Default Remains A Concern In Venezuela: Study

As conditions for the poor and middle-class Venezuelans continue to degenerate, Venezuela faces the possibility of default. Despite mounting debt, the country continues to solicit more short-term capital. Last week, authorities announced that they intend to raise $4.5 billion through the sale of foreign-currency bonds.

David Rees, the author of a report from Capital Economics that was released Thursday, says the country’s future solvency hinges on oil prices, which are hovering at around $110 a barrel. For every $10 per barrel that prices fall, the country will lose about $10 billion in annual revenue, he says.

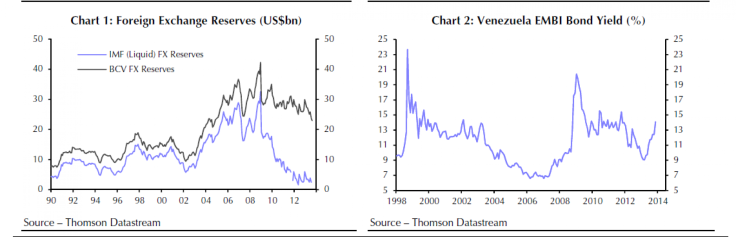

The Central Bank of Venezuela will quickly burn through its cash and gold reserves if the price of oil falls to $90 per barrel, which in turn could lead to a suspension of debt service payments, or a flurry of new bond sales. In either scenario, Rees says that bond yields would rise rapidly, perhaps as high as 16 percent.

On Tuesday, it emerged that parliament has granted President Nicolas Maduro the power to rule by decree for the next 12 months. President Maduro’s attempts to suppress inflation have grown increasingly more extreme. Retailers have been arrested and price controls for consumer goods established. There’s little doubt the profits from the bond sale would go to importers to help them bring in more goods.

The influx of capital would have a salubrious effect on the economy, as a severe shortage of foreign currency has caused a shortage of basic goods in the import-dependent economy. Consumer prices have skyrocketed year-to-year, rising more than 50 percent in October.

Rees says that the bond sale would be imprudent given the long-term repercussions and double-digit interest rates.

© Copyright IBTimes 2024. All rights reserved.