Dow Jones Industrial Average Gains Ahead Of FOMC Statement

U.S. stocks extended gains Wednesday as investors await a statement from the U.S. Federal Reserve this afternoon. The announcement could shed more light on when the central bank plans to lift interest rates this year, which would be the first time in nearly a decade.

The Dow Jones Industrial Average (INDEXDJX:.DJI) gained 45.66 points, or 0.26 percent, to 17,675.93. The S&P 500 index (INDEXSP:.INX) added 5.17 points, or 0.25 percent, to 2,098.73. And the Nasdaq composite (INDEXNASDAQ:.IXIC) edged up 4.20 points, or 0.09 percent, to 5,094.17.

The Federal Open Market Committee, a board of governors at the Federal Reserve that determines the direction of monetary policy, will issue a statement from the central bank at 2 p.m. EDT. Most market professionals anticipate the Fed could lift rates as soon as September.

“There will be at least one rate hike this year,” said Greg McBride, chief financial analyst at Bankrate.com. “Whether or not it happens in September depends on the economic data we see between now and then, specifically two more jobs reports for July and August.”

Dow component Visa Inc. (NYSE:V) led the index higher, gaining 1.5 percent, while mining equipment maker Caterpillar Inc. (NYSE:CAT) was the biggest decliner, down more than 1 percent.

Seven out of the 10 Standard & Poor's 500 sectors traded higher, led by a nearly 1 percent gain from telecommunications. Energy was the biggest laggard, down just 0.3 percent a day after the sector rebounded as oil prices moved higher.

The Nasdaq composite struggled to hold onto gains Wednesday following a series of mixed corporate results this week from Twitter Inc. and consumer review website Yelp Inc. Earnings season continues in full force this week as nearly a third of the S&P 500, or roughly 160 companies, are due to report results.

Shares of Twitter Inc. (NYSE:TWTR) dropped more than 13 percent Wednesday, a day after the social media company warned of slow user growth. But there was a bright spot: Twitter’s revenue soared 61 percent from a year ago, topping Wall Street forecasts, driven by growth in advertising revenue.

Despite Twitter’s headwinds, S&P Capital IQ reiterated its Buy rating on the company and lowered its 12-month price target by $6 to $44. “Despite a limited sequential gain in monthly active users, we see a healthy growth story,” Scott Kessler, equity analyst at S&P Capital IQ, said in a research note Wednesday.

Meanwhile, shares of Yelp plunged 30 percent to a 52-week low of $23.68 after the consumer review website posted a surprise quarterly loss, as it too faces slowing user growth.

Notable companies reporting after the closing bell Wednesday include Facebook Inc. (NASDAQ:FB), which recently jumped to the eighth most valuable company in the Standard & Poor’s 500 index, worth $267 billion, more than General Electric Company ($261 billion) and JPMorgan Chase & Co. ($251 billion).

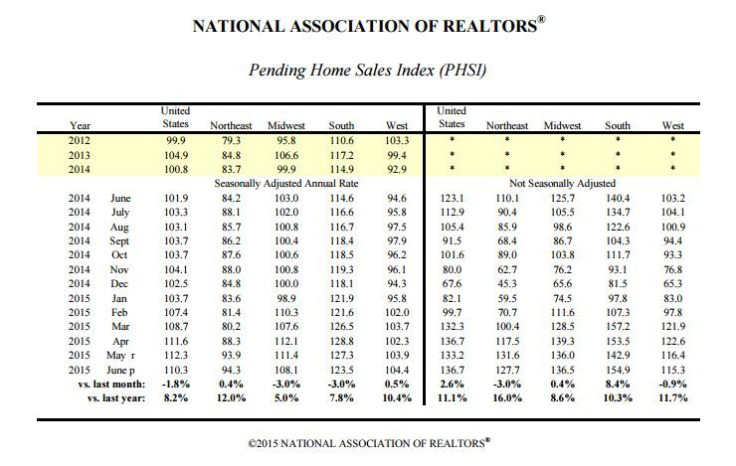

U.S. pending home sales -- a forward-looking indicator of home sales -- slipped in June following five straight months of gains, signaling higher prices are beginning to take their toll on home buyers.

The index of pending home sales fell 1.8 percent to a seasonally-adjusted 110.3 in June, the National Association of Realtors said Wednesday. Sales had previously jumped to a nine-year high in May.

However, sales are still 8.2 percent higher than a year ago, the latest sign the housing market continues to gain traction after a shaky start to the year due to harsh winter weather.

"The demand is there for more sales, but the determining factor will be whether or not some of these buyers decide to hold off even longer until supply improves and price growth slows," Lawrence Yun, NAR chief economist, said in the report.

Oil prices retreated Wednesday, recording their longest streak of daily losses in a year on ongoing fears of oversupply in crude stockpiles. U.S. crude inventories fell by 4.2 million barrels to 459.7 million barrels for the week ended July 24, remaining near levels not seen for this time of year in at least the last 80 years, the Energy Information Administration said Wednesday.

Following the report, West Texas Intermediate (WTI) crude, the benchmark for U.S. oil prices, fell nearly 1 percent to $47.63 per gallon barrel for September delivery on the New York Mercantile Exchange. On the London ICE Futures Exchange, Brent crude, the global benchmark for oil prices, dropped 0.6 percent to $52.98.

© Copyright IBTimes 2024. All rights reserved.