Diverging Businesses: Uber Vs Lyft In Six Graphics

Lyft Inc's choice to stay on the narrow ride-hail road worries investors as its larger rival Uber Technologies Inc explores more profitable paths, such as becoming a food delivery giant during the pandemic.

Lyft shares plummeted more than 30% on Wednesday after an earnings report made investors question whether it could compete with Uber.

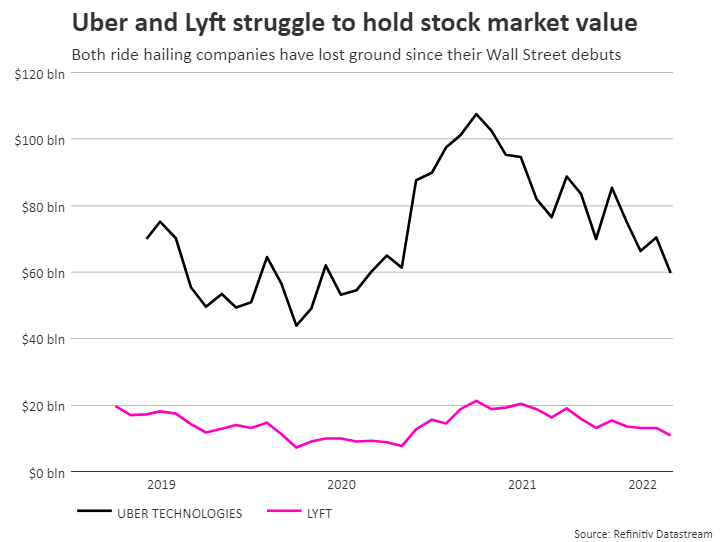

Both tech companies' shares have plunged since they went public in 2019, but while Uber has dropped around 35% in value, Lyft is down more than 70%.

Graphic - Uber and Lyft struggle to hold stock market value :

Analysts had feared that the Uber Eats delivery business, launched in 2014, would never make money. Its value became clearer during the pandemic as a surge in food delivery orders offset plummeting ride-hail demand.

Uber also boosted revenue at its freight trucking division with a $2.25 billion acquisition of a logistics company.

Lyft also owns bike and scooter-share networks, but does not break out the revenue from those services.

Graphic Uber's revenue outstrips Lyft's -

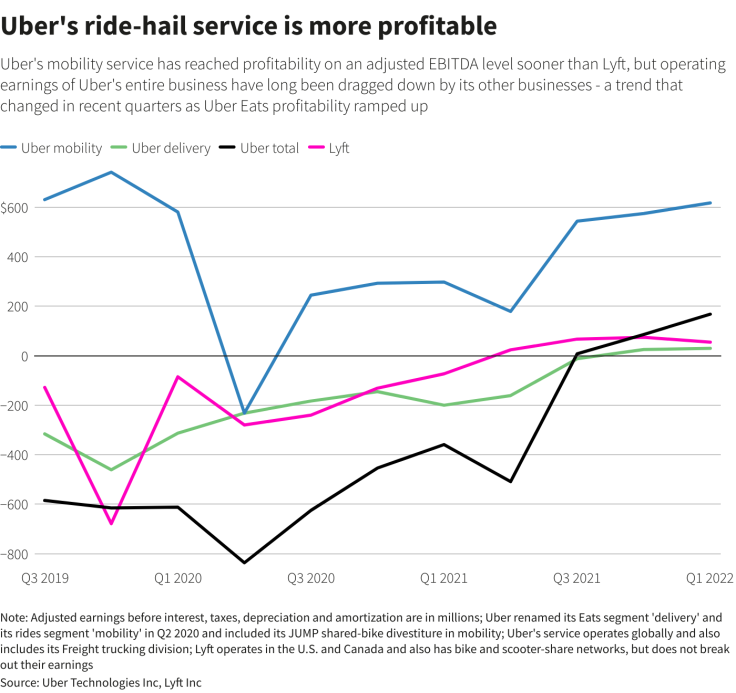

While Lyft achieved operating profit a quarter earlier than Uber, Uber's ride-hail business had already been profitable for years on an operating bases, as measured by adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA). In the latest quarter, Uber's total operating profit surpassed Lyft's.

"Uber has grand ambitions to become a one stop transport hub for the world, and that strategy of diversification into other sectors is being well received," said Hargreaves Lansdown analyst Susannah Streeter.

Graphic : Uber's ride-hail service is more profitable -

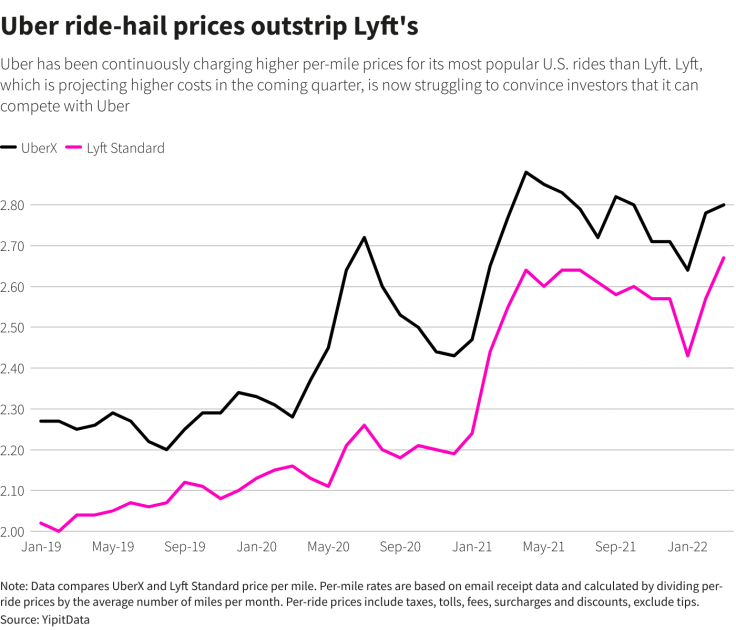

Uber's ability to generate significantly higher operating earnings from its ride-hail segment can partially be explained by its pricing strategy and power: the per-mile prices it charges for U.S. trips are higher than Lyft's.

