Despite Ultra-Low Borrowing Costs For US Banks, 1 In 10 Charge Ultra-High Interest Rates On Loans

For more than four years now, the nation's banks have been able to borrow at close to zero percent, courtesy of the Federal Reserve's loose monetary policy and extraordinary steps to encourage lending. But despite that, depositors with savings accounts and even short-term certificates of deposit get little more than pennies in interest after handing tens of thousands of dollars to banks for safekeeping.

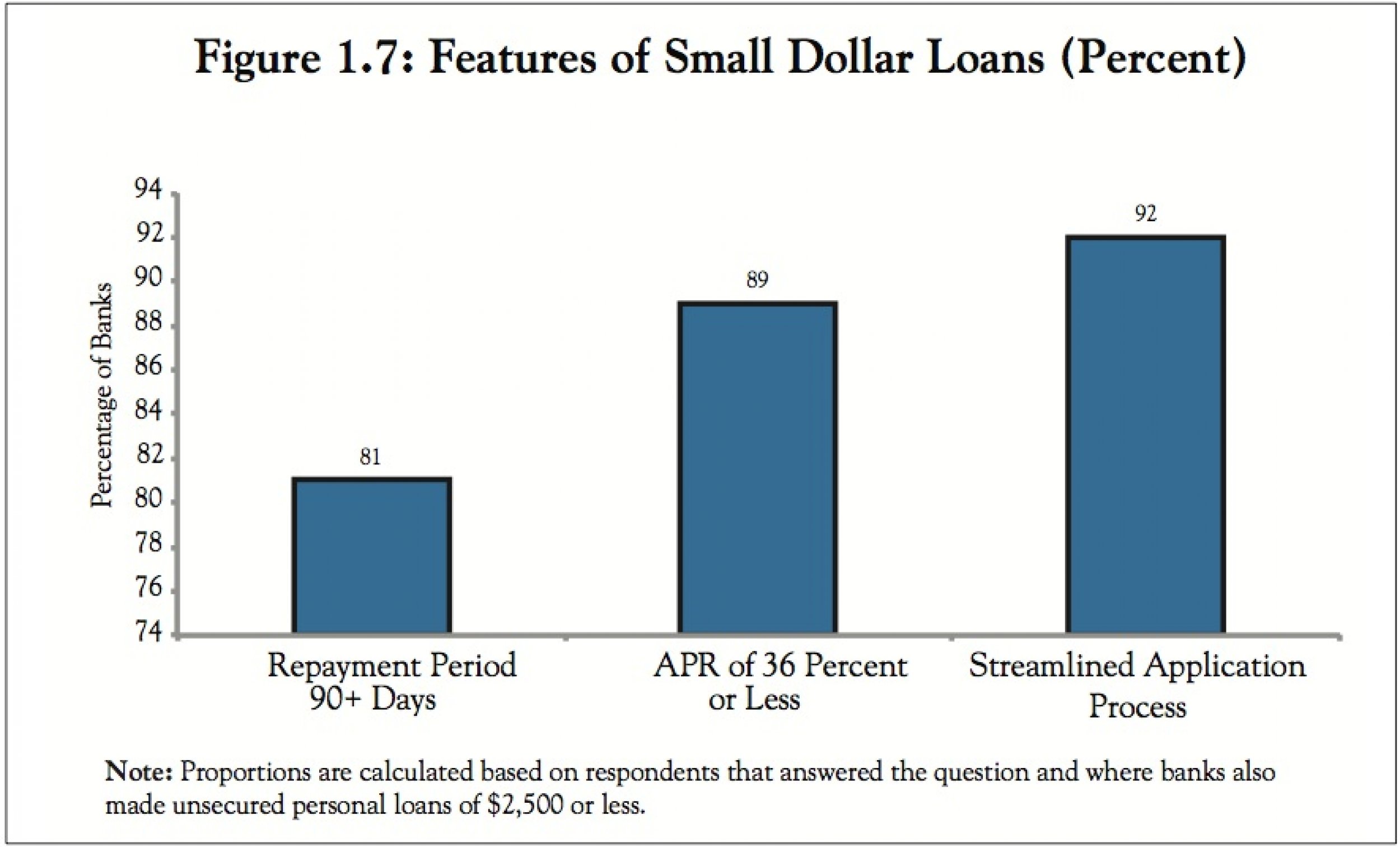

Not only that, but a new report from the Federal Deposit Insurance Commission shows 11 percent of banks admitting they charge more than 36 percent annual interest on small consumer loans of less than $2,500. That's so high it exceeds the penalty rates on many credit cards, and blows past the maximum amount payday lenders can charge in many states.

The 11 percent figure comes from a report by the FDIC that was meant to show what steps banks are taking to provide services to underserved communities, and where they are falling short. The FDIC uses the 36 percent threshold, given that research has found such an amount -- slightly less than $2.80 each month for each $100 loaned -- is the most lenders can charge before many consumers begin falling behind on their debt.

Providing small loans with reasonable rates is considered important to getting people at the margins of the financial community to use bank services, establish credit and otherwise become financially functional.

But banks, especially larger ones, don't always prioritize providing this kind of service.

"Small and mid-size banks were more likely to make unsecured personal loans in amounts under $2,500, to charge less on the auxiliary products and services they did offer, and to make funds available on the same day when cashing checks," the FDIC report found.

© Copyright IBTimes 2024. All rights reserved.