Dow Jones Industrial Average Drops 100 Points, Turns Negative For 2015 After Caterpillar Inc (CAT), 3M Co (MMM) Sink 3%

U.S. stocks traded lower Thursday, with the Dow Jones Industrial Average turning negative for 2015 after multiple blue-chip companies posted mixed earnings results and warned of currency headwinds due to a strong U.S. dollar. A trio of Dow components, including Caterpillar Inc. (NYSE:CAT), Post-it notes maker 3M Co. (NYSE:MMM) and credit card issuer American Express Company (NYSE:AXP), led the blue-chip index lower, tumbling 100 points after all three stocks dropped more than 3 percent.

In afternoon trading, the Dow Jones Industrial Average (INDEXDJX:.DJI) dropped 101.72 points, or 0.57 percent, to 17,749.32. The Standard & Poor's 500 index (INDEXSP:.INX) dipped 9.93 points, or 0.47 percent, to 2,104.21. And the Nasdaq composite (INDEXNASDAQ:.IXIC) lost 14.79 points, or 0.29 percent, to 5,156.85.

For the year, the Dow has shed 78 points, or 0.44 percent. However, the S&P 500 has gained 45 points, or 2 percent, while the Nasdaq has rallied 419 points, or more than 8 percent.

Seven of the 10 S&P 500 sectors traded lower Thursday, led by declines in utilities and materials.

The Dow was weighed down following a series of mixed earnings reports. Caterpillar shares tumbled to a 52-week low of $76.75 after the world’s largest manufacturer of construction and mining equipment missed revenue forecasts and cut its outlook for the year, citing currency effects from a stronger U.S. dollar and continuing economic weakness in China and Brazil.

Shares of Caterpillar have lost nearly 13 percent since January.

Meanwhile, both 3M and American Express missed revenue forecasts, with the diversified manufacturer citing sluggish global growth and the credit card issuer citing a stronger U.S. dollar.

The robust greenback over the last year has been a huge drag on growth for the benchmark S&P 500, because the index’s companies derive more than 40 percent of their revenue from overseas. The dollar has gained more than 20 percent against major global currencies in the last 12 months.

“I’m anticipating we will still see some positive growth for the quarter, even though it’s still a little bit touch and go, with only 20 percent of the companies reporting so far,” said Karyn Cavanaugh, senior vice president and senior market strategist at Voya Investment Management. "People have been focusing on all the bad things, but if you take a look at the scheme of things, over the last 30 years the dollar has been normalizing to where it was."

Meanwhile, the stock price of Dow component McDonald's Corporation (NYSE:MCD) fell 1 percent after the fast-food chain’s quarterly profit dropped 13 percent in the wake of fewer customers visiting its restaurants. Global same-store sales fell by 0.7 percent, wider than the 0.4 percent drop analysts were expecting for the quarter, according to Consensus Metrix.

The Nasdaq composite also turned lower in afternoon trading after the index briefly traded higher in morning trading after iPhone maker Apple Inc. (NASDAQ:AAPL) and software company Microsoft Corporation (NASDAQ:MSFT) rebounded after posting declines earlier this week on mixed earnings.

Among the 54 S&P 500 companies scheduled to report earnings Thursday, investors will turn their attention next to e-commerce giant Amazon.com Inc. and the world's biggest coffee chain, Starbucks Corporation; both post quarterly results after the closing bell. Wall Street now expects a 5.3 percent drop in second-quarter profits, below July 10 estimates of a 6.4 percent decline, according to analysts polled by Bloomberg.

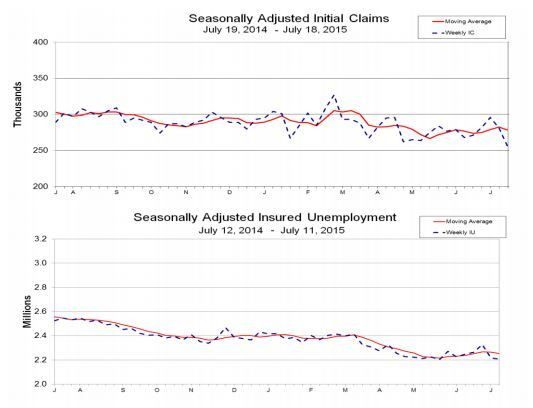

Separately, U.S. jobless claims tumbled to a nearly 42-year low last week as fewer Americans filed new applications for unemployment benefits. Initial claims for state unemployment benefits declined 26,000 to a seasonally adjusted 255,000 for the week ended July 18, the lowest level since November 1973, the U.S. Labor Department said Thursday.

The strong employment data, coupled with a series of better-than-expected housing reports released this week paint a strong picture for the U.S. economy, which could keep the Federal Reserve on course to raising interest rates for the first time since 2006 this year.

Most market professionals anticipate the Fed will lift rates in September. "A rate hike this year is a huge bolster for confidence because it's a sign the U.S. economy is getting better," Cavanaugh said. "That means the central bank no longer needs a crisis level rate policy."

© Copyright IBTimes 2024. All rights reserved.