Dollar, stocks slide on debt gridlock

The dollar fell broadly on Tuesday as lawmakers remained deadlocked over raising the nation's debt ceiling to avoid a devastating default, while U.S. and European shares also declined.

Unless lawmakers reach a deal to raise the $14.3 trillion ceiling by August 2, the United States faces the prospect of a default on some of its $9.6 trillion bonds outstanding.

President Barack Obama, in a televised address Monday night, warned that this would be a "reckless and irresponsible outcome," but he gave no indication that a compromise was imminent.

Weakness in the greenback helped buoy crude oil prices, while gold hovered near a record high above $1,600 an ounce as investors sought the precious metal for safety.

The U.S. currency hit a record low against the Swiss franc of 0.7997 franc on trading platform EBS and fell to a four-month trough at 77.828 yen, approaching a record low of 76.25 set in March.

"The market is getting more nervous about the debt ceiling issue," said You-Na Park, currency strategist at Commerzbank in Frankfurt. "If the market was really starting to price in the possibility of a default, the dollar would be losing more than what we saw."

Against a basket of currencies, the dollar .DXY fell 0.7 percent. The euro rose 0.9 percent to $1.4508. Investors fear a potential debt default and a downgrade of the U.S. credit rating would tarnish the dollar's status as a global reserve currency.

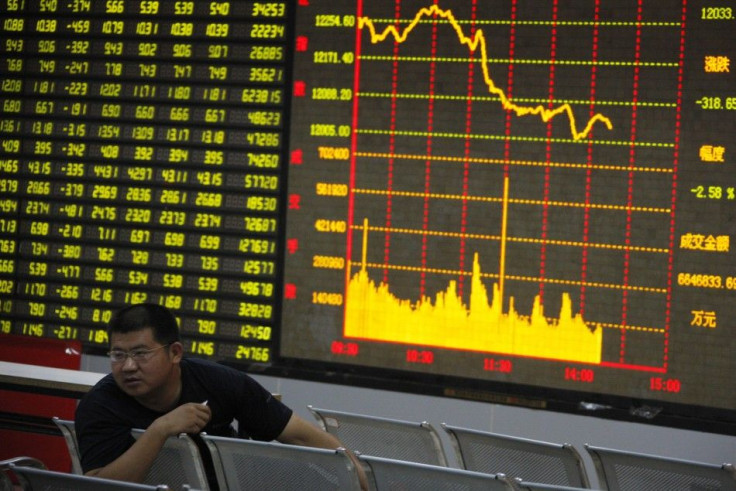

The debt gridlock in Washington also hit U.S. stocks. The Dow, the biggest loser, suffered additional pressure from disappointment over quarterly earnings from 3M (MMM.N).

The Dow Jones industrial average .DJI ended down 91.50 points, or 0.73 percent, at 12,501.30. The Standard & Poor's 500 Index .SPX lost 5.49 points, or 0.41 percent, at 1,331.94. The Nasdaq Composite Index .IXIC was down 2.84 points, or 0.10 percent, at 2,839.96.

Just 6.46 billion shares changed hands in composite trading, another lower-than-average day of activity.

"Investors are just kind of sitting on the sidelines," said King Lip, chief investment officer at Baker Avenue Asset Management in San Francisco. "No one wants to be short and no one wants to be long."

European stocks closed down 0.3 percent at 1,100.97 points .FTEU3. World stocks as measured by MSCI world equity index .MIWD00000PUS rose 0.3 percent, while emerging stocks .MSCIEF gained 0.7 percent.

Investors so far appear to have done little to prepare for a default or a cut in the U.S. AAA credit rating. Many are still clinging to the hope that lawmakers will eventually reach a deal.

It is also nearly impossible to insure against what is considered a low-probability event, especially given the lack of alternatives and the depth of the market, analysts said.

The cost of insuring the United States against default stood around 60.8 basis points, nearly half the March 2009 peak.

The CDS curve is nearly flat with one-year CDS at 61.2 basis points. This in itself reflects investor jitters, but it is not the kind of pricing normally seen when investors expect an imminent default.

The United States will lose its top-notch credit rating from at least one major rating agency, according to a Reuters poll.

TREASURY AUCTION

Treasuries prices rose as a decline in the U.S. stock market renewed a safe-haven bid. The benchmark 10-year note traded up 13/32 for a yield of 2.95 percent.

Fears the government will soon run out of cash fueled anxiety about appetite for this week's $99 billion of new debt supply even after Tuesday's sale of $35 billion of two-year notes attracted relatively solid demand.

"We have a lot of uncertainties with these auctions with what's happening in Washington. People are hesitant to take on risk," said Thomas Roth, executive director in U.S. government bond trading at Mitsubishi UFJ Securities USA in New York.

Safe-haven Bund futures rose as buyers demanded a high yield in debt auctions by Spain and Italy, underscoring persistent concern about euro zone peripheral countries despite a second bailout package for Greece last week.

In commodities trading, U.S. crude recouped early losses to settle at $99.59 a barrel, up 39 cents. Spot gold traded around $1,619 an ounce, after hitting a record $1,622.49 on Monday.

© Copyright Thomson Reuters 2024. All rights reserved.