Democratic Upset In U.S. Midterms Could Roil Markets, Options Mavens Say

An unexpected result in Tuesday's U.S. midterm election could roil markets positioned for relative calm, options strategists said.

Control of the U.S. Congress is at stake in Tuesday's midterms, with Republicans favored by polls and betting markets to win control of the House of Representatives and possibly the Senate. With Democrat Joe Biden in the White House, that potential result would lead to a split government, an outcome seen as broadly favorable to markets over the long term.

But a surprise victory by the Democrats could throw the markets for a loop, potentially bringing to the fore concerns about tech-sector regulation as well as budget spending that could buoy already-high inflation, according to market participants.

Analysts said a calendar full of closely watched macroeconomic events such as last week's Federal Reserve meeting and U.S. consumer price data later this week have left traders less focused on the vote than might normally be the case.

With investors' election-related hedging comparatively light, "any surprise would probably be exacerbated by thin markets and the relatively high volatility landscape that we are looking at right now," said Chris Murphy, co-head of derivatives strategy at Susquehanna International Group.

Options positioning implied a 1.5% decline in the S&P 500 on the day after the vote should Democrats pull off a stronger-than-expected showing, according to Tom Borgen-Davis, head of equity research at options market making firm Optiver.

A "big Democratic win could be taken negatively for the tech sector just given they are more likely to bring in regulations in the sector, relative to Republicans," Borgen-Davis said.

That said, options traders do not seem to be positioned for fireworks. For example, open puts on the Nasdaq 100-tracking PowerShares QQQ Trust's options, typically used for defensive positioning, outnumber calls, usually employed for bullish wagers, 1.4-to-1, one of the smallest margins since mid-June, according to Trade Alert data.

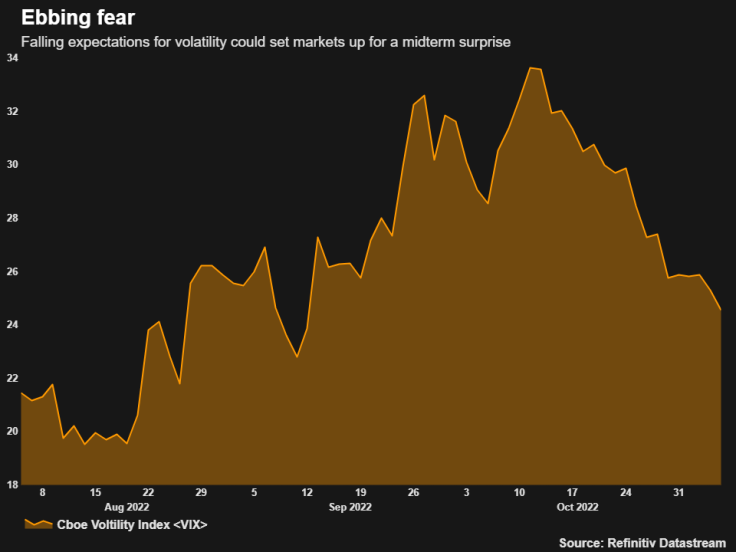

Meanwhile, the Cboe Volatility index, known as Wall Street's fear gauge, fell on Monday to close at a near two-month low. The SPX rose 0.96% but is still down 20% for the year.

(Graphic: Ebbing fear,

)

Strategists at Morgan Stanley including Mike Wilson wrote on Monday that a Democratic win could send Treasury yields higher and strengthen the dollar, reflecting the view that higher fiscal spending could exacerbate inflation and force the Fed to raise rates higher than expected.

"Markets could assign a higher probability to further fiscal expansion, with Congress and the Fed effectively pulling in opposite directions on inflation," Morgan Stanley's analysts wrote.

On the other hand, a clean sweep by the Republicans could increase the chances of a Republican spending freeze, boosting Treasuries and supporting the most recent rebound in U.S. stocks, which has sputtered this month, according to Morgan Stanley.

At the individual stock level, certain names have the potential for higher election-related volatility, strategists at Goldman Sachs said in a note earlier this month.

For instance, revenue at iHeartMedia Inc Fox Corp, Paramount Global and Meta Platforms Inc could potentially get a short-term boost from ad-related spending around midterm elections, according to the report.

Meanwhile, shares of tobacco company Philip Morris International Inc could be volatile around regulatory restrictions, Goldman's analysts wrote.

© Copyright Thomson Reuters 2024. All rights reserved.