While both companies adjust prices at similar times and proportions, Lyft on average has been charging 10% less on a per-mile basis than Uber, an analysis of email receipt data by research firm YipitData showed.

The companies also differ on average driver pay. Uber said those on the road for more than 20 hours a week earned an average of $39 an hour in the first quarter, including tips and a fuel surcharge. Lyft on Tuesday put March driver average earnings at $24 including tips, but excluding a 55 cent per-ride fuel charge.

Graphic - Uber ride-hail prices outstrip Lyft's:

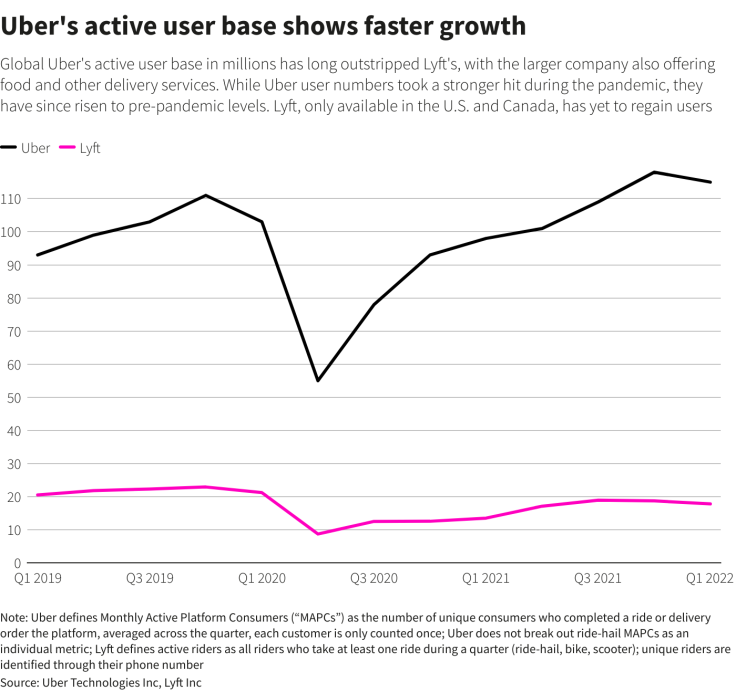

Food delivery has allowed Uber to grow its customer base, as many of those customers later use the app to book rides.

Lyft, which unlike Uber only operates in the United States and Canada, has seen user growth stagnate and its active riders in the first quarter remain 13% below the pre-pandemic first quarter of 2019. Uber's user base increased 23% during the same timeframe.

Graphic - Uber's active user base shows faster growth:

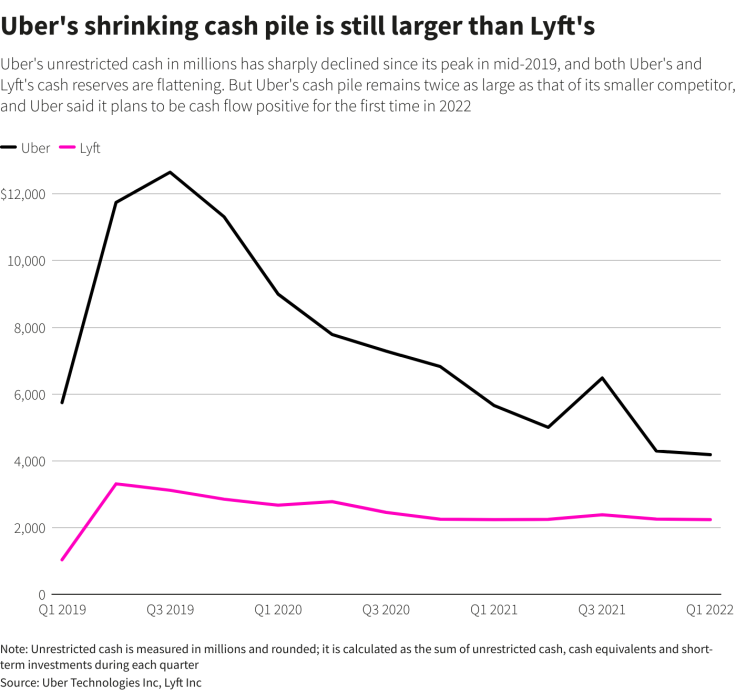

But Uber's massive investments and several acquisitions in the delivery and freight sectors have eroded its cash pile much faster than at Lyft.

Uber's unrestricted cash is only a third of its peak amount in mid-2019, and despite its significantly larger size, Uber only has double the cash at Lyft.

Uber on Wednesday told investors it will be full-year cash flow positive in 2022 for the first time in its 13-year history.

Both companies significantly cut cash burn over the pandemic.

Graphic - Uber's shrinking cash pile is still larger than Lyft's :

© Copyright Thomson Reuters 2024. All rights reserved.