Debt Bomb: IMF Warns Global Debt Threatening World's Economic And Financial Stability

The International Monetary Fund reported Thursday global debt has reached a record $188 trillion, amounting to 230% of world output, and threatens risk to the world’s economic and financial stability.

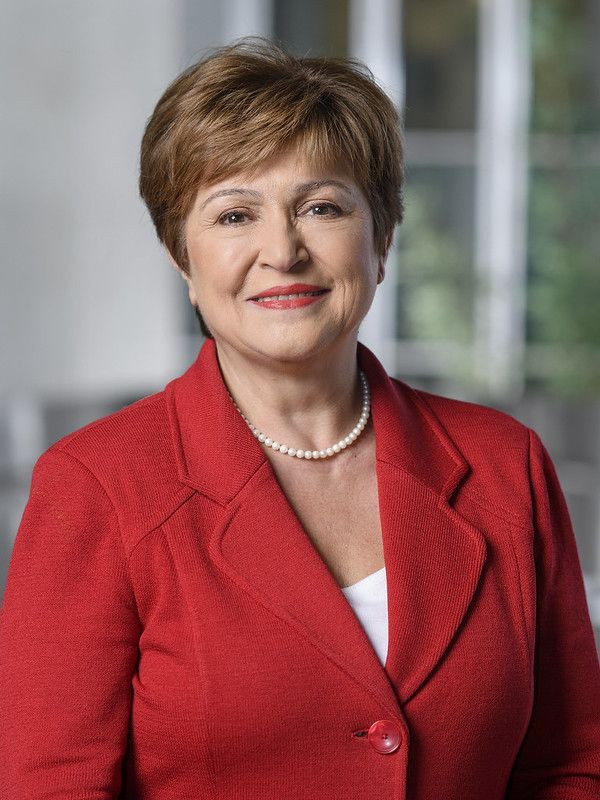

“If investor sentiment were to shift, the more vulnerable borrowers could face financial tightening and higher interest costs—and it would become more difficult to repay or roll over debt,” Kristalina Georgieva, IMF managing director, said in a speech prepared for delivery to the 20th Annual Research Conference in Washington. “This, in turn, could amplify market corrections and intensify capital outflows from emerging markets.”

Private debt makes up two-thirds of the total debt while public debt is at levels not seen since World War II among advanced economies. In emerging markets, public debt is at levels not seen since the 1980s.

U.S. public debt currently stands at a record $23 trillion, or $186.58 per taxpayer, with the Institute of International Finance pegging private debt at more than $50 trillion in the first quarter of this year. The IIF pegged China’s public debt at $40 trillion in May.

Georgieva noted much of the public debt stems from the 2008 financial crisis when a significant level of private debt moved to public balance sheets, Georgieva noted.

“Recent IMF staff research showed that direct public support to financial institutions alone amounted to $1.6 trillion during the 2008 crisis,” she said, adding, “The bottom line is that high debt burdens have left many governments, companies, and households vulnerable to a sudden tightening of financial conditions.”

She cited trade tensions, Brexit and geopolitical conflicts as risks.

Georgieva called on countries to proceed more carefully in piling on debt, focusing on attracting equity-based investment, boosting tax revenues and cutting red tape and corruption.

“It means focusing on investment projects with credibly high rates of return. And it means increasing the responsibility of lenders—who need to assess the impact of new loans on the borrower’s debt position before providing new loans,” she said.

She also called for more transparency in borrowing and lending practices, and urged better collaboration between borrower countries and lenders.

© Copyright IBTimes 2024. All rights reserved.