Davos 2016: Heads Of Morgan Stanley, Deutsche Bank, IMF Discuss Bitcoin And The Future Of Banking

At the annual meeting of the world's economic titans in Davos, Switzerland, the heads of Morgan Stanley, Deutsche Bank and the International Monetary Fund played down suggestions that digital currencies like bitcoin could soon shake the foundations of the finance industry. "It's not going to change everyone's life tomorrow," said James Gorman, the chairman and CEO of Morgan Stanley, who last year called bitcoin "surreal."

While he noted that some aspects of the investment banking industry could be impacted by the march of digitalization and cryptocurrencies — including securities trading and cash transfers — Gorman said regulatory challenges still occupy more of his attention than online currency technologies.

"I wouldn't be so worried," said John Cryan, co-chief executive of Frankfurt-based Deutsche Bank, which has experimented with bitcoin-like transactions. Cryan expressed more interest in the digital software underlying bitcoin — called the blockchain — than the much-hyped digital currency itself. "Blockchain technology is interesting. Bitcoin, I don't think is."

The discussion came during a World Economic Forum confab whose theme — "the Fourth Industrial Revolution" — centers on the potential of automation and connectivity to revolutionize markets and society.

For bankers, the timing is apt. In 2015, digital currency technologies made unprecedented incursions into the mainstream of the financial world, with top industry players staking out positions in the booming market. Goldman Sachs joined a $50 million financing round for bitcoin startup Circle Internet Financial. The Nasdaq stock exchange began using a blockchain-based platform to settle trading in private startup shares.

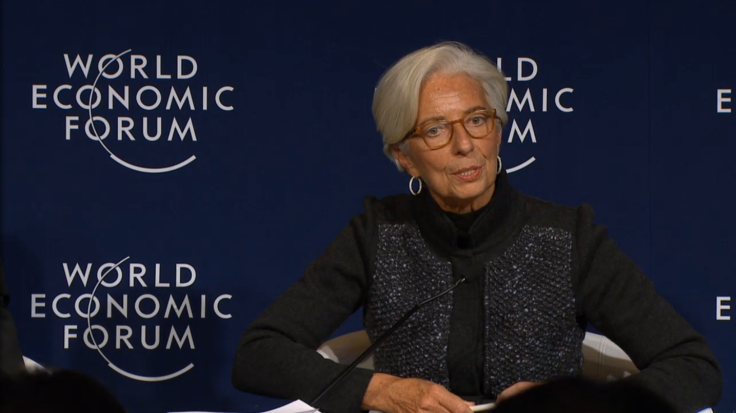

On the flipside, the burgeoning digital currency space remains largely unregulated. Christine Lagarde, head of the International Monetary Fund, told the panel that bitcoin and related currency innovations "could disrupt monetary policy" in the future, potentially posing a "substantial threat to financial stability."

But at present, Lagarde noted, digital currencies have a relatively puny market value of $7 billion, the equivalent of less than 0.1 percent of the current $12.3 trillion U.S. money supply.

Technological changes beyond bitcoin, however, gave the finance executives some pause. From the digitization of monetary transactions to the increasing importance of security in a connected world, panelists saw deep changes ahead in the way banking operates.

PayPal CEO Dan Schulman, the sole "disrupter" on the panel, emphasized the security risks that financial firms face online. "Everybody's password has been compromised," Schulman said. "That's just the reality."

"Financial markets are going to be hacked," he added, echoing fears among financial regulators that increasingly digitized securities exchanges and global banking hubs could become the targets of belligerent parties on the world stage.

The financiers noted that the industry began moving into cyberspace decades ago, long before bitcoin reared its head. “On the stockbroking side, we’re really just trading electrons anyway,” said Cryan, who predicted that physical cash would follow suit within a decade.

But the bank executives didn't see those seismic changes knocking them from their roosts at the top of the financial pecking order. Panel moderator Gillian Tett of the Financial Times put the question bluntly, asking whether Wall Street could be like "rabbits in the headlines of the train" of blockchain technologies.

"Look at how we actually make money," answered Gorman, whose company participated in the largest-ever initial public offering with Chinese online retailer Alibaba last year. "Is blockchain going to stop us from bringing Alibaba to market?"

He let the rest of the panel answer that question for themselves.

© Copyright IBTimes 2024. All rights reserved.