The SEC was given time until midnight last Friday to submit a challenge to the court's decision that found it was unjust for the financial regulator to reject Grayscale Investments' application to create a spot bitcoin exchange-traded fund. The SEC's decision now clears the way for the first spot Bitcoin ETF in the U.S. although a separate approval order from the regulator is still required.

Last month, Delaware District Judge John Dorsey approved an order to allow the now-bankrupt crypto empire to sell, hedge price movements, or generate yield through staking off the crypto assets it is holding to repay its creditors.

Despite the potentially imminent approval of spot Bitcoin ETF filings, some are concerned that the eventual arrival of traditional financial giants, including the mega-investment company BlackRock, could "fundamentally change" Bitcoin.

The CFTC alleged that Stephen Ehrlich and Voyager Digital defrauded customers by making them believe that the crypto brokerage firm is a "safe haven" to buy and store assets, with its CEO promising high-yield returns as high as 12%.

While The Money Mongers report included exploits committed by malicious actors, it did not include exit scams, rug pulls, or theft committed by employees.

Welly "represents the first step in making Welly a bridge between the web3 and web2 worlds," its community manager Piergiorgio Petoia said.

Bankman-Fried had previously blamed CZ for the FTX crash, describing it as "an extreme, quick, targeted crash precipitated by the CEO of Binance that made Alameda insolvent."

Earlier this week, TFL and Kwon's lawyers urged the court to ask Citadel Securities to provide documents containing its trading activities in May 2022.

Elliptic acknowledged the potential that an insider may have carried out or aided the exploit. It pointed out the possibility that some employees at FTX could have taken advantage of the turmoil that ensued when the company declared bankruptcy to move its cryptocurrency assets.

The wallet also eliminates the necessity of retaining and recalling the complex 12-word seed phrase, significantly simplifying the process of creating a wallet, even for individuals unfamiliar with web3.

Ellison's voice trembled during Wednesday's testimony, and said she "felt a sense of relief that I didn't have to lie anymore."

The recent update on the joint spot Bitcoin ETF application for approval of ARK Invest and 21 Shares underscored information on the proposed BTC ETF, as well as practices on how it will custody assets and determine the values of the assets.

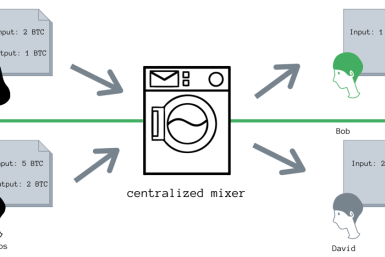

Blockchain analysis firm Arkham Intelligence said that Tornado Cash has recovered more than a year after the U.S. government imposed sanctions on the platform and arrested several key figures behind the business.

The use of crypto by terror groups and organizations trying to evade financial sanctions across the globe is nothing new. In fact, since 2021, Israeli authorities have seized around 190 Binance accounts allegedly linked to terror groups.

Ellison revealed that she experienced persistent anxiety, explaining that they would need to rely on their FTX credit line, which was subject to potential withdrawal at any moment.

Hayes said BlackRock's entry into the industry could "fundamentally change" Bitcoin. Though he acknowledged that the spot Bitcoin ETF approval might bring a stream of funds into the crypto market, the BitMEX co-founder was concerned about its potential influence on traditional finance.

After finding a solution to its issue in the U.K., Binance is facing another hurdle in its global ambitions.

Binance aided authorities in identifying and deactivating the alleged crypto donation accounts of the Islamic Resistance Movement.

Ellison testified after the testimony of Gary Wang, the mysterious co-founder of FTX who admitted last week that he wrote the programming that enabled the crypto exchange's fraud.

The study used Google searches to find out which among nearly 23,000 crypto assets were the most preferred alternatives to Bitcoin for investors this year.

The recent claim seemingly aligned with the previous report, which, aside from claiming that Alameda Research is the second-biggest donor of Tether, had estimated that the crypto hedge fund minted $36.7 billion.

Wang testified in court last Thursday and admitted that he, Bankman-Fried, Caroline Ellison, the former CEO of Alameda Research, and Nishad Singh, the FTX director of engineering, committed wire fraud, securities fraud and commodities fraud.

In a court motion filed last week against the crypto exchange platform Coinbase, the SEC stated that digital assets have no inherent value since they cannot generate profits.

But while the non-profit organization has been mum on the reason behind its latest move, data from token flow-oriented data platform EigenPhi revealed that when it sold 1,700 ETH via Uniswap v3, it came under a Sandwich attack by MEV Bot (0x00...6B40).

Kusama seemingly hinted that the development team is preparing to roll out a new initiative for the community in the coming weeks.

Stephen Ehrlich was reportedly "angered and perplexed" by the regulator's potential civil claims, labeling them unfounded.

Binance announced the rollout of a new subpage to cater to its customers in the United Kingdom in line with the country's changing regulations.

A report said that more than 173,939 workers at U.S.-based tech companies have been laid off in mass job cuts so far in 2023.

The HTX Global attack has been classified as a white hat incident since all the stolen funds have now been returned.

While others are optimistic about the launch of Ethereum Futures ETF, analysts noted that it could reduce market volatility but could also dampen the potential of Ether's performance, a trend that typically emerges as the asset class matures.