Dalian Wanda Taking Stake In Legendary Entertainment

Chinese property and investment firm Dalian Wanda Group has agreed to acquire a majority stake in Legendary Entertainment, valuing the U.S. movie studio company at between $3 billion and $4 billion, according to a person familiar with the matter.

The move represents Wanda's latest bid to expand overseas and become a major player in the U.S. entertainment industry following its acquisition of AMC Entertainment Holdings, the second-largest movie theater chain in North America, for $2.6 billion in 2012.

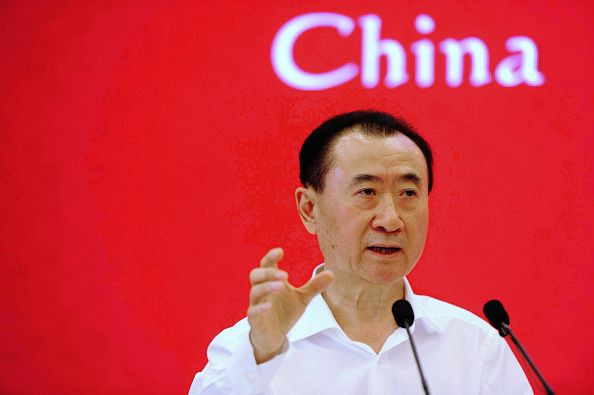

Wanda, controlled by China's richest man, Wang Jianlin, will own a little more than half of Legendary Entertainment, with Legendary founder and Chief Executive Officer Thomas Tull and the rest of its management owning the remainder, the person said on Monday.

Other investors in Legendary, including Japan's telecommunication conglomerate SoftBank Group Corp and investment firm Waddell & Reed Inc, have agreed to sell their stakes in the company, the person added.

An agreement has been signed and could be announced as early as next week, the person said, asking not to be identified because the deal is not yet public.

Wanda, Legendary, SoftBank and Waddell & Reed did not immediately respond to requests for comment.

Founded in 2000, Legendary has produced hits such as "The Dark Knight," "Jurassic World," "Man of Steel," and the 2014 remake of "Godzilla," as well as "The Hangover" film franchise.

Legendary generally provides half the financing for movies whose budgets can run up to $200 million or more. It also has an agreement with China Film Co, the largest and most influential film company in China, to co-produce movies.

Wanda is the leading shareholder of China's biggest theater chain, Wanda Cinema Line Corp (002739.SZ). Wanda may also list its film production and distribution unit by the end of 2016, its company founder was quoted as saying in an interview with Caixin Weekly financial magazine in November.

(Reporting by Liana B. Baker in New York; Editing by Lisa Shumaker)

© Copyright Thomson Reuters 2024. All rights reserved.