Cryptocurrency Forecasts Are Mere Speculation, Major Market Analysts Say

Cryptocurrencies are touted to be the next big asset class, poised to suck in a large chunk of global investments from traditional favorites like gold. Surprisingly, many financial analysts do not seem to share the exuberance around the rise of this relatively young asset. Nineteen prominent banks, research houses and hedge funds that International Business Times/Newsweek spoke to said they are yet to start regular forecasts for cryptocurrencies, citing the uncertainty surrounding them.

"We need better data and examples to define what economic success looks like before we can model how benefits accrue to asset owners, aside from sentiment and expectations," says Autonomous Research in its note on cryptocurrencies.

"Valuation would involve an extraordinary amount of guesswork," Yung-Yu Ma, chief investment strategist at BMO Wealth Management, is brutally honest in his research note on Bitcoin.

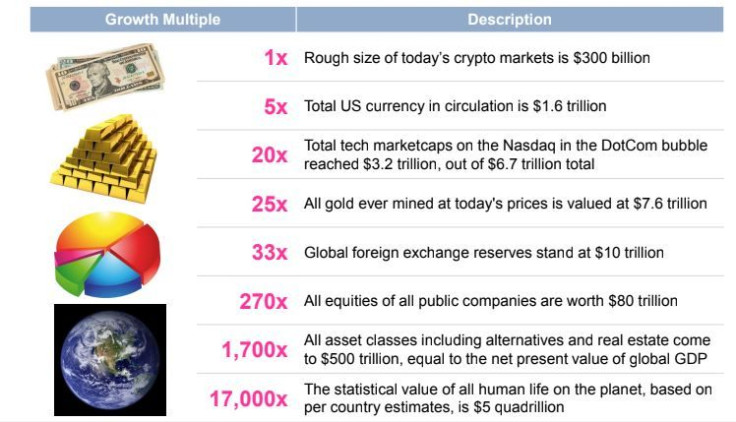

Bitcoin was one of the first cryptocurrencies, and is still the biggest and most well-known, with a current market cap of around $132 billion. The current overall market capitalization for all cryptocurrencies is estimated at about $300 billion, down 70 percent from their January peak of about $820 billion, and just about a third the value of Apple which became the first $1 trillion public company Thursday.

That is chump change compared to the asset classes cryptos are expected to edge aside. The global stock of gold is worth around $7.5 trillion, according to the latest World Gold Council report. The total market capitalization of all U.S. stocks is about $30 trillion.

Analysts led by Vicky Redwood, the global economist at Capital Economics, are harsh in their assessment. "Claims that cryptocurrencies will replace established fiat currencies are rubbish," they said, adding that replacing national currencies with a cryptocurrency is not "economically desirable."

Some analysts do have forecasts on cryptos but they mainly focus on the cryptocurrency market.

RISING PRICES AND EUPHORIA

Most analysts IBT/Newsweek spoke to are worried about a crypto bubble. Bitcoin, for instance, grew at an annualized rate of 2,478 percent from 2015 to 2017, says Hugh Johnson, chief investment officer at Hugh Johnson Advisors. The second stage of a bubble is characterized by rising prices and leverage, and euphoria, he says. “If the rise of Bitcoin in 2017 was not symptomatic of a bubble/ mania, nothing would qualify.”

Johnson says the volatility of Bitcoin makes it difficult to imagine the currency as a widely accepted legal tender. “As soon as I hear pundits say this is a virtuous circle and trees do indeed grow to the sky, I become worried.”

The cryptocurrency was trading in the $2,000 range in August 2017, jumped to around $20,000 in December, and now trades in the $7,000 range.

In a note dated April 5, Capital Economics said: “We still think that Bitcoin is essentially worthless, meaning that it is likely to fare much worse than other assets in the coming months.”

Yung of BMO has no doubt that Bitcoin’s underlying blockchain technology will continue to increase in importance, but says the future of Bitcoin itself (and other cryptocurrencies) has less clarity.

Alisa Gus, CEO of social market network WishKnish, compares the cryptocurrency market to the dotcom bubble. “What worries me is that now all the techies have come into the market before it can grow again and sustain its growth and promise.”

THE REGULATORS’ DILEMMA

Capital Economics analysts point out that policymakers face a trade-off between protecting consumers and not stifling a sector at the forefront of the technology industry. Also, regulating cryptocurrencies would require a level of international cooperation that is not visible -- yet. Brazil’s central bank, for instance, recently warned about the “risks derived from storing and negotiating virtual currencies.” The U.S. Securities and Exchange Commission has ruled that cryptos may, in some cases, be securities and therefore subject to regulation. The Chinese have gone further, declaring all new ICOs illegal. By contrast, Japan — the third-largest economy in the world — has relatively friendly regulatory regime for cryptos. The government there is focusing on strengthening consumer protection measures and recently revamped processes for cryptocurrency exchange registrations.

The uneven regulatory landscape opens up the market for manipulation. For instance, analysts say big holders of cryptos can trade among themselves and, in effect, manipulate the market without violating laws.

Cryptos have been built on the promise of being fraud-proof, with the blockchain technology that underpins them supposedly making it almost impossible for fraudsters to tamper with. Yet, scamsters have found other ways to siphon off investors’ money.

Autonomous Research in its note says exposure to crypto assets has a 20 percent annual fraud rate on entry, and a 0.5 percent hacking/ phishing rate at exchanges and digital wallets.

Lex Sokolin, global director of Fintech Strategy at Autonomous Research, says, “Until the regulatory question mark is resolved, I don’t expect to see price targets from the major banks because they would be taking the risk of having investors rely on that number and then exposing themselves to legal risks without having a solid valuation or methodology or confidence in that number because the volatility is so high and so many things can happen.”

‘SPECULATIVE SLICE OF A SPECULATIVE SLICE’

The dizzying rise of Bitcoin last year has fuelled talk of cryptocurrencies as an alternative investment option, in order to balance risk in the case of a crash in traditional asset classes. But we are yet to see that shift on the ground.

Autonomous Research says in its note that crypto assets are now valued at $300 billion and that trends and valuation approaches are still emerging.

It argues that a 5 percent allocation to crypto or tokenized assets within the $5-10 trillion global allocation to alternative investments would amount to roughly $500 billion. Such a holding, it says, “is not a fundamental shift in capital markets, but a speculative slice of a speculative slice within a globally diversified portfolio." It adds that maintaining $500 billion in crypto value does not require much change in asset allocations.

BMO chief investment strategist Yung thinks cryptocurrencies will gradually edge out gold as an alternative investment option, especially as millennials – who he says look at owning yellow metal as kind of “preposterous” – age.

“The way gold is thought of today, say, by investors who might be on an average 50 years old and above is probably the way cryptocurrencies is going to be thought of by investors who today are 30 years old and below.”

Autonomous Research argues that moving crypto from alternatives into the core of portfolios using efficient ETF products would drive far larger growth.

But that is not an easy road to take.

The SEC on July 26 rejected a proposal by the Winklevoss brothers to launch a bitcoin ETF, citing issues of fraud and investor protection. That just shows how difficult it is to convince regulators in the current environment. The SEC had declined to approve an application for the Winklevoss Bitcoin Trust in 2017 as well.

(With inputs from Ramsey Touchberry)

© Copyright IBTimes 2024. All rights reserved.