Did Fannie Mae Overpay Bank Of America For Servicing Rights?

Fannie Mae agreed to pay Bank of America Corp (NYSE: BAC) about 20 percent more than it was contractually obligated to last year to transfer the servicing of high-risk mortgages to firms more likely to prevent their foreclosure, according to a government watchdog report released Tuesday.

The report, issued by the inspector general for the Federal Housing Finance Agency (FHFA), concludes that Fannie Mae is probably contractually required to pay a breakup fee in order to shift troubled loans to companies more skilled at working with borrowers and that could reduce loan losses for the government-backed mortgage giant and taxpayers. It could also reduce foreclosures.

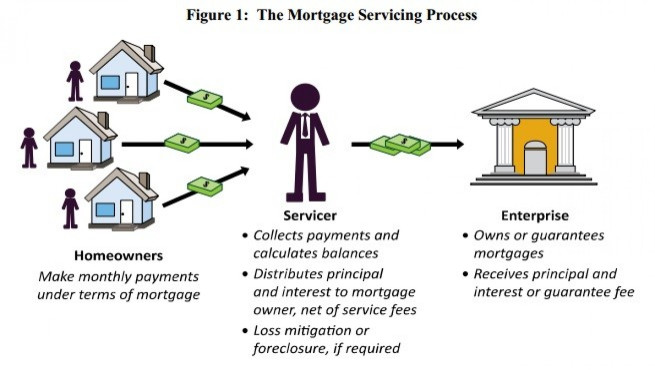

Fannie Mae was chartered by Congress to create liquidity and promote affordable housing in the mortgage market. To carry out this mission, Fannie Mae purchases mortgage loans originated by banks and other lenders, enabling those institutions to replenish their funds so they can lend to other homeowners.

Regardless of whether a loan is sold, securitized or retained in a lender's portfolio, the mortgage itself must be serviced. This means that payments must be collected and disbursed appropriately and the loan must be administered.

At issue is a program in which Fannie Mae sought to reduce losses on troubled loans by bringing in specialized firms to handle payment collection and loan modifications. These servicers intensively contact borrowers, educate them on the impact of not paying, and explain options to avoid foreclosure.

In order to transfer mortgage servicing rights, or MSR, from a regular servicer (i.e. Bank of America) to a specialty servicer, Fannie Mae must first terminate the regular servicer's contract by purchasing or otherwise take away the mortgage servicing rights.

However, in many cases, Fannie Mae appeared to be paying millions of dollars too much.

The taxpayer-owned company paid more than legally required to Bank of America and 12 other lenders when it spent $1.5 billion in termination fees for servicing rights on 1.1 million loans between 2008 and 2011.

The deal that prompted the investigation was a $412 million payment from Fannie Mae to Bank of America in August 2011 to transfer the servicing rights to more than 300,000 of these loans over to specialty companies it calls high touch servicers.

The loan portfolio's delinquency rate was high -- about 11 percent -- and without any action Fannie Mae determined it would lose $10.9 billion on the pool of loans. In transferring the rights to specialty servicers, Fannie estimated it would save between $1.7 billion and $2.7 billion over five years.

The inspector general does not say how much Fannie Mae might have overpaid, only that the agency should not be paying more than what the contract dictates.

The watchdog found that while the contract allows for a breakup payment of twice the annual fees a bank would collect, Fannie has paid on average 2.3 times that amount in order to quickly close the transactions and forestall a bank from marketing the rights on its own.

While the Bank of America transaction, which was at 2.4 times the annualized servicing fee, was not significantly different from the typical High Touch Servicing Program transaction, the report recommends that FHFA should ensure that Fannie Mae does not have to pay a premium to transfer inadequately performing portfolios.

Fannie Mae argues that while it paid a premium over the minimum required price, it paid for the transfers at an appropriate rate.

In a letter to the FHFA dated July 13, 2011, Fannie Mae stated that in light of the high risk nature of the portfolios and disproportionate share of expected future losses relative to the entire Single Family portfolio ... it was in Fannie Mae's best interest to negotiate mutually beneficial terms in order to gain control of servicing and therefore, credit performance of the assets.

Fannie Mae added that any attempt to transfer MSR without proper compensation would have resulted in litigation as well as unnecessary and costly delays.

Fannie Mae also asserted that, from a business perspective, a negotiated settlement was a better choice. If we had not negotiated on price, the existing servicers would have not cooperated, thereby impacting credit losses, the borrower, and the new servicer's ability to service, Fannie Mae stated.

© Copyright IBTimes 2024. All rights reserved.