Demographics, Inequality, Education and Debt Are Slowing The US Economy – And Technology Can’t Save It

On Monday, former U.S. Treasury Secretary and now Financial Times columnist Lawrence Summers wrote about the possibility of the United States becoming a "Downton Abbey economy," as family incomes fail to rise enough to meet demand, real wages stagnate, and the top 1 percent of earners see record income growth.

"It's very likely that these issues will be with us long after the cyclical conditions have normalized and budget deficits have at last been addressed," he wrote.

It's a depressing thought, especially considering the slow yet steady decrease in the U.S. unemployment rate since the financial crisis. But Northwestern University economist Robert Gordon's outlook is even bleaker.

In a recent paper entitled "The Demise of U.S. Economic Growth: Restatement, Rebuttal and Reflections," he outlined four factors that will cause U.S. gross domestic product (GDP) growth to be slower, on average, in the next few decades than it has been in the past century.

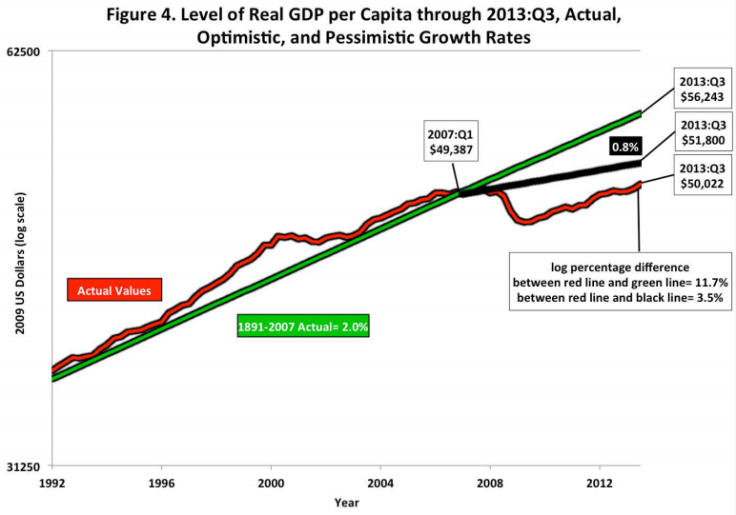

He writes that U.S. GDP growth between 1891 and 2007 was 2 percent per capita. But between 2007 and 2047, the rate will be just 1.3 percent. The "bottom 99 percent of the income distribution" will be hit hardest as their real income per capita will increase at an average rate of just 0.4 percent.

"The primary cause of this growth slowdown is a set of four headwinds, all of them widely recognized and uncontroversial," he wrote.

Demography, education, inequality and debt are the main reasons he outlined, while also addressing the issue of technological innovation -- something many feel is on an upswing, when the opposite is true.

The problem, demographically speaking, is that there are simply fewer and fewer people in the U.S. workforce. Of course, the retiring baby boomer generation is a major factor; by some estimates, one in five Americans will be older than 65 by 2030, and most will have stopped working.

But "the decline in the participation rate involves more than just baby-boomer retirement," Gordon wrote. He cited several cities from the American "rust belt" that have lost essential manufacturing jobs, causing more than 40 percent of adults to leave the workforce.

“A unique feature of the slow 2009–2013 economic recovery has been the fact that the employment rate has been steadily improving while the participation rate has been declining, so there has been virtually no improvement in the employment-to-population ratio.”

Education is another headwind slowing American growth.

Having more people graduate from secondary or higher education institutions has long been associated with economic growth. While graduation rates in the United States increased by 80 percent from 1900 to 1970, they fell to 74 percent by the year 2000.

Decades ago, U.S. public funding for higher education was high, but it fell by a third between 2001 and 2012 – and now ranks 16th among the world’s developed nations.

“Even when account is taken of the discounts from full-tuition made possible by scholarships and fellowships, the current level of American college completion has been made possible only by a dramatic rise in student borrowing,” said Gordon. Now, Americans owe more than $1 trillion in debt.

“Dear graduate, face your future as an indebted taxicab driver or barista,” he wrote.

Inequality is on the rise… again.

Though in the 1950s, '60s and '70s, the share of the country’s top 1 percent was proportionally less, it has risen again, to levels similar to the early 1900s, before the crash of 1929.

This is obvious when looking at the wages of low-level U.S. workers.

The bottom 20 percent of American workers earn less than $9.89 an hour, and their wages actually fell by 5 percent between 2006 and 2012, after adjusting for inflation.

“Holding down wages is an explicit corporate strategy at retail firms like Wal-Mart, which hires only temporary workers to fill job openings and forces many of its workers onto part-time shifts,” he wrote.

“For many Americans, my pessimistic predictions for the future have already become a fact,” he added.

Growing debt is another major problem future generations will face. Gordon writes that Americans will have to pay more and more taxes to help the country pay its debt in the next few decades. He cites data that the Medicare fund will reach zero balance by 2026, and Social Security will do the same on 2033.

Meanwhile, Detroit’s recent bankruptcy may be just the first of many. “While the Congressional Budget Office currently estimates that the federal ratio of debt to GDP will stabilize between 2014 and 2020, its optimism is based on unrealistically optimistic economic forecasts,” he wrote.

And if you think innovation will save the American economy, think again, he says. Most people, especially the young, will say that technology today is developing faster than ever, but that’s not exactly the case.

“They appear to treat the iPhone and iPad as a major technical advance, forgetting that their hand-held devices rest on the shoulders of previous advances including personal computers, laptops, cell phone technology, not to mention the air conditioning which makes their homes and offices comfortable year-round, all of which rests in turn on the electricity upon which they rely to recharge their devices every night,” Gordon wrote.

Plus, the things Americans do invent may actually cost them in the long run.

Gordon wrote that “techno-optimists” think that U.S. inventions spread easily to other countries, but that isn’t always beneficial.

“Innovation is a free good for the world as a whole, while headwinds are uniquely nation-specific,” he said.

Other countries will be able to buy American innovation “while facing headwinds that for many countries are mild breezes compared to the gale-force headwinds experienced by the United States.”

© Copyright IBTimes 2024. All rights reserved.