second quarter

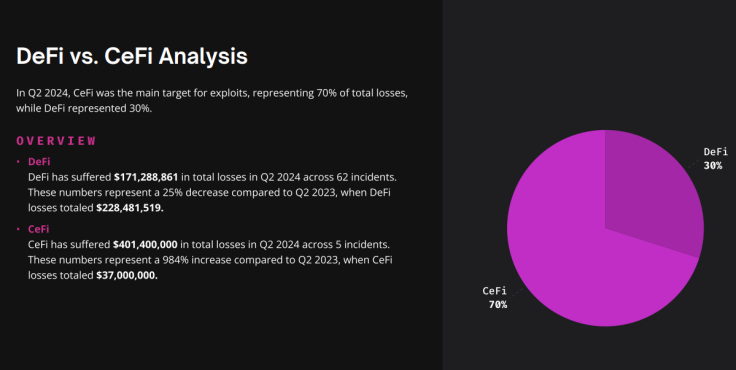

- CeFi platforms losses more than doubled compared to the DeFi space

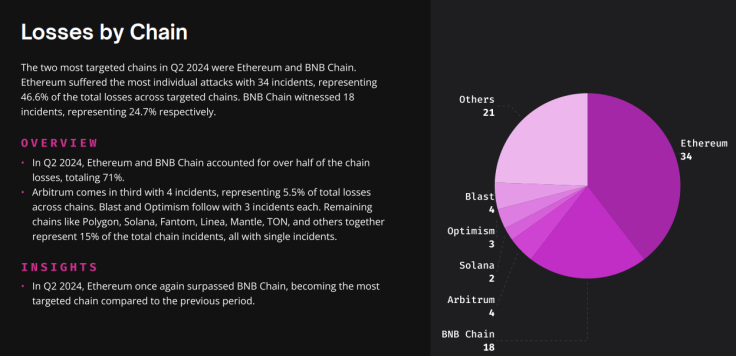

- The Ethereum blockchain was the most targeted chain during the quarter

The cryptocurrency industry saw a significant spike in hacks and frauds during the second quarter of the year, driving the sector's total losses linked to security incidents so far in the year to a whopping $920,940,078, a new security report revealed.

The massive losses marked a 24% increase from the same period last year at $702,965,135, blockchain security firm Immunefi said in its Crypto Losses in Q2 2024 report. Total losses for Q2 reached over $572.6 million, as per the report.

Furthermore, Q2 2024's losses to fraud activities and exploits represented a staggering 112% spike compared to the same quarter last year at over $265.4 million. Majority of the quarter's losses were due to hacks across 53 incidents that took $564.2 million from the crypto market, while 19 fraud-related incidents resulted in losses of more than $8.4 million.

"Most of that sum was lost by two specific projects: DMM Bitcoin, a Japanese crypto exchange, suffered an attack that resulted in $305,000,000 lost, and BtcTurk, Turkey's biggest cryptocurrency exchange, which incurred a loss of $55,000,000," the report noted.

Among Immunefi's other notable findings was that the Ethereum blockchain surpassed the BNB Chain in terms of being the "most targeted chain" in Q2 2024. This finding comes as the Ethereum community waits for a decision on the full approval of spot Ether (ETH) exchange-traded funds (ETFs).

One of the top incidents featured in the report was the $200 million exploit of leading Web3 gaming platform Gala Games in May, wherein $21 million worth of GALA tokens were sold illegally and 4.4 billion coins were burned.

Another notable highlight of the report was the comparison of losses between decentralized finance (DeFi) and centralized finance (CeFi). DeFi saw over $171.2 million in losses in the second quarter, while CeFi recorded loss of more than $401 million across five incidents.

Unfortunately for the crypto industry, only $26.7 million was recovered from pilfered funds across four incidents, including the exploit of Gala Games.

The report comes just days after the X (formerly Twitter) handle of heavy metal band Metallica was hacked to promote a fake token. The exact losses from the said exploit are unclear.

Late in May, the U.S. Treasury Department flagged the vulnerability of nonfungible tokens (NFTs) to frauds and scams, warning users that criminals have used NFTs to launder proceeds from crimes.

Blockchain security and analytics firm Chainalysis warned in February that it has become clear bad actors "are becoming increasingly sophisticated and diverse in their exploits," which requires crypto platforms to act promptly when their systems are breached.

© Copyright IBTimes 2024. All rights reserved.